-

Oil extraction in western North Dakota has created a big economic spike in the region, but the area's community banks are also struggling to keep up with the growth.

December 16

A lot of bankers would envy the challenges facing their North Dakota brethren: rapid economic growth, and perhaps too strong a housing market.

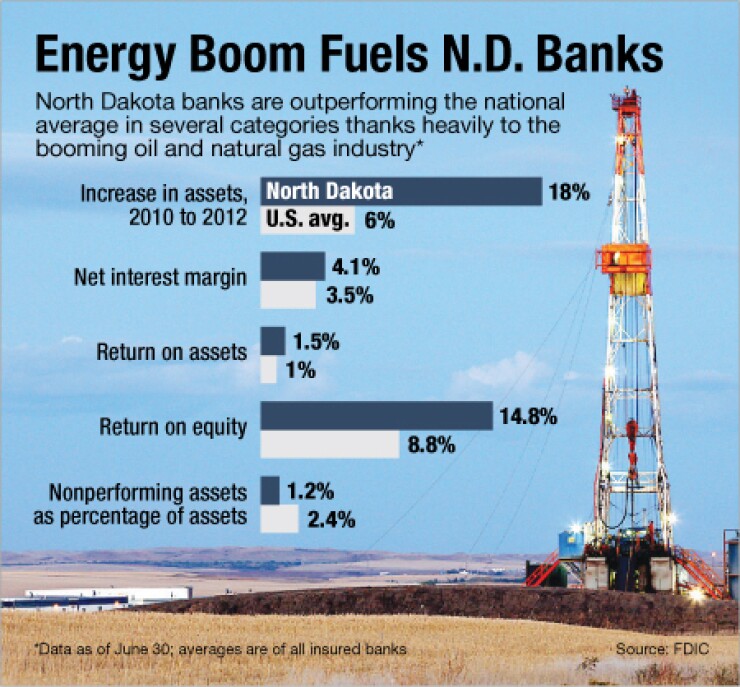

The state's oil boom has brought new riches and opportunities for North Dakota's community banks. Their assets grew three times faster than the national average over a two-year span, and they outperformed banks nationally on margins, returns and credit quality at midyear.

Keeping up with the growth means adding employees - and creates the surprising headache of having to buy them housing so they can afford to move there.

As the

"Every employer is struggling to find employees," said Gary Petersen, the chairman and chief executive of the $238 million-asset Lakeside State Bank in New Town, N.D., in describing the gold-rush atmosphere. "Some oil companies and some suppliers are willing to pay almost anything to get things done" and banks are under pressure to do the same.

In the past two years, $1.2 billion-asset First International Bank & Trust and $102 million-asset McKenzie County Bank, both based of Watford City asked the North Dakota Department of Financial Institutions for approval to acquire homes because "there is limited affordable housing in the Watford City area due to the increase of population as a result of the oil boom," according to the minutes of a July 20 meeting of the department's board. It approved the requests on condition the banks sell the homes as soon as they were no longer needed.

The housing market is moving so rapidly that these banks' requests quickly become outdated. First International had initially asked for approval to spend up to $300,000 for a home. The bank later came back to ask if the ceiling could be raised to $400,000.

Calls to First International, McKenzie County Bank and North Dakota regulators were not returned.

Other threats loom for North Dakota banks. Some community bankers had expected that large or regional banks would have opened retail offices there by now because of the explosive growth. That has not happened - so far.

"I've seen zero sign of them trying to open branches in the area," Petersen said. "I thought there might be a level of interest in some branching here."

Perhaps this is where the state's hot housing market has worked to small banks' advantage, creating a costly barrier to entry for the big banks.

Only two banks with $100 billion or more of assets operate there. Wells Fargo (WFC) of San Francisco is the largest in the state by deposit market share at 9.5%, and U.S. Bancorp (USB) of Minneapolis is No. 3 at 6.6%.

So far, Wells has been content to add staff to its offices that are located on the edge of the 200,000-square-mile Bakken oil field, which stretches across portions of North Dakota, Montana and Saskatchewan. Wells' offices in Bismarck, Dickinson and Minot have added staff in business lending, mortgage lending and wealth management, according to John Giese, regional business banking manager in North Dakota for Wells.

Wells is "always looking" at whether to open branch offices in the central part of oil country, primarily centered around the city of Williston, Giese said.

U.S. Bancorp spokeswoman Amy Frantti declined to comment on its plans for retail branches in the state.

Other companies from outside the state appear to have their eye on North Dakota. The private-equity firm

Community banks have moved slowly in opening new physical locations. The last new branch opened in the oil region of the state was in Jan. 2010, when $109 million-asset State Bank & Trust of Kenmare opened an office in Berthold, N.D. As of Nov. 21, no applications for new offices were pending with the state regulatory agency.

Even big banks are concerned about overextending, Giese said.

"We want to help accommodate the growth, while taking into account being careful on how you underwrite it," Giese said. "There is always that possibility that things could get overbuilt."