Want unlimited access to top ideas and insights?

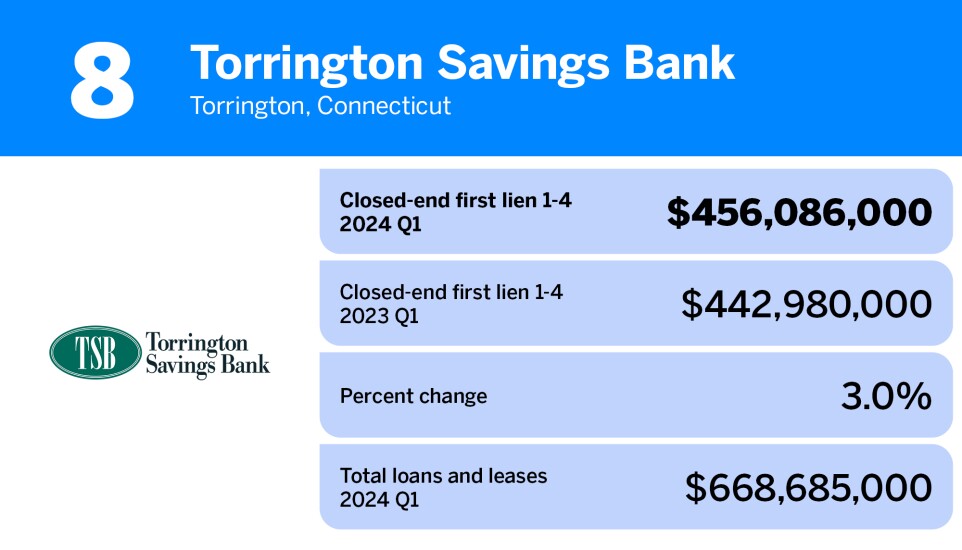

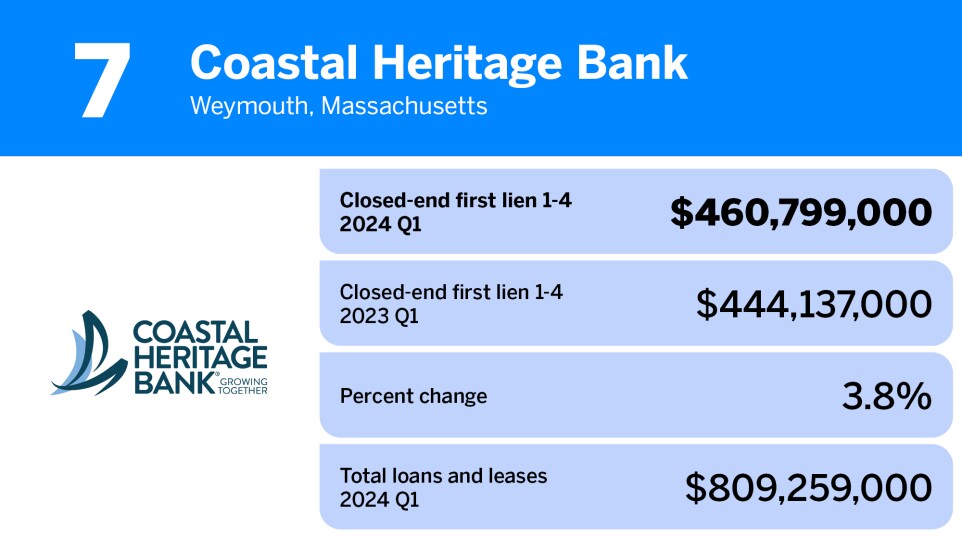

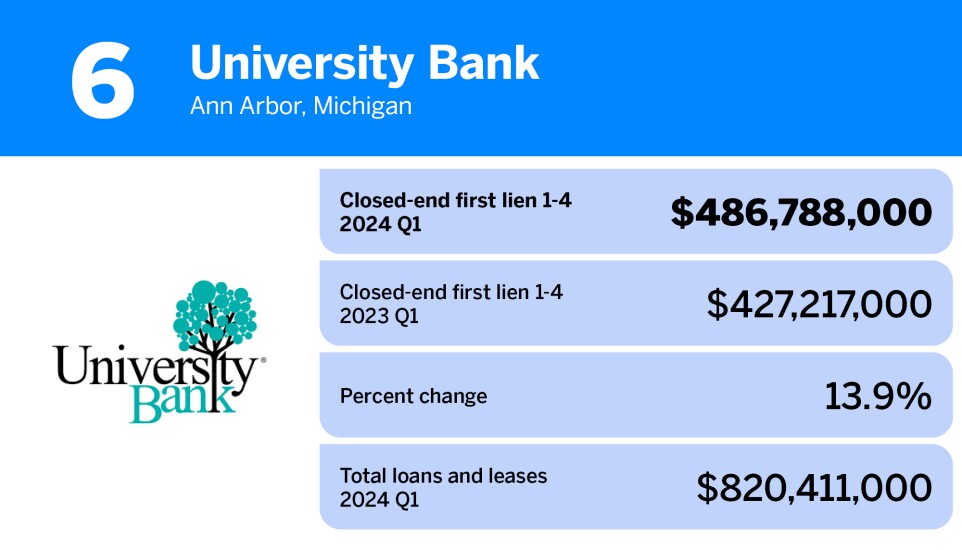

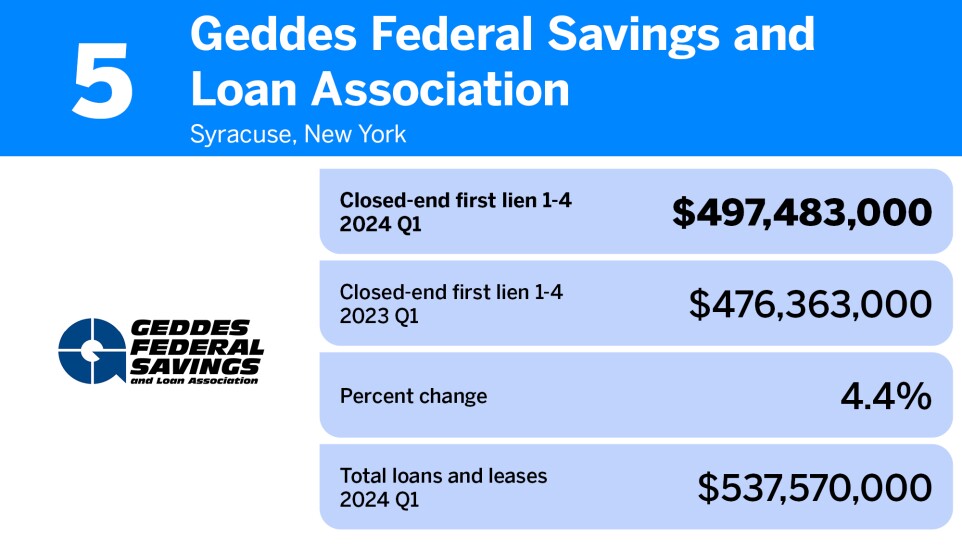

