In this week's banking news roundup: City National Bank of Florida is starting a national capital markets division, Orrstown Financial will close branches in Pennsylvania and Maryland, JPMorgan Chase unit announces in-store biometric payments and more.

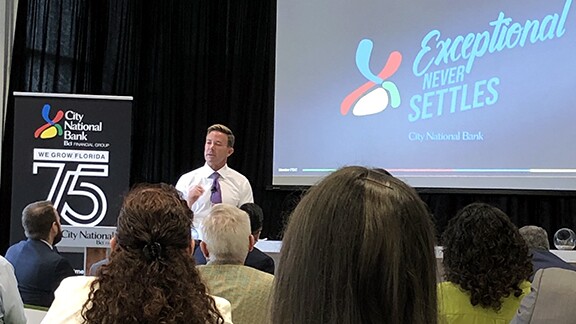

City National Bank of Florida starts capital markets business

Orrstown Financial to shutter branches in Pennsylvania, Maryland

In July, Orrstown completed its acquisition of in-state rival

Orrstown said in the filing its branch network and Peoples' footprint were "highly complementary," but it identified several overlapping locations. Orrstown said it would have 38 full-service branches and seven limited-service locations at the end of 2024. —Jim Dobbs

JPMorgan Chase unit launches in-store biometric payments

Whataburger customers, after uploading a picture of their face to the Whataburger app, can use PopID hardware to pay for purchases and participate in the retailer's rewards program. The $3.9 trillion-asset bank

PopID estimates that its platform reduces ordering and checkout times by up to 90 seconds and can increase ticket sizes by 4%, according to the release. —Joey Pizzolato

Credit Union 1 ventures north of the Arctic Circle

Located on the edge of the Chukchi Sea in far Northwest Alaska, Kotzebue is an isolated but thriving seaside community. But despite its regional stature, Kotzebue, like many rural Alaskan communities, has limited financial service options – and, currently, only one institution has a physical location there.

"We couldn't be more thrilled to be able to offer our services in a new community like Kotzebue. As a hub for much of Northwest Alaska, the branch will enable Alaskans in nearby villages to access financial services that may not have been available to them before," said CU1 President/CEO Mark Burgess. The location is scheduled to open in late 2024. —Traci Parks

DBS picks Tan to be first female CEO of Singapore’s top bank

Tan, currently head of DBS' institutional banking group, was given the additional appointment of deputy CEO, according to a statement from the Singapore bank on Wednesday. She will succeed Gupta when he retires at the next annual general meeting on March 28.

The appointment caps speculation over who will succeed Gupta, one of Asia's most high-profile bankers who has led DBS for more than 14 years. Gupta, 64, is credited with multiplying returns at the Temasek Holdings Pte-backed bank, while transforming its culture and technology to face growing competition from digital lenders. —Chanyaporn Chanjaroen, Bloomberg News

Wells Fargo hires PJT banker Kevin Healey for health care M&A

Healey, who most recently worked at PJT Partners, will be based in New York when he joins Wells Fargo after a period of garden leave, the person said, asking not to be identified discussing confidential information. He'll report to Jeff Hogan, Wells Fargo's global head of M&A, the person said.

A spokeswoman for San Francisco-based Wells Fargo confirmed the hire but declined to comment further.

Healey spent just shy of a decade at PJT, most recently as a managing director in the firm's strategic advisory group. He previously held roles at JPMorgan Chase, consulting firm Deloitte and General Electric, according to his LinkedIn profile. —Michelle F. Davis, Bloomberg News

U.S. guarantees Dominican bank loans in push to boost relationship

The U.S. International Development Finance Corp. is providing the support to Banco de Reservas de la Republica Dominicana to support women entrepreneurs, small businesses and green lending, the agency said in a statement. The announcement came during a visit by Samantha Power, President Joe Biden's chief for humanitarian aid, and DFC deputy head Nisha Biswal.

A loan guarantee is a common form of development assistance that backstops lending to riskier borrowers by promising to take on the obligations if there's a default. The portfolio guarantees from the DFC will cover up to 50% of losses due to default and are being subsidized by the U.S. Agency for International Development, according to a DFC spokesman. — Eric Martin, Bloomberg News

The OCC names Mark Thomas chief financial officer

Thomas' 20-plus years of federal service spans financial management operations and accounting, overseeing budgetary processes, government contracting and internal controls. Most recently, he served in a senior role at the Federal Deposit Insurance Corporation where he performed acquisition management and administered financial quality assurance. Prior to his federal service, he spent nearly nine years in the private sector, in retail operations management. —Traci Parks