Want unlimited access to top ideas and insights?

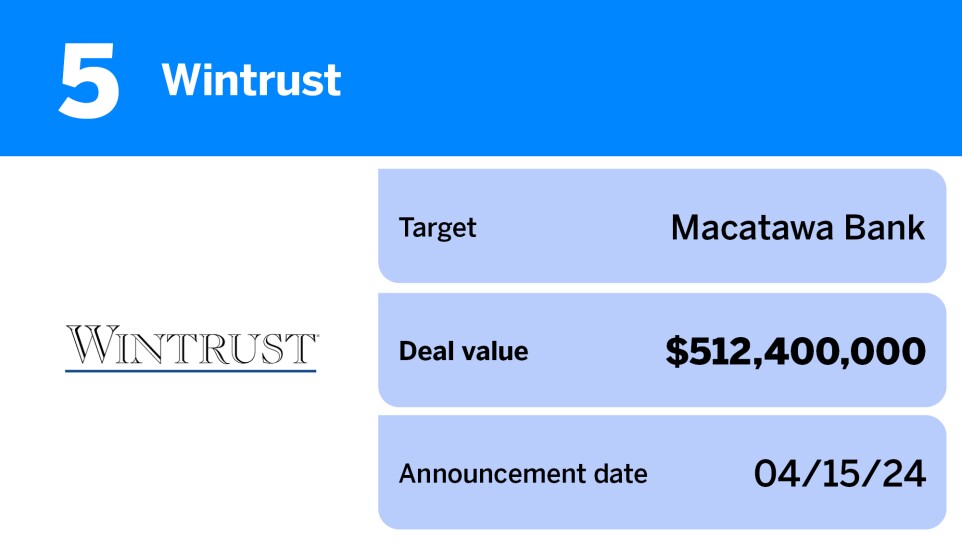

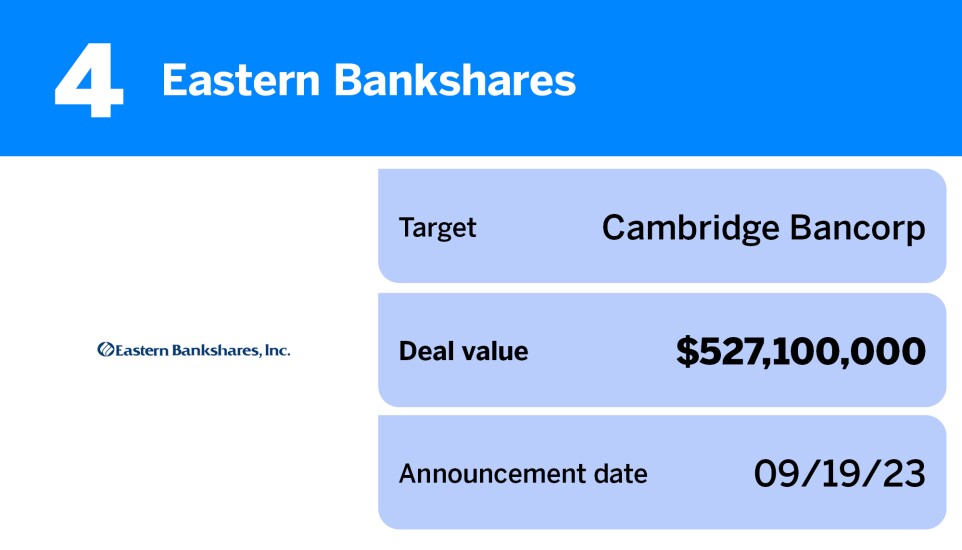

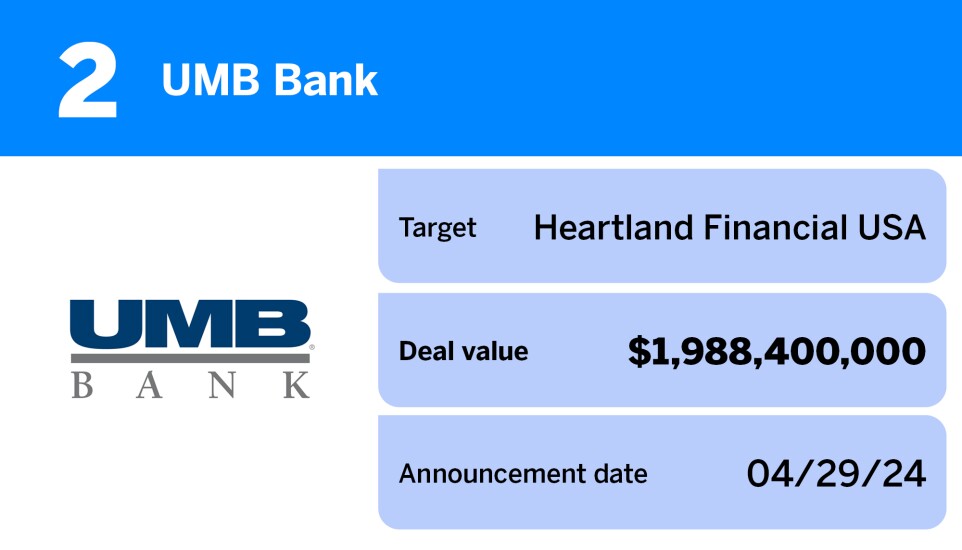

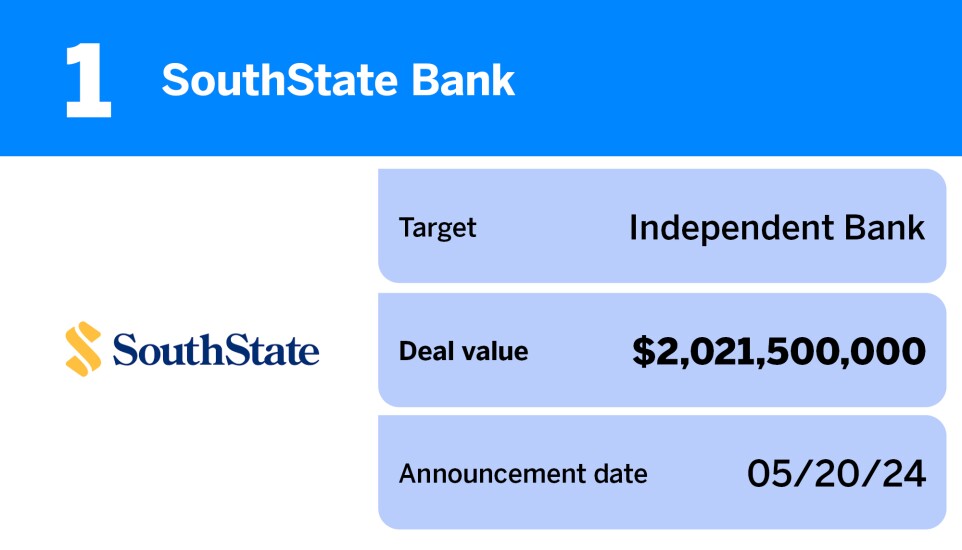

The five largest bank M&A deals of the past year had an average deal value of more than $1.2 billion. The largest deal was the SouthState Bank purchase of Independent Bank at $2.02 billion.