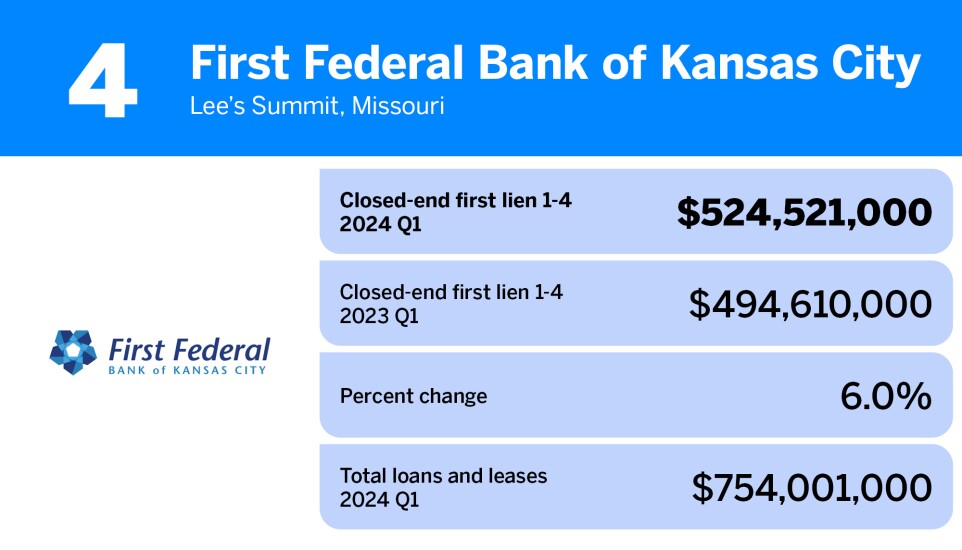

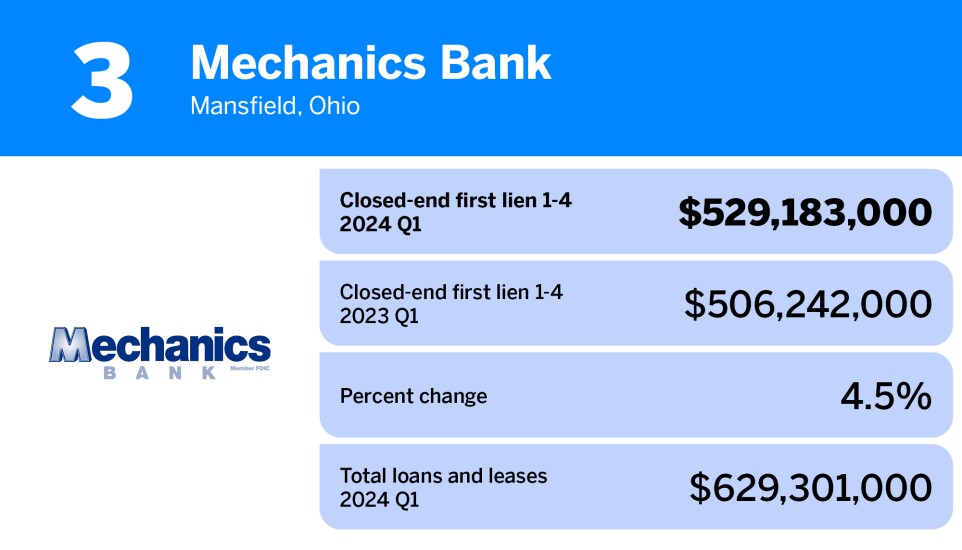

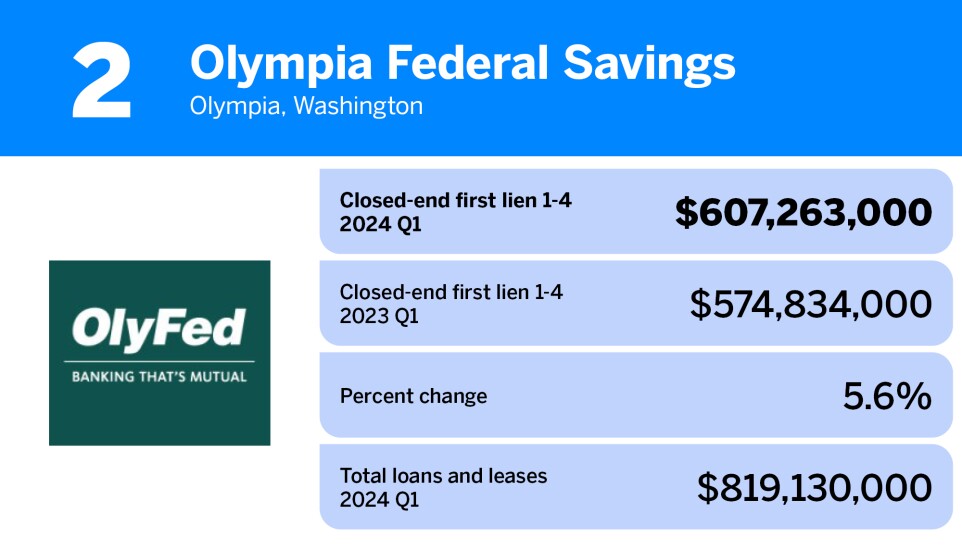

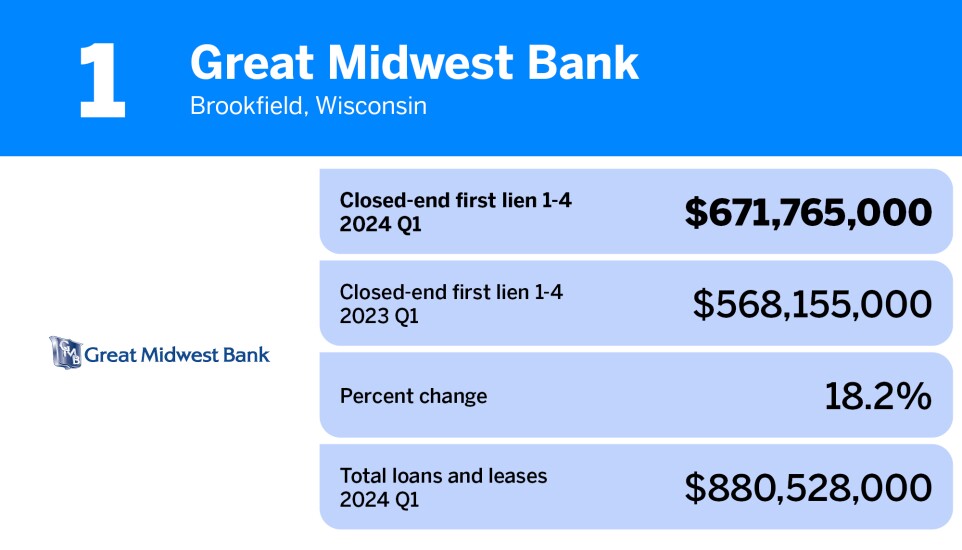

The top five community banks in our ranking have combined first mortgage loans of more than $2.8 billion as of March 31, 2024. Several banks increased their loans over the last year, with one seeing an increase of more than 18.2%.

