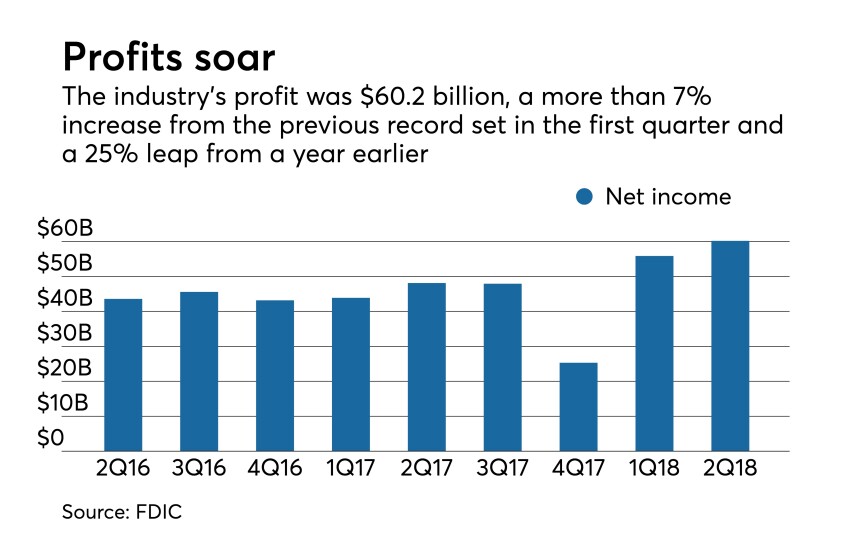

Banks earned a record $60.2 billion in the second quarter, thanks to lower taxes resulting from last year’s legislative overhaul and growth in interest-related revenue, the Federal Deposit Insurance Corp. said in the

While a little more than half of the industry’s dollar-amount increase in net income was due to a lower corporate tax rate, rising net interest margins and higher loan balances are a sign that institutions continue to derive revenue from their loan book. The $10.7 billion increase in net interest income from the second quarter of 2017 was the highest year-over-year jump ever.

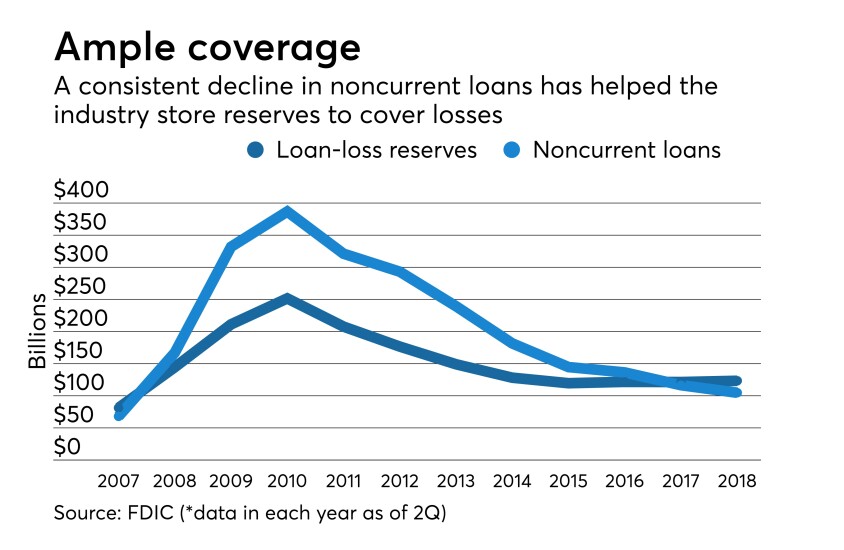

“It is worth noting that the current economic expansion is the second-longest on record, and the nation’s banks are stronger as a result,” FDIC Chairman Jelena McWilliams said in her first QBP presentation since joining the agency in June. “The competition to attract loan customers will be intense, and it will remain important for banks to maintain their underwriting discipline and credit standards.”

Here are six takeaways from the report: