What do consumers want from their banks, and how are their digital-banking behaviors changing? New research from Forrester, Javelin Strategy & Research, and digital experience analytics company ContentSquare offers some clues as to how people are interacting with banks online and on mobile. Scroll through to learn what the researchers found.

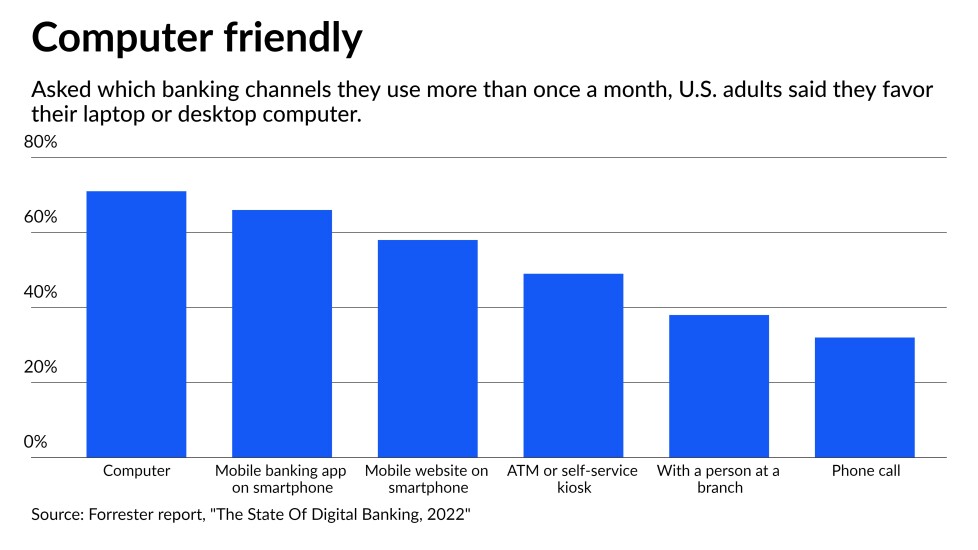

1. Americans still prefer online banking over mobile banking.

This can partly be explained by the shift to remote work, according to Aurelie L’Hostis, senior analyst at Forrester.

“Lots of people are working from home and they are on the computer all day,” she noted. “You are already on your computer. If you want to check something, you can go online using the device you are already in front of.”

She also noted that there is a cohort of consumers who've been using online banking for a long time and are used to it. And people with eyesight issues tend to prefer a larger screen.

But customers continue to do business in branches, both at ATMs and at the teller window, and one-third end up calling their bank’s helpline each month, the study found.

2. But consumer preferences are shifting toward mobile banking.

But the way they see it, online banking adoption is beginning to tilt downward as Gen Z consumers enter adulthood and reach for their smartphones for financial matters, according to Mark Schwanhausser, director of digital banking.

Online banking remains vital, he said, and financial institutions cannot afford to let it languish.

“But the writing is on the wall,” Schwanhausser said. “Online banking is being supplanted as the go-to channel — at least for the routine financial chores. This will require continued investment in mobile to expand beyond routine capabilities.”

3. The majority of people leave bank websites after looking at one page on their phone.

The study did not specify whether or not these visitors are customers. For bank customers, such a quick bounce would suggest a failed login, perhaps due to forgetting a password.

If people are visiting a site to research financial needs, they might realize that this is easier to do on a desktop than a phone, L’Hostis hypothesizes.

“Sometimes it just helps to have a bit more real estate,” she said.

To Schwanhausser, this data point shows banks need to put more effort into their mobile websites. Banks have done a good job making their websites and mobile apps useful for common banking chores, like monitoring balances and reviewing transactions.

“The next big challenge is to figure out how to make apps the go-to, or should we say, stay-in, channel for financial matters that require more thought,” he said.

4. Customers have started using smart speakers for basic banking activities.

L’Hostis said this finding surprised her. But this could also tie back to the fact that people have been home so much in recent months.

“I have a friend who just had a baby,” she said. “Last week she told me that when she’s breastfeeding, she uses Siri to check on things like the time, because both hands are busy. People are using virtual assistants when they're looking for simple information, but maybe they're too busy doing some other things and don’t want to have to login to an app or website.”

5. A lack of resources impedes banks’ digital efforts.

There’s a race for digital talent, L’Hostis said.

“On the one hand, banks have to invest in talent in order to perform the kind of transformation they need to do,” she said. “And at the same time they're facing shortages of technology workers for their digital operations. Banks are going to struggle to find enough people and the right people in order to do the job they need to do around transformation.”

Schwanhausser agrees.

“One digital banking strategist for a giant bank noted last week that there’s a shortage of smart talent in financial fitness,” he said. “Financial institutions lower on the totem pole often start conversations by saying, ‘We don’t have budgets like BofA and Chase.’”