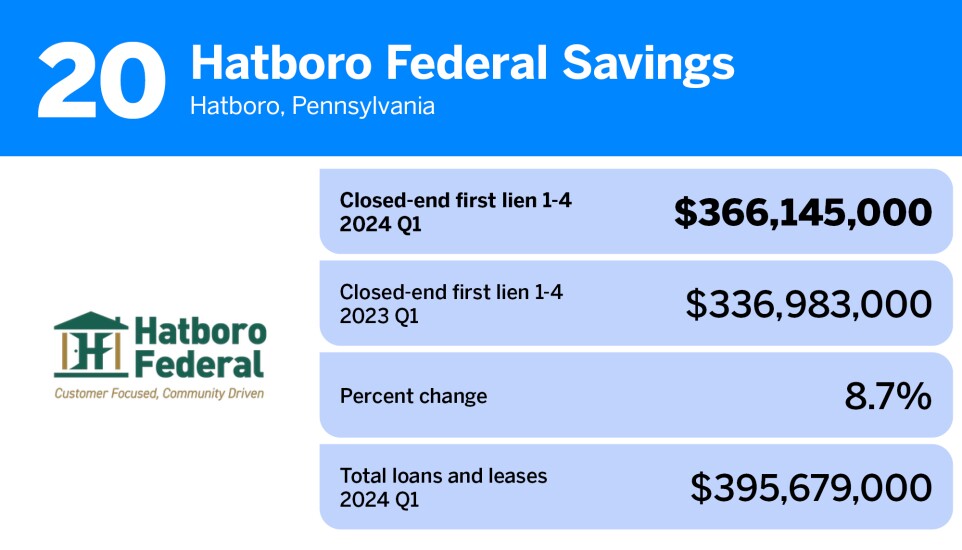

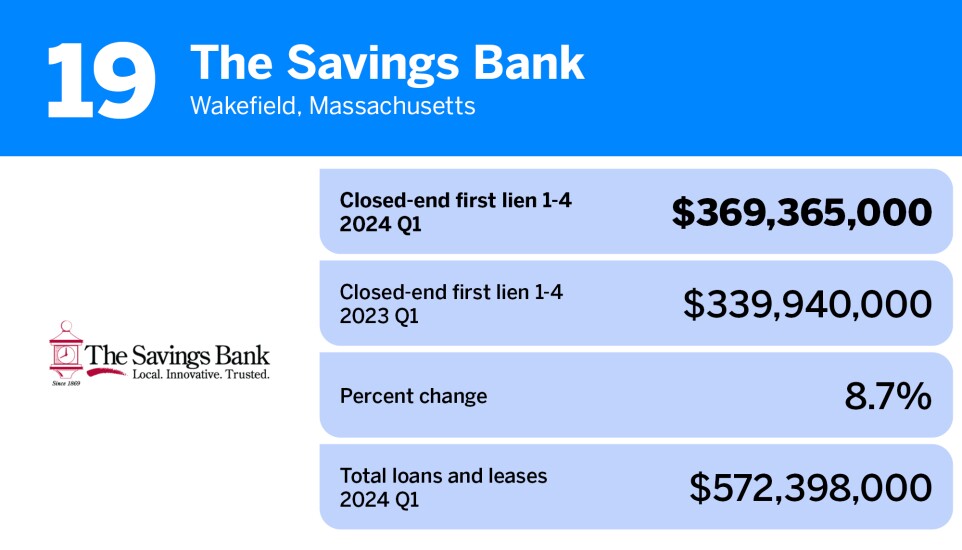

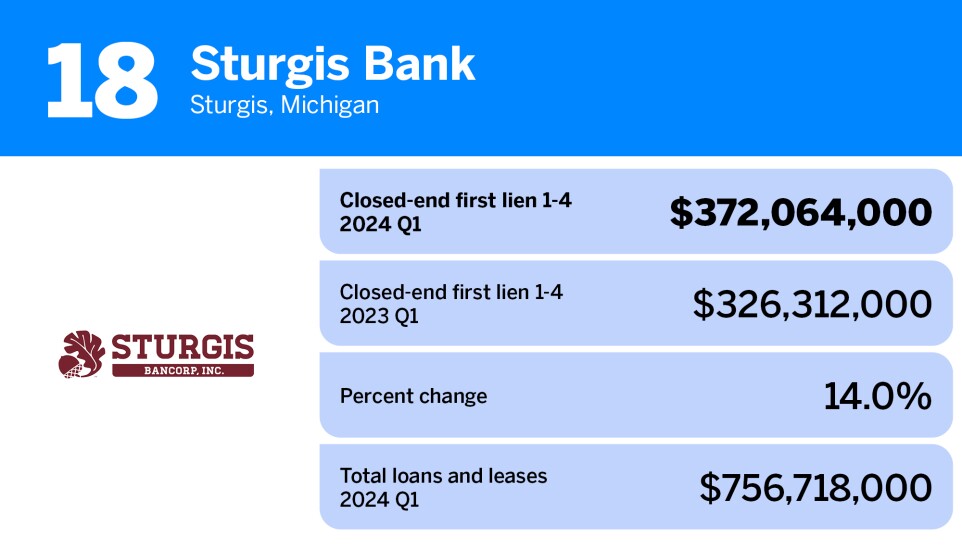