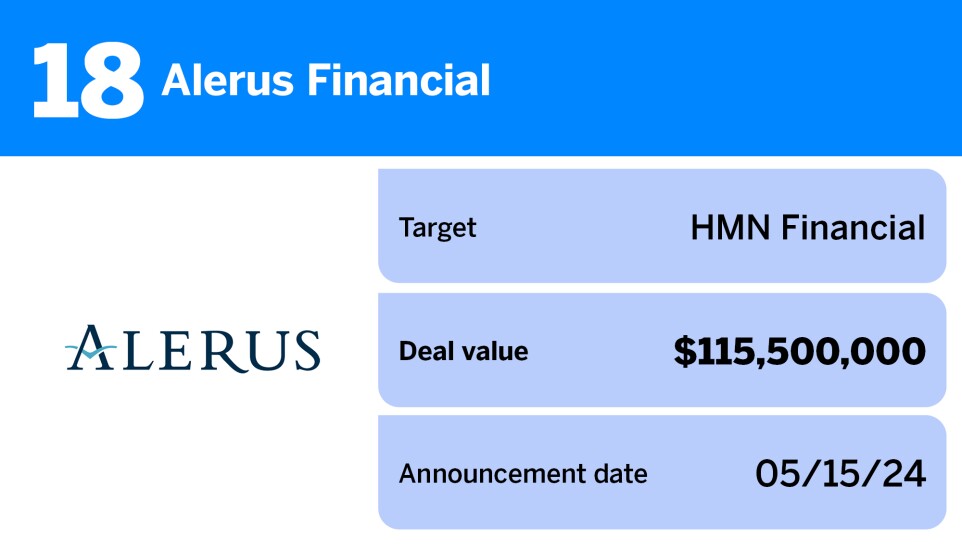

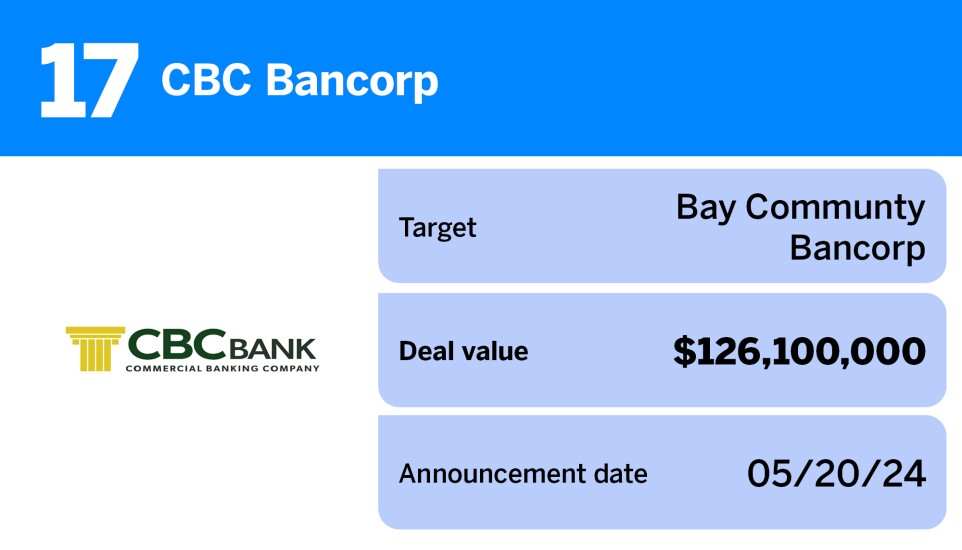

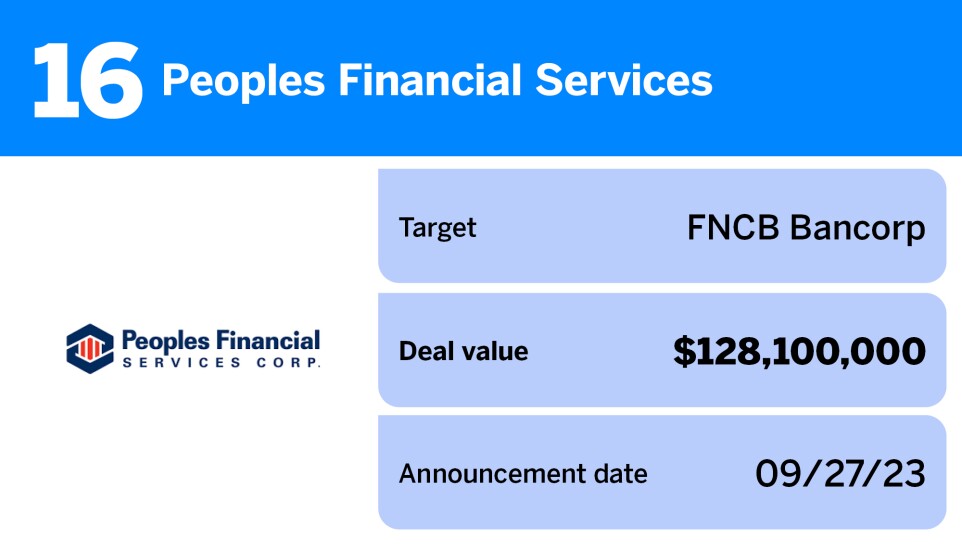

