Although the banking industry has recently faced some turbulence, there is still much to celebrate for many community banks.

Each year, American Banker publishes the list of the top 200 performing publicly traded banks with under $2 billion in assets. The data is compiled and analyzed by the consulting firm Capital Performance Group.

Capital Performance Group conducts the rankings analysis using data provided by S&P Global Market Intelligence, which drew on Security and Exchange Commission filings.

The banks that made this year's list, which was based on data from year-end 2022, posted a lower median efficiency ratio,

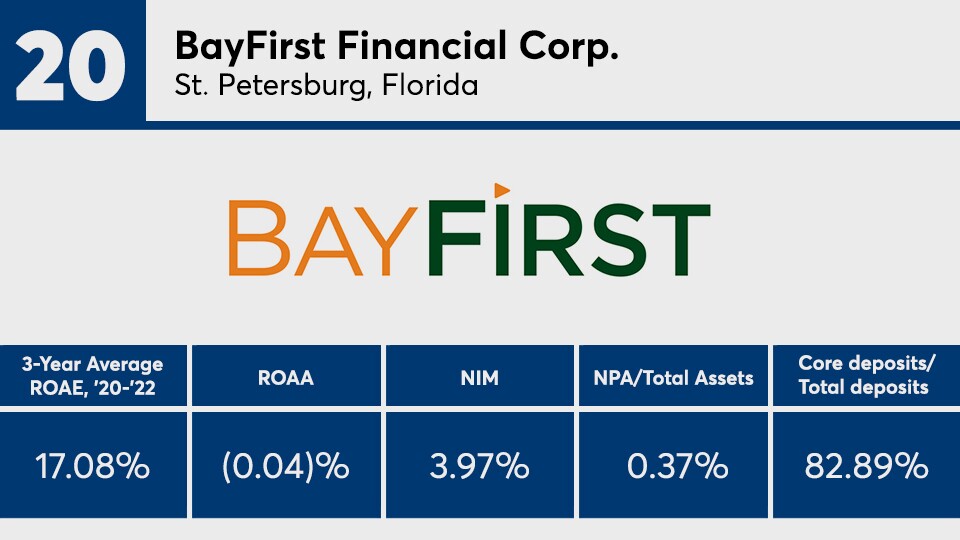

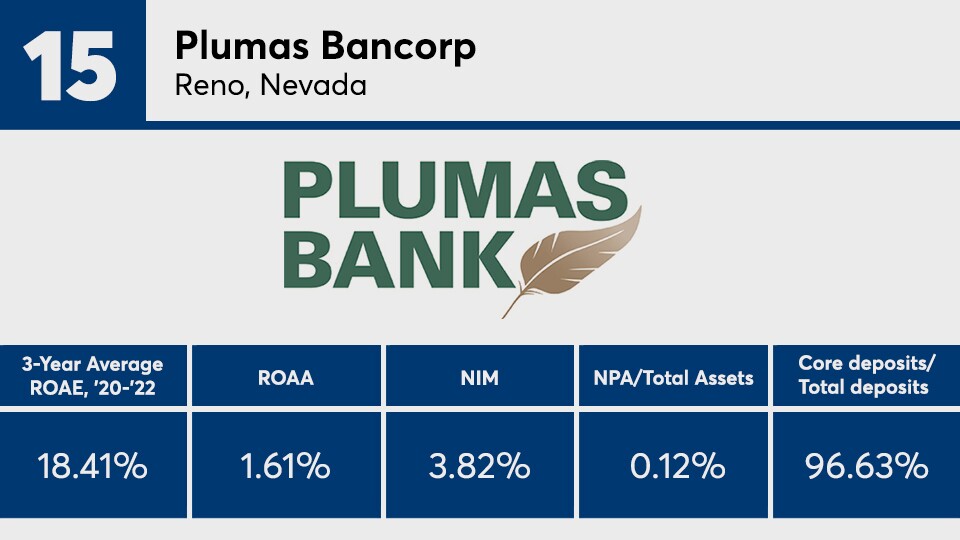

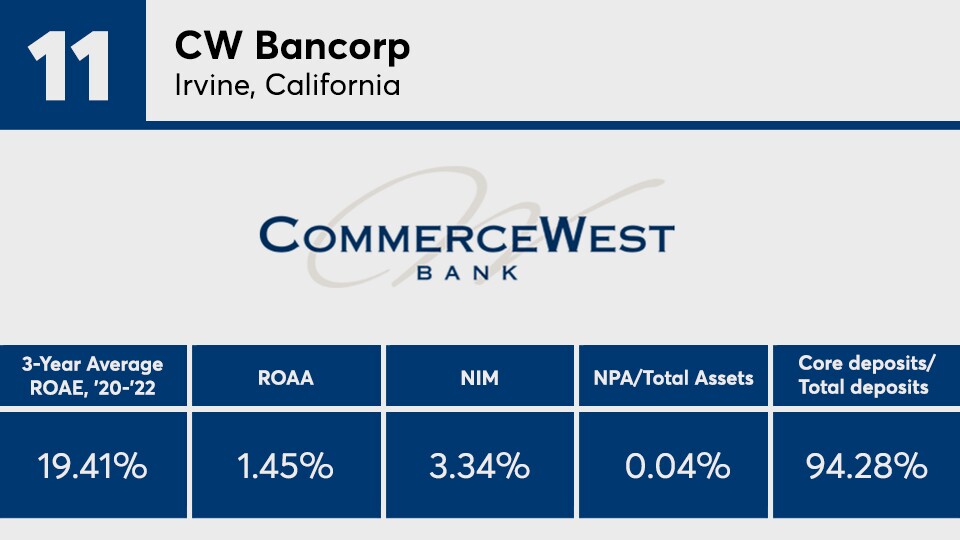