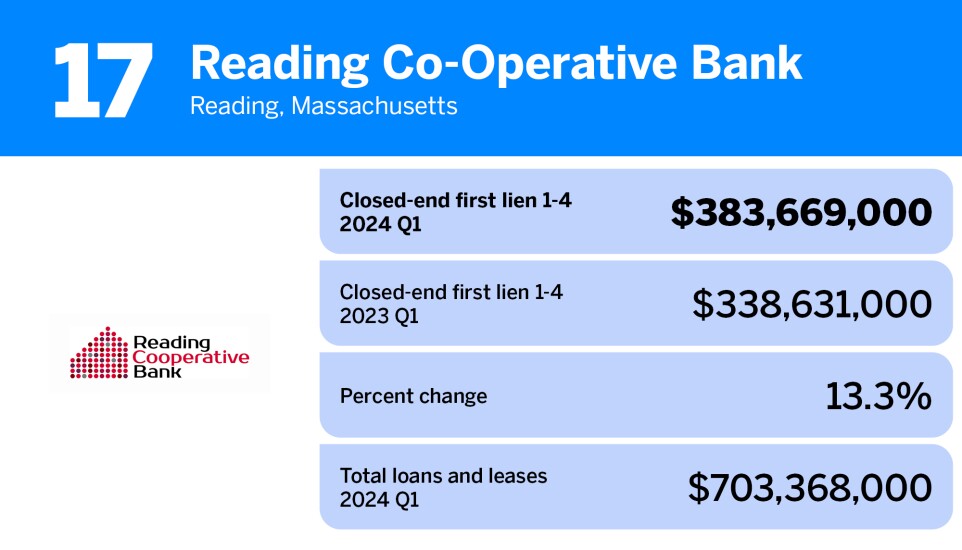

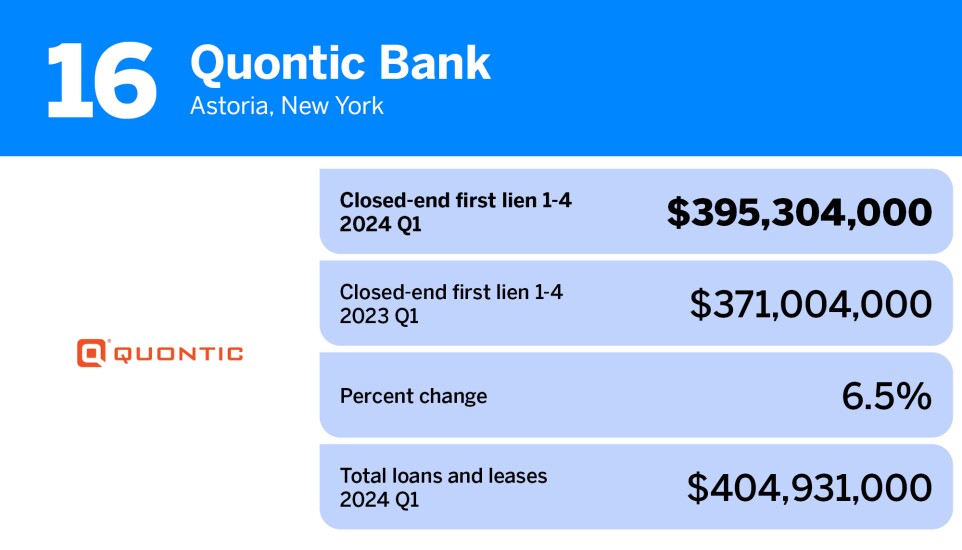

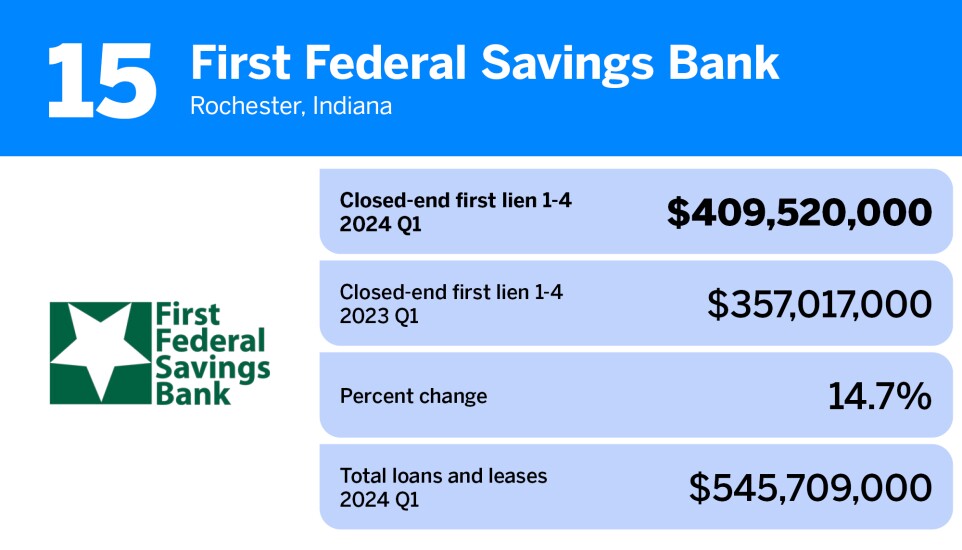

