-

The Consumer Financial Protection Bureau has made two significant decisions for examinations: to hire a large portion of examiners from outside of the other federal financial regulatory agencies and to bring lawyers along at the beginning.

July 10 -

The bureau is still the lead agency, but Dodd-Frank's ban on certain harmful practices known as UDAAP could give other agencies a significant role through their enforcement authority over community banks.

May 14

Do you want more job security or, even better, a big, fat raise? If so, you should quickly get up to speed on consumer protection laws, then apply for a job in your bank's compliance department.

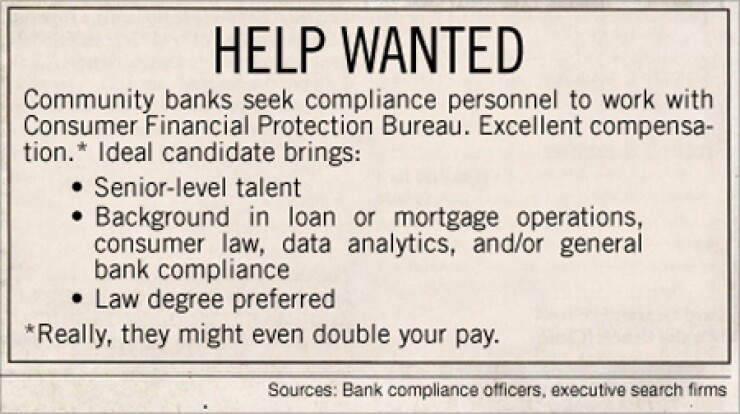

Because of the Dodd-Frank Act and the creation of the Consumer Financial Protection Bureau, banks are scrambling to find compliance personnel with expertise in consumer protection law.

The nation's biggest banks have done the most hiring to date, but community banks are also out looking to expand their compliance staffs.

"Nobody is ignoring this, because they can't afford to," says Tom Watkins, a founding partner of executive search firm Chartwell Partners.

The shift has created a windfall for aspiring bank executives who are fortunate enough to have the relevant professional experience.

"These are often senior hires," says Jeanne Branthover, a managing director at Boyden Global Executive Search. "Banks are having to pay more for the right talent, often 50% to 100% more if they want someone to manage it."

The rising demand for personnel could have another side effect that could benefit certain existing employees. "Give your compliance officers a raise," suggests Jo Ann Barefoot of Treliant Risk Advisors.

Banking companies that are unable to bring on a new staff member are often resorting to rearranging job duties, says Michelle Brewer, the chief compliance officer at $1.2 billion-asset Palmetto Bank.

Management at the Greenville, S.C., company may eventually hire someone to exclusively oversee consumer compliance, Brewer says. For now, she says the bank is relying on her professional contacts at rival banks to help it understand the changing climate for consumer protection.

"It's just [involves] calling someone and saying, this is how were interpreting it, how are you interpreting it," Brewer said.

Banks, of course, have always had to deal with consumer compliance laws such as the Truth in Lending Act and the Truth in Savings Act.

But two key changes have transpired. The first is an emphasis by all federal and state bank regulators on Unfair or Deceptive Acts or Practices, or UDAAP. Another change is that the one-year-old CFPB

"Technical compliance with the law" used to be the primary responsibility of compliance officers, says Ann Jaedicke, a managing director at Promontory Financial Group.

"Now the compliance officer has to focus the organization on fairness, because fairness is the focus of the CFPB," Jaedicke adds. "It's just a different way of thinking."

The CFPB did not respond to requests for comment.

It's

"UDAAP is the area of consumer protection that's causing banks the most consternation," Farrell says.

Regional and community banks have mostly been stealing talent from the largest banks, since the biggest financial institutions have done more work on consumer-compliance matters, Watkins says.

"A $60 billion-asset bank will drag someone out of Bank of America, since B of A has already taken more steps to deal with these issues," Watkins says.

Smaller banks that lack the financial resources to hire a full-time consumer compliance executive are often hiring part-time consultants or relying on contacts at trade groups such as the American Bankers Association or the South Carolina Bankers Association, Brewer says.

The need to rely on personal contacts is especially acute for banks not located near a large metropolitan area. "If you're near a big hub, you'll have a better chance of finding applicants with a consumer law background," Brewer says.

Community banks with an particular emphasis on commercial lending are less likely to need compliance officers with a background in consumer issues, says Ronald Paul, the chairman, president and chief executive of the $3 billion-asset Eagle Bancorp in Bethesda, Md. "Community banks that are much more retail-oriented are going to need to hire people in that compliance area," Paul says.

Still, most of the banking industry is trying to hire new staff with experience in consumer issues, Branthover said. And to make it more difficult, banks are even competing with other industries, like healthcare, for compliance talent.

"There's not a huge talent pool, but every single financial institution has to have someone who can directly answer these issues," Branthover says.