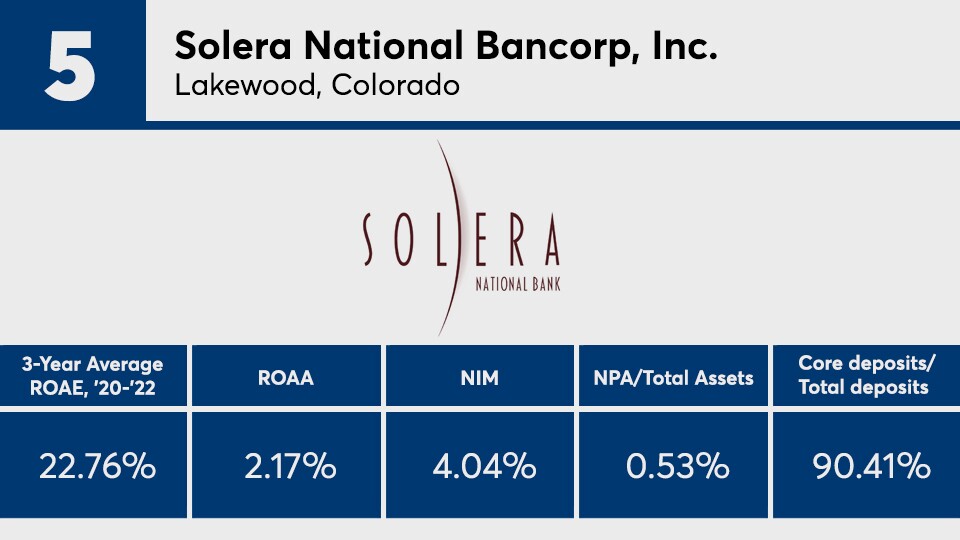

The top 200 banks also had a median return on average equity of 14.16%, compared with 11.67% for all publicly traded banks in this asset class. The three-year average for this figure was 12.6% for the top performers. That's more than 2 percentage points higher than their peers.

Of course liquidity has been a significant issue for banks in 2023. The top performers did better in metrics related to this as well. For instance, the top 200 banks had a ratio of core deposits to total deposits of more than 86%. That figure was about 84.5% for all small banks. Core deposits grew at more than 2.5% for the top performers, compared with just over 2% for all publicly traded banks in this asset category.

