There is a definite yin and yang to Florida banking these days.

The state's banking market is still seriously impaired, but foreign banks are increasingly attracted to it for the same reason — and their arrival may feed the turnaround.

Buyers from Brazil and Spain have aggressively sought out community banks in Florida because of the historically low prices, the expansion of its international business and the inflow of foreign cash. Foreign banks need ways to diversify beyond their own troubled economies.

Especially in South Florida, international banks "feel it's a good entry point in the U.S. given there are so many Spanish-speaking people" and the state has "a very rich, deep deposit base" said Fernando Alonso, a partner at the Hunton & Williams LLP, Miami office who helped in some of the international deals. "But that is not so much a driver as the fact that once they establish a beachhead, they can expand throughout the country."

In late April, Banco do Brasil (backed by Brazil's largest bank) agreed to buy the $95 million-asset Eurobank in Coral Gables for $6 million. Banco do Brasil had a foreign agency in Miami but this would be its first domestic bank acquisition.

Two months earlier, CBM Florida Holding Co., which is backed by Brazilian investors, agreed to buy First Community Bank Corp. of America in Tampa for $10 million. CBM will merge First Community into its subsidiary, Community Bank & Co. in Lakewood Ranch.

CBM Florida's chairman, Marcelo Faria de Lima, is an international investor and former commercial banker for ABN Amro Bank in Brazil and Chicago.

"Brazil is one of the biggest powerhouses in the Western Hemisphere so they are going to go to Miami. It's a natural connection," said Ken Thomas, a bank consultant and economist in Miami.

South Florida is known as a safe haven for foreign deposits, and that reputation makes international business attractive to both foreign and domestic banks.

The Florida Office of Financial Regulation stated recently that there were 22 foreign banks and 32 state-chartered banks in South Florida. Statewide, international branch assets grew 19% to nearly $15 billion and produced $58 million in profits last year, according to the state regulator.

Alonso estimated that at least 40% of banks based in Florida have some foreign ownership.

Thomas added that the expansion of the Panama Canal and seaport facilities will help fuel U.S. bank acquisitions in the area by foreign buyers.

"Some institutions have already grown and expanded in South America and other markets … so they look to places in the U.S. as stability and growth" even though Florida may seem over-banked to domestic bankers, Alonso said. "From [foreign bankers'] perspective we're not over-banked and they see the opportunities for consolidation."

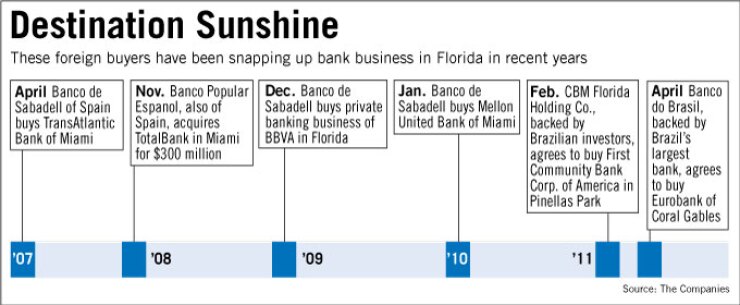

Several large Spanish banks had already stepped into Florida through acquisitions right before the financial crisis. Two of the most notable banks with Spanish connections that weathered a global financial meltdown, raised capital and are looking to expand are Banco de Sabadell and TotalBank in Miami, observers said.

Since its first acquisition of TransAtlantic in 2007, Banco de Sabadell of Barcelona, Spain, has made about one acquisition per year, last purchasing Mellon United National Bank in January 2010.

Alonso, who assisted in the latest deal, said by the time Sabadell acquired Mellon United, it was clear that there was risk in the market so it structured the deal to minimize its exposure to problem loans. Sabadell essentially cherry-picked the loans and has rights to certain assets that perform well over time.

"Having completed the [Mellon United acquisition], we are now undertaking an ambitious plan to bolster our position in South Florida," said Fernando Perez-Hickman, managing director of Sabadell's U.S. operations. "In the next couple years, we want to increase our volumes significantly organically, and we will naturally be paying special attention to opportunities arising in this market, as we count on the support of our parent company for this important project."

Its main U.S. banking arm has $2.4 billion of assets; it grew 33% for the year ended March 31.

The $2 billion-asset TotalBank, which was acquired by Spain's Banco Popular Español in 2007, also received a $20 million recapitalization in 2009 to help it through credit issues and get back to expansion. It said in the first quarter that it was continuing its branch expansion plan after turning a profit consistently since the third quarter of 2010.

The $1.8 billion-asset City National Bank of Florida, which was purchased by Caja Madrid of Spain in April 2008, also received a $100 million capital injection last year from its parent and plans to expand across the state.

In the Eurobank deal, Banco do Brasil will recapitalize the bank from its "adequately capitalized" status and likely leverage it for future deals. CBM's deal for First Community Bank also involves an additional $20 million capital injection upon closing, which was expected mid-year.

Foreign intervention will help restore banking conditions in the state, industry officials said.

"The strategic foreign buyers are making longer term bets which means they make more thoughtful decisions," said Eddy Arriola, chairman of Apollo Bank in Miami. "Although they are competition, we'd rather compete against smart rationale competitors."