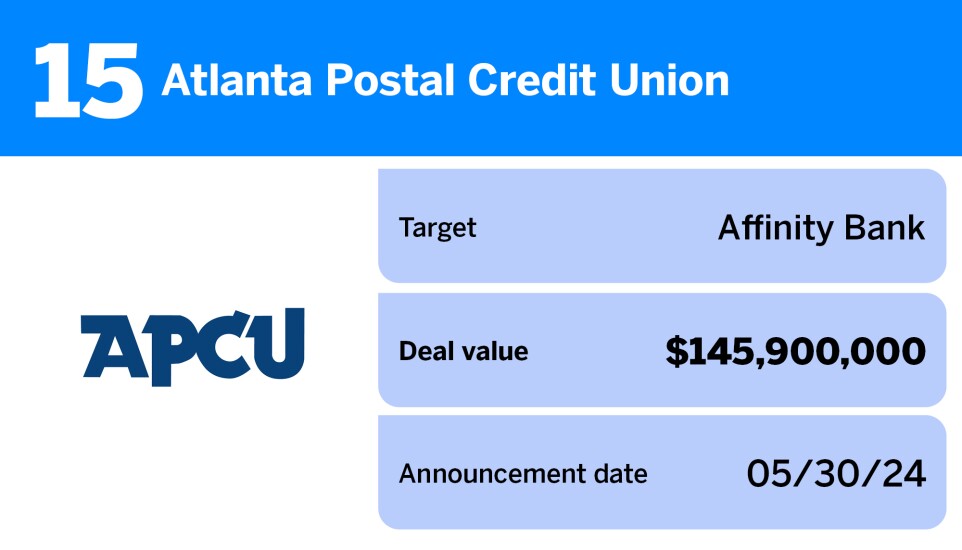

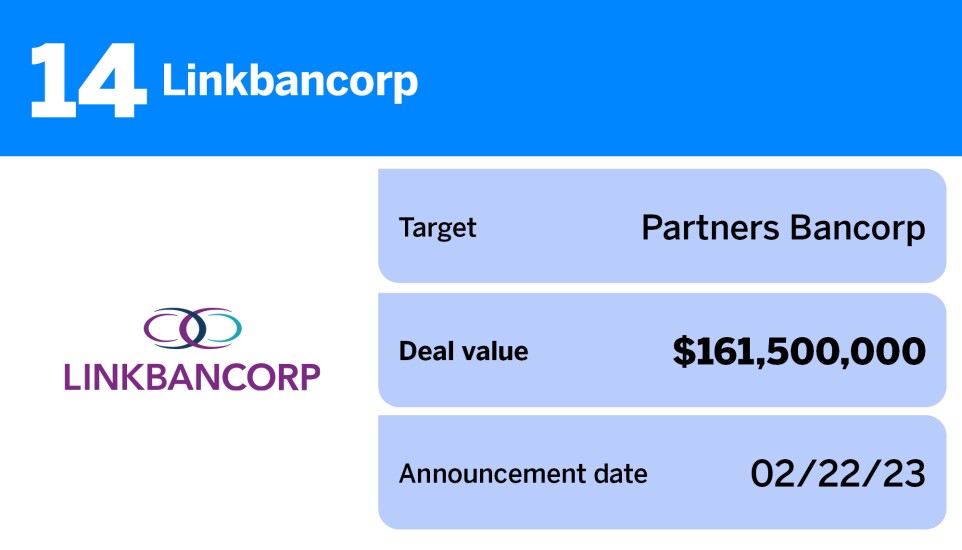

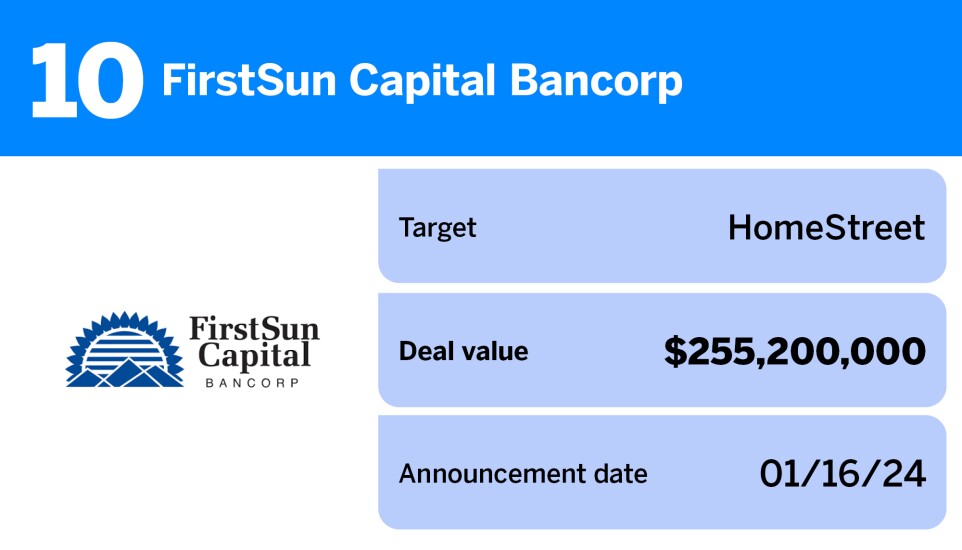

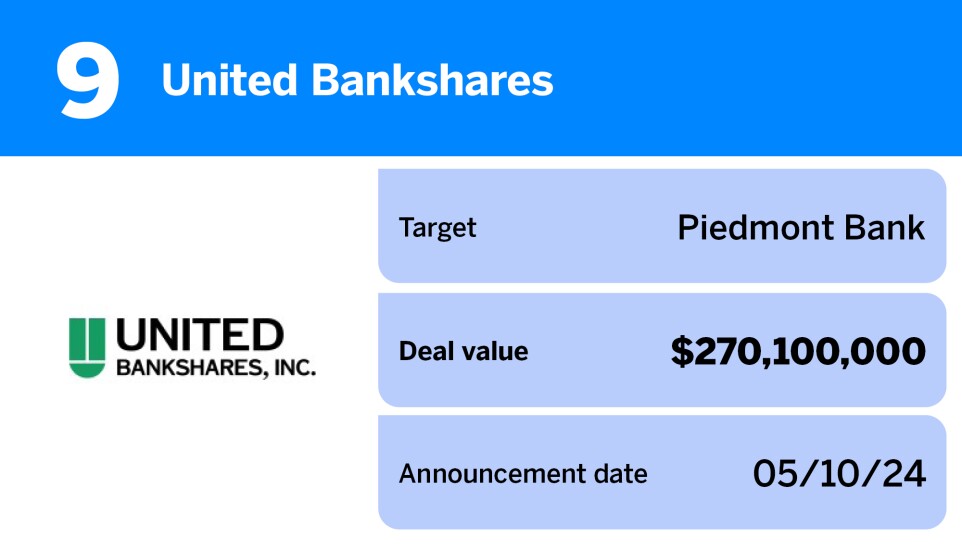

