-

Healthier sellers are searching for growth partners instead of saviors, and buyers seeking greater density in their current markets are ready to oblige.

February 27 -

The valuation of United Bankshares' deal for Virginia Commerce — 1.8 times tangible book — is an encouraging sign for other sellers.

January 30 -

Heritage Financial is paying 1.5 times tangible book value for Valley Community, but the markets welcomed the deal because Heritage expects to slash the seller's expenses as much as 50% because of market overlaps.

March 18 -

Bryn Mawr Bank in Pennsylvania It has agreed to buy MidCoast Community Bancorp in Wilmington, Del.

March 28

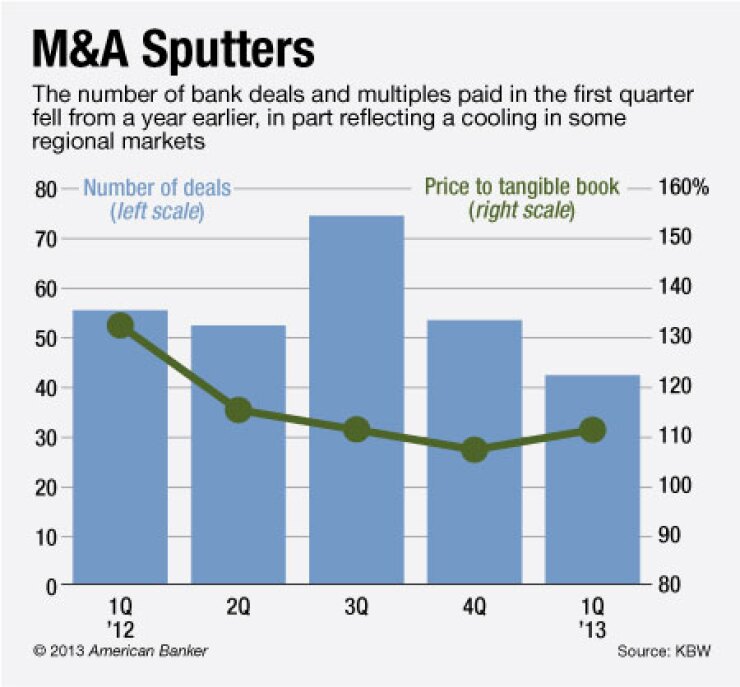

Warning to M&A optimists: ignore the data if you want to stay upbeat.

Bank deals and their multiples fell in the first quarter, undermining chatter among many industry players that merger discussions have been heating up.

Banks announced 42 deals in the quarter, with an average price of 111% of tangible book value, according to data provided KBW. That compares with 55 deals and average valuations of 132% a year earlier.

"There was a feeling that there is a much steadier stream of dealmaking," says Scott Siefers, an analyst at Sandler O'Neill. "We've had a couple of fits and starts in M&A, but there is a sense that there is healthy vigor. In many ways, deals beget deals."

Those January-to-March stats, of course, miss part of the story. One of the biggest differences in the quarter was where dealmaking occurred. Deals in the South made up roughly a quarter of the total, compared with just a handful last year, according to data from ParaCap Group. That is a welcome relief to one of the regions hardest hit by the downturn.

"Real estate has found a firm footing, and buyers are less skeptical about the bottoming out of prices," says Lee Burrows, chief executive of Banks Street Partners in Atlanta.

However, that Southern shift likely helped to pull down the tangible book multiples. Buyers and sellers there found common ground by pricing credit and other lingering risks

Though the average tangible book value of 111% in the first quarter rose slightly from 109% in the fourth, it was off 21 basis points from a year earlier.

Five deals

Multiples last quarter were more down to earth. The highest valuation in the first quarter of 2013 was United Bankshares' (UBSI)

Another shift — toward publicly traded buyers — also took place in the quarter.

Data from KBW show 52% of the deals involved publicly traded acquirers, up from 37% in the fourth quarter and 31% in the first quarter 2012. The change is meaningful because it suggests a strengthening market and improving perceptions about M&A among shareholders, observers say.

Bank stocks trended up in the first quarter. Additionally, the stock prices of buyers in some cases

"It might be that investors' interest in M&A has picked up the most prominently," Siefers says. "There had been a lot more trepidation with concerns over things like tangible book value dilution."

Given the low-growth environment, more publicly traded banks might be more aggressively looking for deals to prop up earnings, says Rick Foggia, a managing director at Commerce Street Capital.

"They have more pressure to find earnings than privately held banks, so that should lead to an increase," Foggia says.

The need to augment anemic loan growth drove one of the final deals of the quarter.

"It is harder to come by pure organic growth now," said Ted Peters, chief executive of Bryn Mawr Bank Corp. in Pennsylvania, which announced last Thursday it would