What kind of start did bank M&A get off to in January, and what does it foreshadow for the rest of the year? Well, it's hard to say.

On the one hand, there was a big headline: Chemical Financial in Detroit and TCF Financial in Wayzata, Minn., unveiled the biggest deal in eight months; it would create a $45 billion-asset bank.

Regulatory reform paved the way for the Chemical-TCF deal. It would have been less likely — or at least more complicated — had Congress not raised the asset threshold for systemically important financial institutions well above the previous $50 billion cutoff. The agreement, a so-called merger of equals, raised the question whether more big deals like it are on the way.

On the other hand, some of the data from January suggested a lackluster start.

The 17 whole-bank deals announced last month were roughly the same as a year earlier, based on figures from Keefe, Bruyette & Woods and S&P Global Market Intelligence. If not for Chemical-TCF, deal values would have been well off the pace of the last several years. Moreover, the average deal value to tangible common equity was 160.7%, below the 180% in the year-earlier period and 174% for all of 2018.

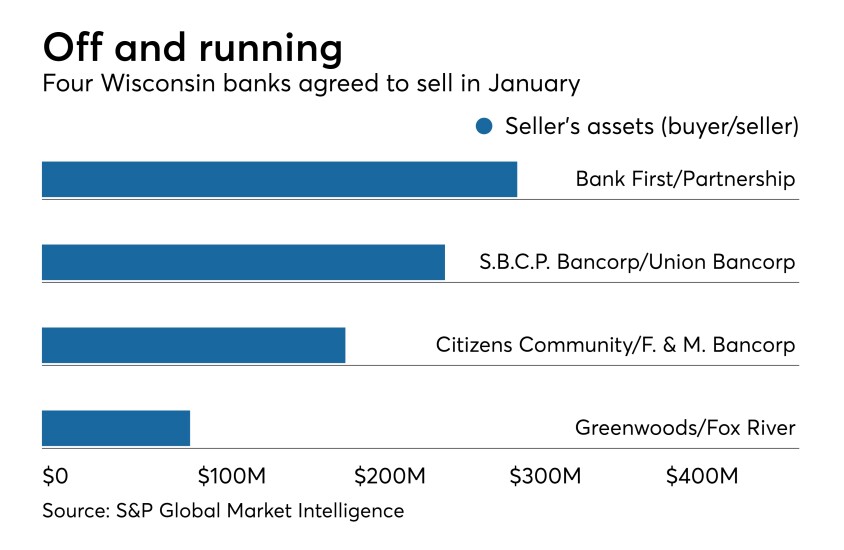

All that said, it was an interesting month. Serial acquirers were active; credit unions were among the buyers of banks; and a handful of banks from Wisconsin decided to be sold. The following is a look at the month's most noteworthy deals.