-

Artificial intelligence developments are stoking investor fears about software companies. Banks' limited exposure to the sector and general stability is proving attractive to investors.

February 6 -

Prosperity Bancshares finalizes the second of three acquisitions it's announced since July; Sumitomo Mitsui Banking Corporation appoints a new chief information security officer for its American operations; Huntington Bancshares, Third Coast Bancshares and Heritage Financial completed acquisitions; and more in this week's banking news roundup.

February 6 -

CEO Max Levchin said the lender is testing technology that allows merchants to perform more advanced testing of promotional financing offers.

February 5 -

Unlike some of its expansion-minded regional bank peers, Montana-based First Interstate is reconfiguring its business model to be smaller and more focused on relationship banking. The blueprint is the work of CEO Jim Reuter, who joined the bank 15 months ago.

February 5 -

The mortgage technology unit at Intercontinental Exchange posted a profit for the third straight quarter, even as lower minimums among renewals capped growth.

February 5 -

American Banker's 2026 Predictions report finds that nonbank entities and check fraud are major threats to local banks in the coming months.

February 5 -

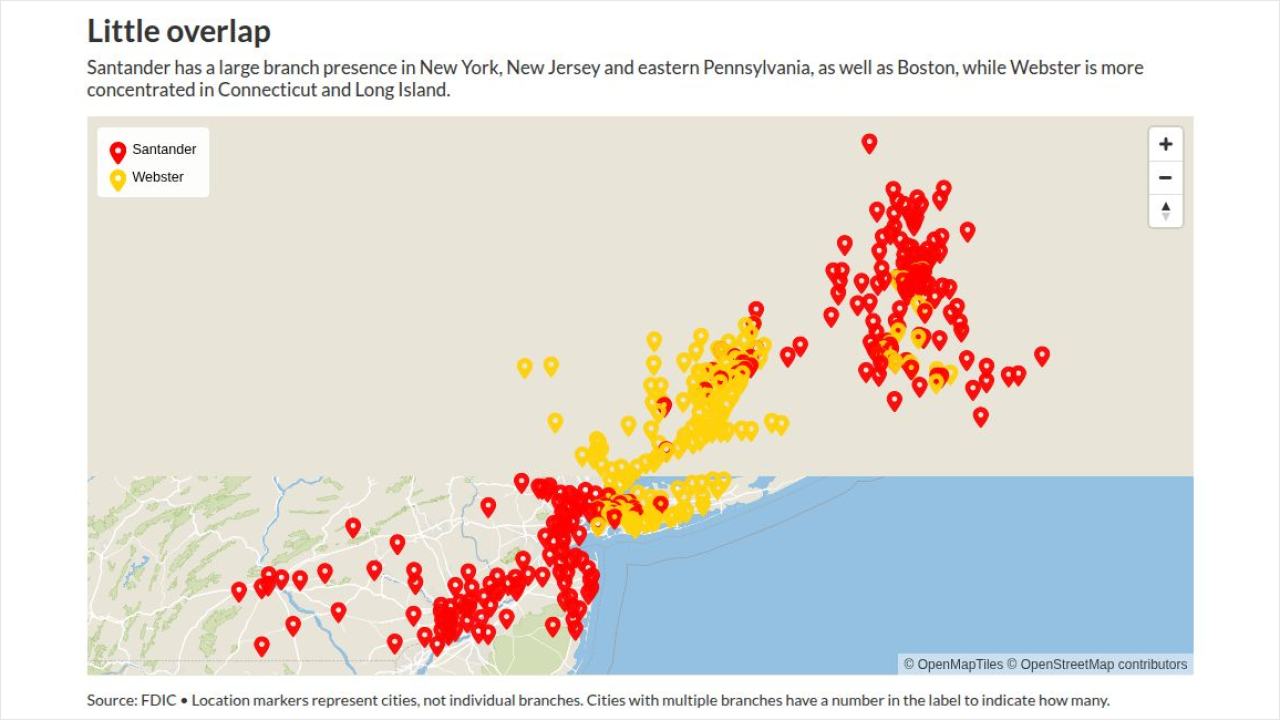

The Spanish banking giant is accelerating its U.S. growth plans with the pending acquisition of Webster Financial in Connecticut. The combined entity will be the second-largest foreign-owned bank operating in the country.

February 4 -

The Spanish banking giant, which has been trying to grow its U.S. business, plans to acquire the Connecticut-based parent company of Webster Bank.

February 3 -

The crypto and payment fintechs both debuted on the stock market in late January with strong openings, then traded down ahead of a four-day partial government shutdown.

