-

BNC, of High Point, N.C., would pay $35 million for First Trust, its fifth deal in the Carolinas in nine months.

June 4 -

A number of banks are asking shareholders to convert preferred shares to common stock to lift tangible common equity ratios.

April 23 -

BNC Bancorp in High Point, N.C., has agreed to buy KeySource Financial Inc. in Durham, N.C., in an all-stock deal valued at $12.2 million.

December 21

BNC Bancorp is sticking with the Troubled Asset Relief Program despite showing twice in the last two years that it can land capital from other sources.

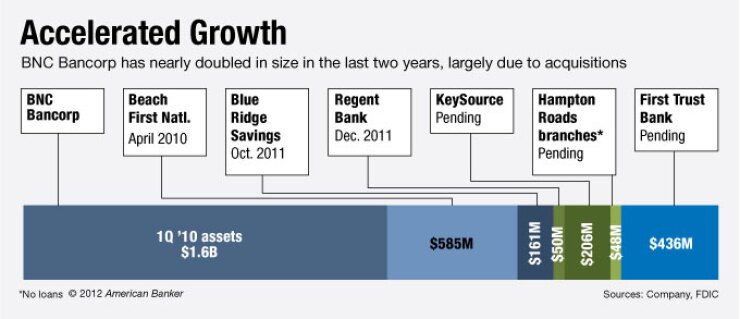

The $2.5 billion-asset company has twice relied on private equity firm Aquiline Capital Partners for capital in the last two years, including

BNC (BNCN) has no immediate plans to use the private equity to exit Tarp because they believe the government money offers the cheapest way to fund an ambitious acquisition strategy. For now, Tarp requires banks to pay a 5% preferred dividend quarterly.

"We consider it fairly inexpensive capital that still counts as Tier 1," says Swope Montgomery, who has overseen seven acquisitions in the last two years as BNC's president and chief executive. "We considered it growth capital."

Industry observers would prefer to see banks exit Tarp, but some say BNC's view of its $31 million of government money makes sense. Chris Marinac, an analyst at FIG Partners, says BNC would pay a 12% minimum rate to get that capital from private sources.

"It's about perception," says Marinac, whose firm advised BNC on its agreement Monday to buy First Trust Bank in Charlotte, N.C. "Mathematically, they're making a little more money by leveraging the capital for longer."

If BNC can grow enough with acquisitions and internal efforts, it would create a greater return for shareholders and book value when it repays its Tarp funds. Likewise, any further capital raise would be less dilutive to existing shareholder if BNC's recent deals can add to its earnings.

Montgomery says that BNC will spend the "next year or two" focusing on improving its earnings per share and return on equity to "justify" the new capital.

BNC has been somewhat hampered recently with a

Aquiline invested $35 million in BNC in 2010. It was enough capital to exit Tarp, but management instead elected to embark on an aggressive growth strategy. Its pending purchases of First Trust and KeySource will boost BNC to more than $3 billion in assets.

BNC has also bought two failed banks, assets and liabilities from two other banks, and a portfolio of residential mortgage receivables. It has also built lending teams in North Carolina cities such as Raleigh and Winston-Salem.

"No doubt, we could have used that [Aquiline capital] to pay back Tarp," Montgomery says. "We felt that with the opportunities we were seeing — mostly organically — growing" was more important.

Montgomery says BNC already has more than $100 million worth of commercial loan deals in the pipeline in Charlotte and more than $70 million in Raleigh.

Though uncommon, there are other Tarp participants that have declined to exit the program to make acquisitions, including Ameris Bancorp (ABCB) in Moultrie, Ga. Like BNC, the $3 billion-asset Ameris has used its $52 million in Tarp, along with previous capital raises, for a string of acquisitions. Ameris has bought nine failed banks since 2010.

On Tuesday the Treasury Department said it would auction off the preferred stock of seven Tarp banks, including Ameris.

Montgomery says BNC has been in contact with the Treasury about its actions. He says management is closely watching the results as a possible option to exit Tarp. "We're going to wait and see if we're in line for the Dutch auction," he says. "If not, there are other things we can do."