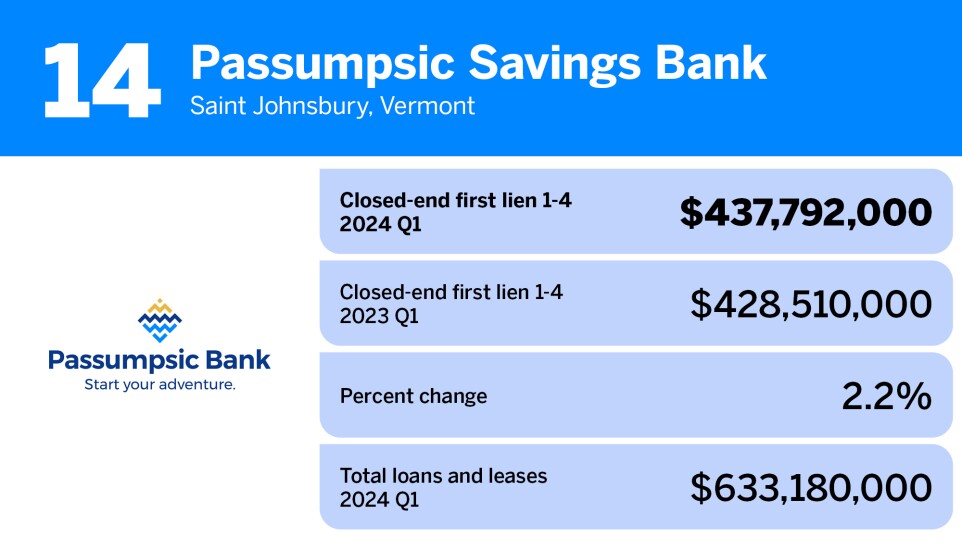

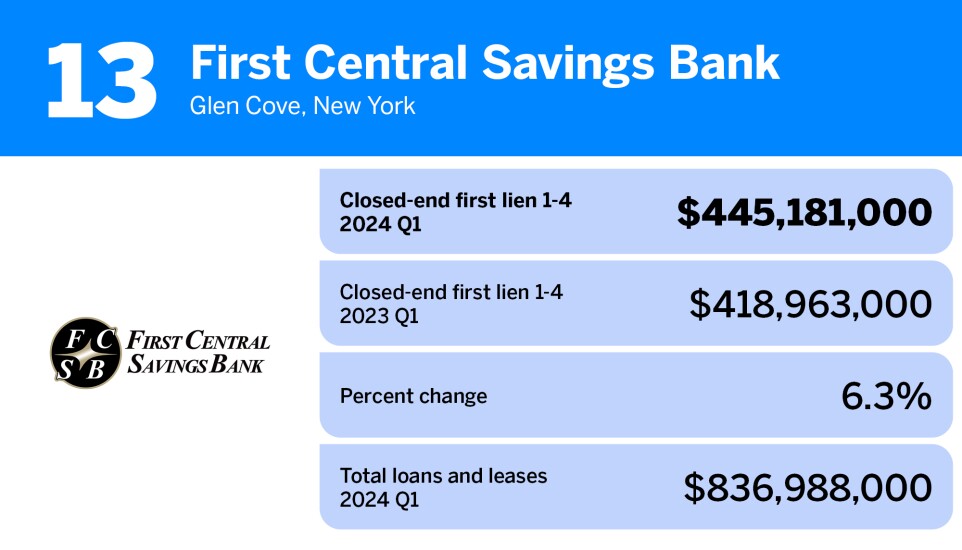

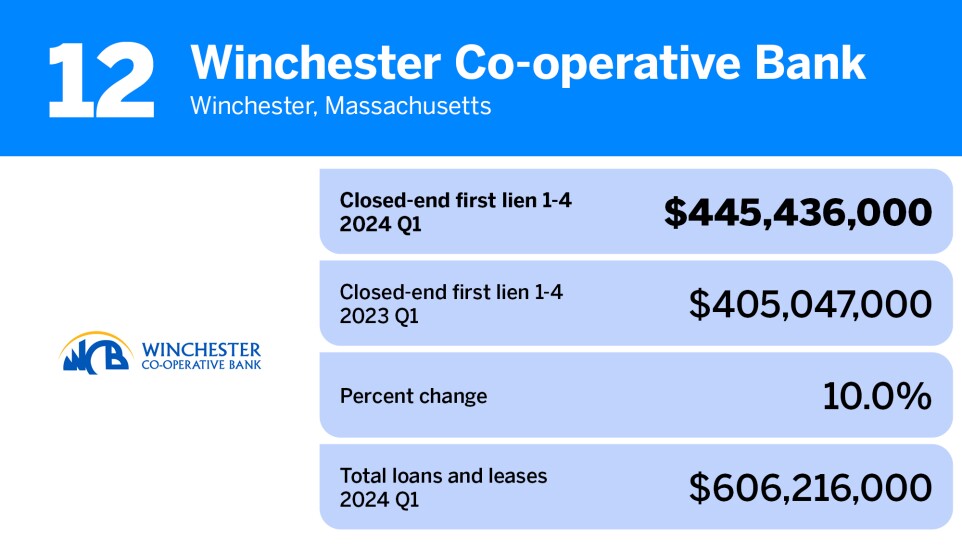