February 3 -

Acquiring the $5.8 billion Northfield Bancorp would give Columbia a presence in both Brooklyn and Staten Island. The deal provides a window into the impact of New York Mayor Zohran Mamdani's plan to freeze rents on the city's multifamily real estate market.

February 3 -

HP CEO and current PayPal board chair Enrique Lores will take over March 1, following a deep slump in the payment company's key metric.

February 3 -

The digital bank added two new board members and raised $123.9 million as it continues to manage regulatory costs amid its push for profitability.

February 2 -

While stablecoins aren't widely used for merchant payments, blockchain tech firms such as BVNK and Polygon Labs are seeking opportunities to add speed to slow-moving international transfers.

February 2 -

In keeping with its policy of outsourcing functions outside its core commercial and retail banking competency, Signature Bank near Chicago teamed with a larger trust company to fill a longstanding gap in its product set.

February 2 -

Instead of fighting to keep the banking industry unchanged, perhaps it's time for banks to accept that change is inevitable and focus on adapting to remain competitive.

February 2

-

As tokenization increasingly brings instant settlement to transactions, the liquidity buffer that batch settlement has provided for decades is going to shrink and then disappear. Banks will need to rethink liquidity management.

February 2

-

The Arkansas-based company pivoted to organic growth a few years ago, after making 14 bank acquisitions in less than a decade.

February 2 -

The combination of the banks is the latest in a trend of deals closing on speedier timelines, and signals the industry's hunt for scale.

February 2 -

When the Swiss banking giant bought rival Credit Suisse in 2023, it inherited an investigation over money the Nazis looted from European Jews. The issue now seems to be coming to a head in Washington.

February 2 -

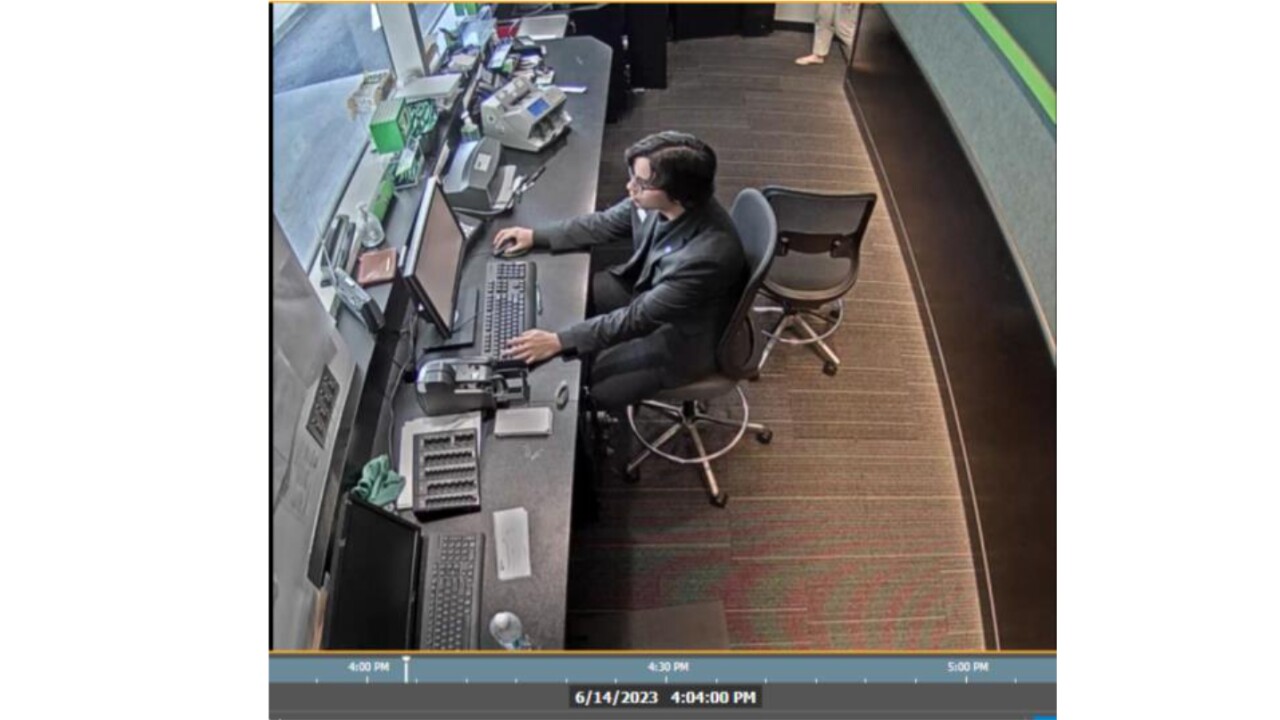

Court documents reveal how a teller used the drive-through window and work email to aid a scheme that bypassed TD's fraud defenses.

January 30