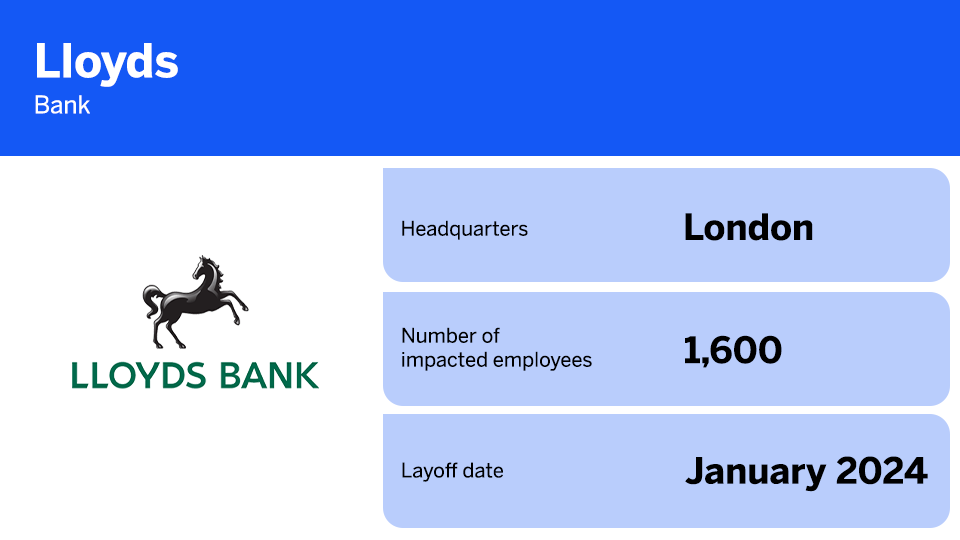

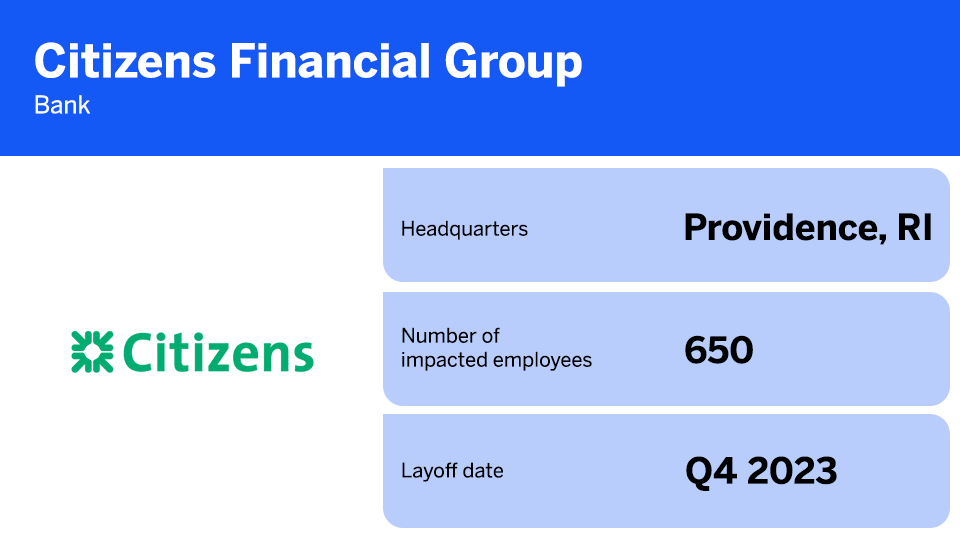

As companies downsize and restructure, American Banker is tracking these decisions to help our readers understand how their industries are adapting.

Click here to see last year's

As companies downsize and restructure, American Banker is tracking these decisions to help our readers understand how their industries are adapting.

Click here to see last year's

The Consumer Financial Protection Bureau said it will not enforce or supervise nonbank financial firms that miss upcoming compliance deadlines for the nonbank registry of repeat offenders.

Lower credit costs and better expense control helped the San Francisco-based titan offset the impact of lighter-than-expected revenue.

The new z17 mainframe, unveiled in a launch event this week, also comes with quantum-resistant encryption.

The combination of San Diego County Credit Union and California Coast Credit Union would create the 16th largest credit union in the United States.

A bill being introduced by Sen. Catherine Cortez Masto, D-Nev., would compel the Federal Home Loan Bank System to contribute 30%, or a minimum of $200 million, of each bank's net earnings into affordable housing or other community development programs.

The chief executives at four of the nation's largest banks weighed in on what evolving trade policies mean for their businesses and the U.S. economy. "I think you have to be a little bit pessimistic here," said Bank of New York Mellon CEO Robin Vince.