Credit card users have been unusually diligent in paying off their bills recently in the wake of the financial crisis. Their discipline slipped a bit late last year, however, which led revolving credit to post a surprise jump in November.

The re-emergence of a sharp seasonal dip in payment rates — the percentage of outstanding balances that cardholders pay off each month — could plausibly be interpreted as a welcome sign that consumers are regaining confidence in their economic futures and thus in rolling over debt.

Despite the recent slippage, payment rates remain near peak levels. That reflects a radical change in the profile of the typical cardholder that has resulted from lenders’ purging of delinquent borrowers from customer rolls and tightening of underwriting standards. Broadly, lenders have shifted to a focus on “transactors,” who use cards to a way to pay, from “revolvers,” who carry balances from month to month. For the industry the change is a mixed bag; what’s good for credit quality can be an

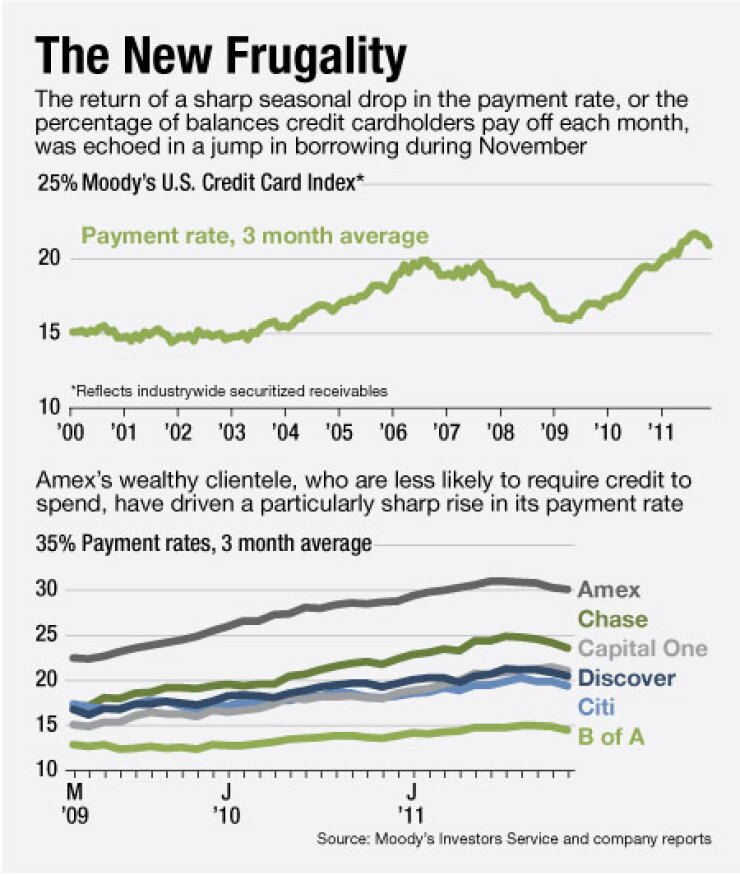

The three-month average payment rate for securitized receivables hit a 12-year high in August 2011 at 21.7%, a Moody’s Investors Service index indicates (see the first chart).

August has often served as a seasonal peak for payment rates and November a seasonal trough.

Even so, the 0.8-percentage-point fall from August 2011 to 20.9% in November was the steepest second-half drop since 2007. It was mirrored by a pop in credit card debt, which increased at a seasonally adjusted annual rate of 8.5% in November, Federal Reserve data published

Even with the seasonal drop, the payment rate remained well above elevated levels posted during the mortgage boom, when many borrowers drew on home equity to pay other debts.

The nation’s six largest issuers have each posted higher payment rates over the last three years (see the second chart).

The three-month average payment rate at American Express Co. increased 8 percentage points from March 2009 to 30% in November last year, remaining considerably higher than its rivals’ ratios in a reflection of Amex’s affluent clientele.

The payment rates at Capital One and JPMorgan Chase both jumped 6 percentage points over the same time. At Discover Financial Services, the increase was about 4 percentage points. For both Bank of America and Citigroup, it was about 2 percentage points.

To be sure, high payment rates are just one influence on loan growth, and can be overcome with increases in the amounts consumers charge to their cards in the first place. Regardless, high payment rates are a force that appears likely to remain in the market for some time.