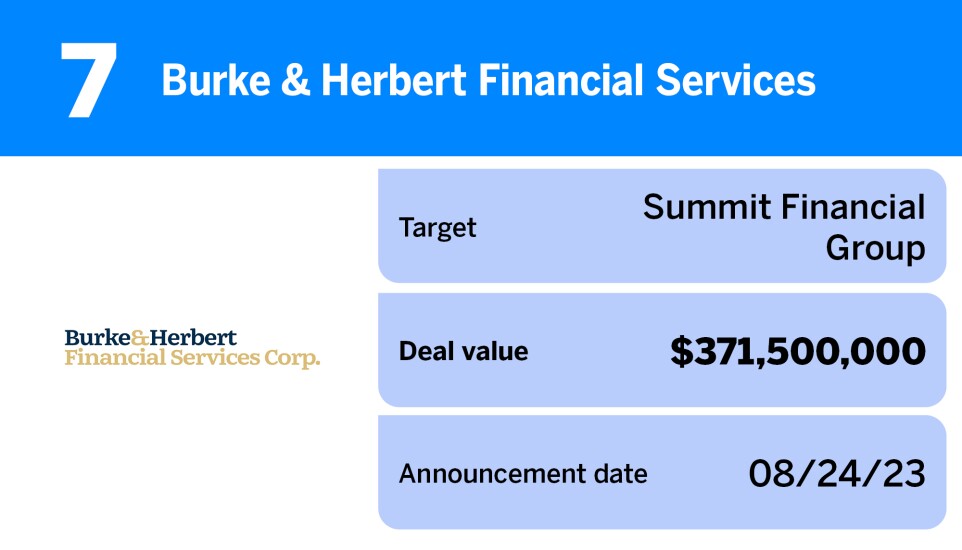

Scroll through to learn more about 20 largest U.S. bank M&A deals of the past year.

Source: S&P Global