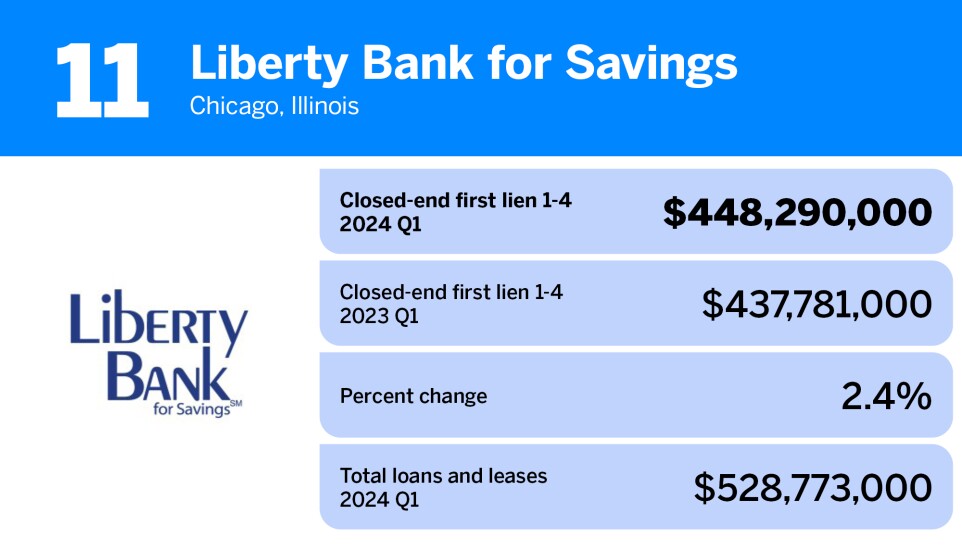

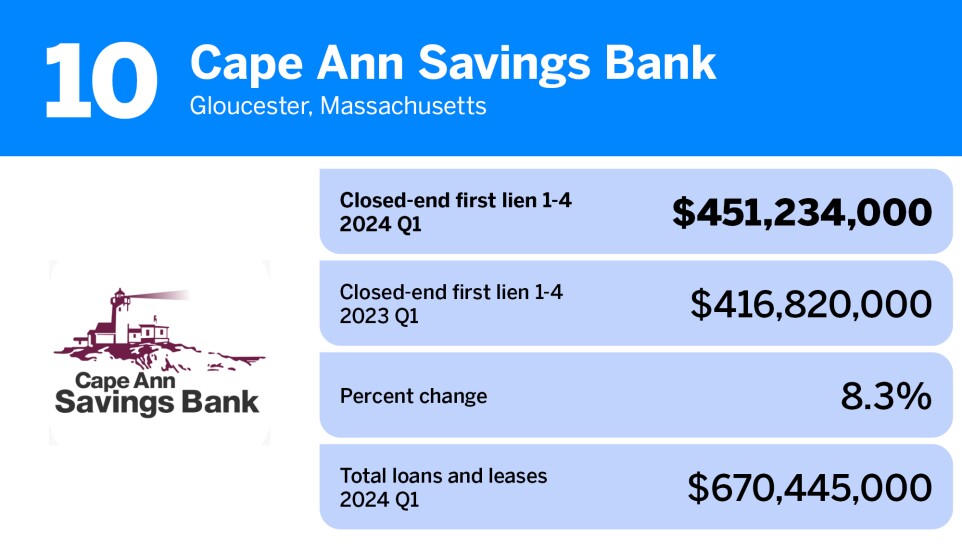

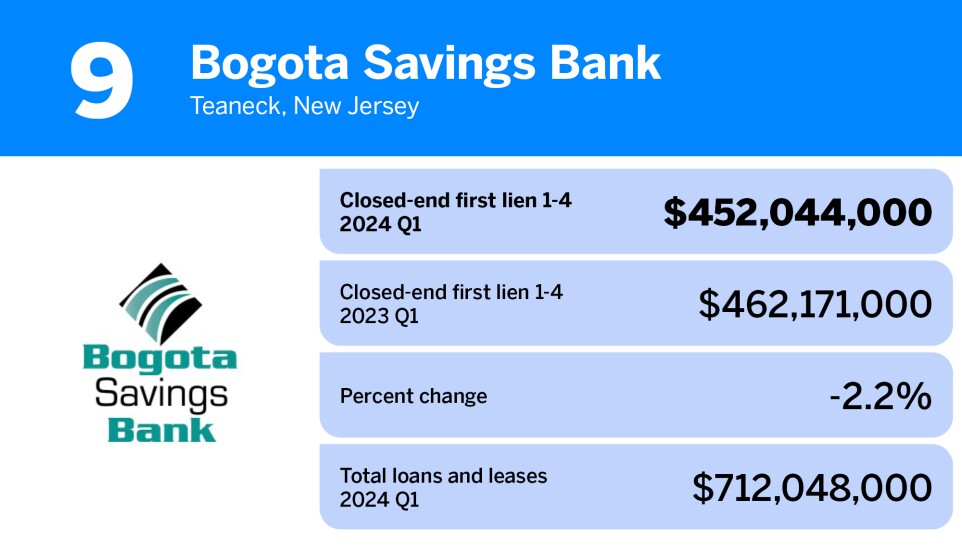

Scroll through to see which community banks made the top 20 and how they fared in the 12 months ending March 31.