Venture capital funding for fintechs got off to a

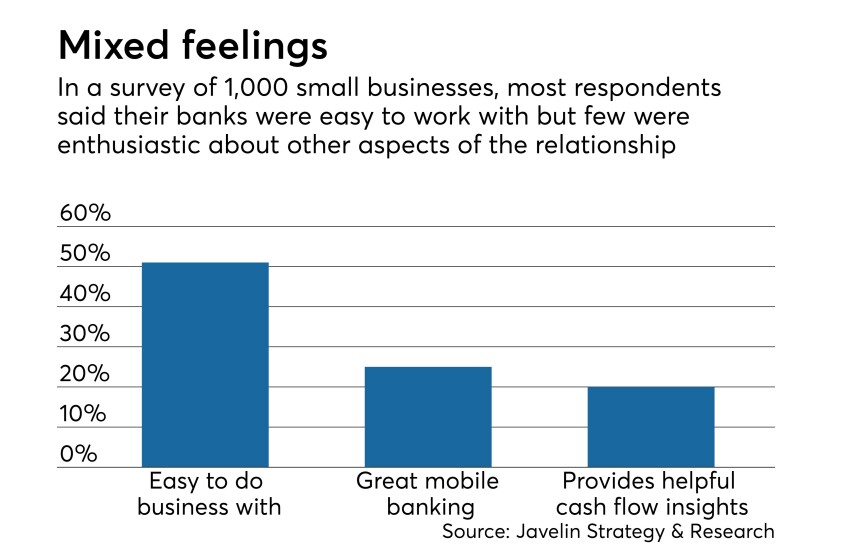

Novo, a challenger institution in the field of small-business banking, and the no-code platform provider Unqork held Series A funding rounds. The simulation software provider Simudyne and the construction-lending platform provider Buillt Technologies attracted investments from large banks like Barclays, Goldman Sachs and Regions Financial.

Artificial intelligence ideas continued to draw bank support, The online lender Upstart, which raised $50 million in a Series D round, says it can both lower loan loss rate and increase the number of customers underwritten.

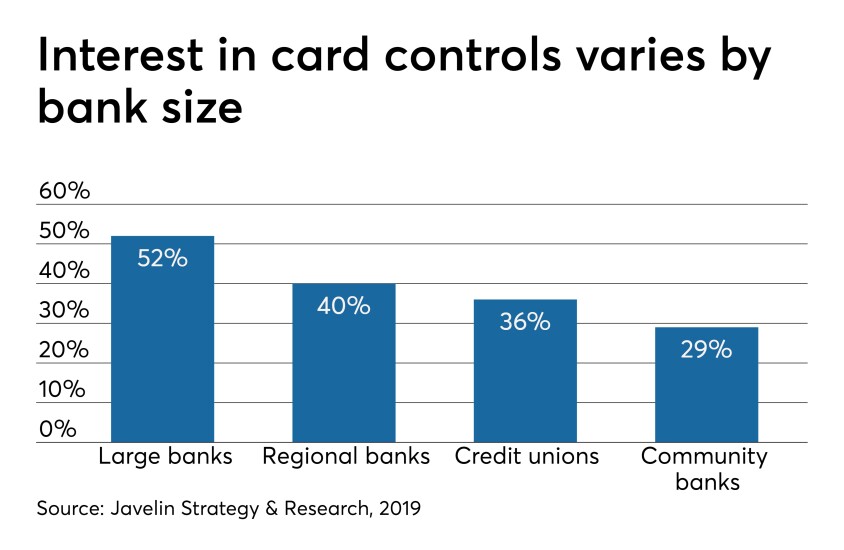

Meanwhile, Extend is building a platform to distribute digital cards by partnering with payment networks and card issuers. Another startup, MotoRefi, claims it can save consumers an average of $100 a month on vehicle refinancing by connecting them to trusted credit unions and community banks.

Scroll down for a summary these recent investment deals, in order of the size of the funding rounds.