And credit quality metrics were better for the top performers. Banks that made the list had a median ratio of nonperforming assets to total assets of 0.25%, compared with 0.27% for all small banks.

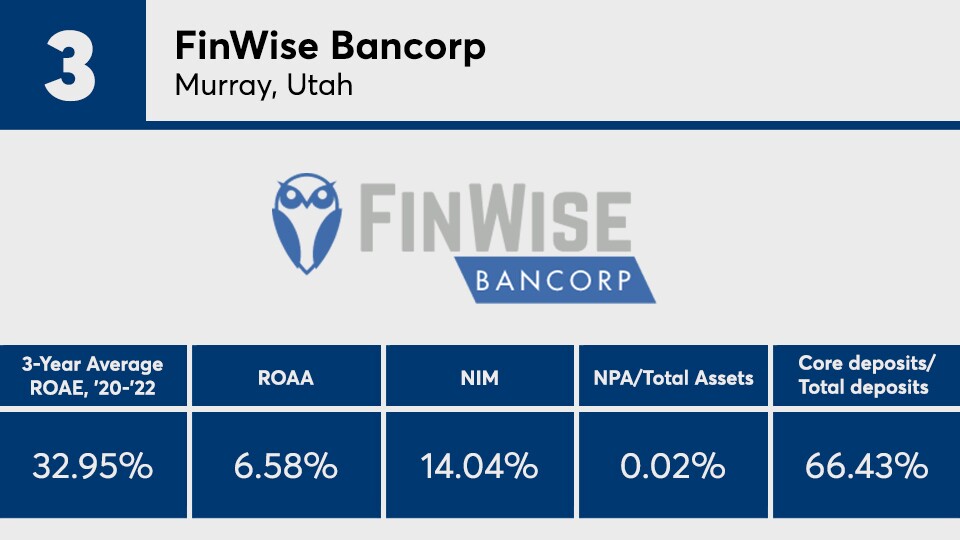

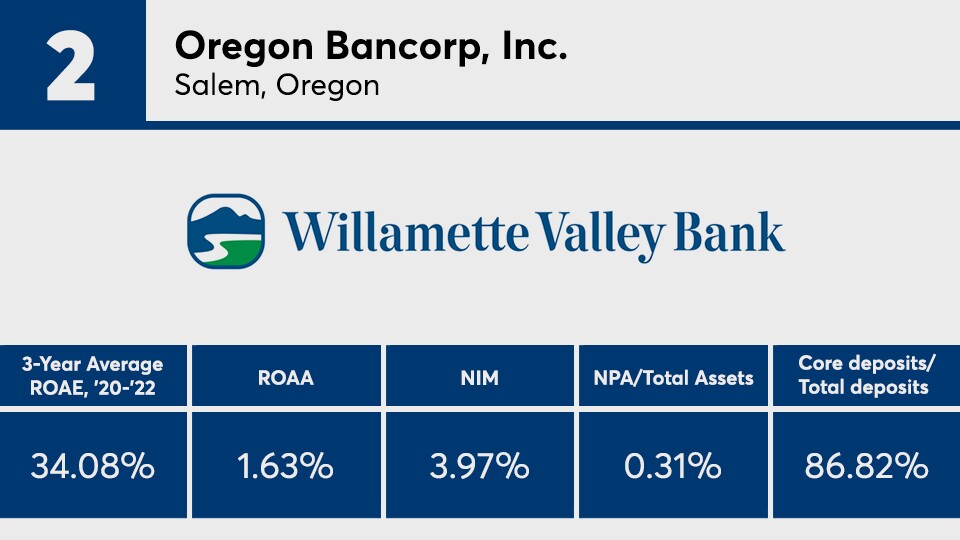

University Bancorp in Ann Arbor, Michigan, jumped from third in last year's ranking to claim the No. 1 spot this year, with a three-year average ROAE of 35.62%. It beat out Oregon Bancorp, the parent of Willamette Valley Bank, which had been No. 1 for four consecutive years.

Here is an overview of the top 20 institutions from this year's list. For a complete list of the ranking, please visit