-

The Federal Reserve is considering allowing banks a chance to comment on stress tests before they take them and dropping any qualitative review for the largest banks’ performance, according to Randal Quarles, the central bank’s vice chairman for banking supervision.

April 16 -

Suggestions that Republicans are working to unwind Dodd-Frank could indicate a vote on a bipartisan regulatory relief bill is near.

April 13 American Banker

American Banker -

The bill, which also exempts community banks from the trading ban named for former Fed Chairman Paul Volcker, would go a step further than the regulatory relief bill that passed the Senate.

April 13 -

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

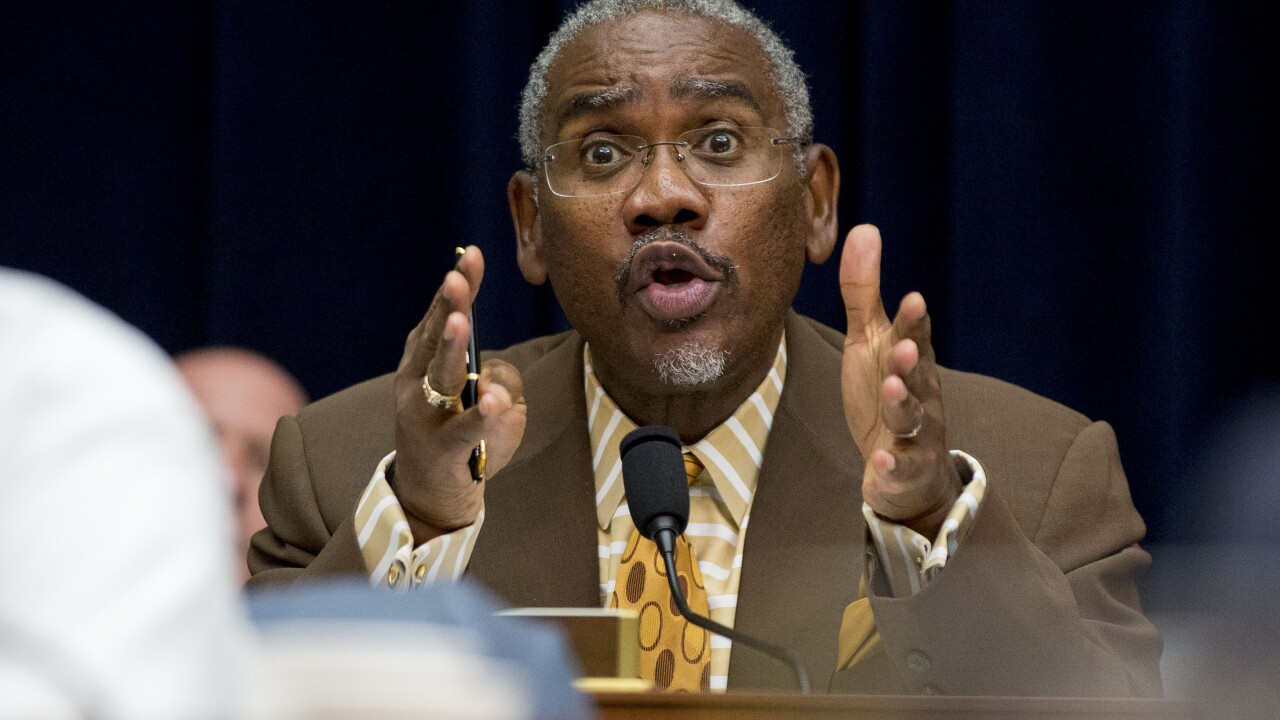

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

House Speaker Paul Ryan's decision not to seek re-election is another sign of the difficulties Republicans will likely face in holding the chamber in November, heightening pressure to move a pending regulatory relief bill as soon as possible.

April 11 -

House Speaker Paul Ryan's decision not to seek re-election is another sign of the difficulties Republicans will likely face holding the chamber in November, heightening pressure to move a pending regulatory relief bill as soon as possible.

April 11 -

Questions about the CFPB’s structure, high-profile enforcement actions and the acting director’s rift with Elizabeth Warren could dominate two days of hearings on Capitol Hill.

April 10 -

The acting head of the Consumer Financial Protection Bureau said he is “pleasantly surprised” with most personnel but raised concerns about those who lean toward the regulatory philosophy of Sen. Elizabeth Warren.

April 9 -

As lawmakers consider reforms to the Dodd-Frank Act, fresh data shows a dramatic reduction in new items issued by the regulatory agencies.

April 6 -

Small financial institutions are eager to see the Senate’s reform bill signed into law, but House efforts to amend the legislation risk stalling the effort.

April 6 America's Credit Unions

America's Credit Unions -

As lawmakers consider reforms to the Dodd-Frank Act, fresh data shows a dramatic reduction in new items issued by the regulatory agencies.

April 6 -

Small financial institutions are eager to see the Senate’s reform bill signed into law, but House efforts to amend the legislation risk stalling the effort.

April 6 America's Credit Unions

America's Credit Unions -

The Financial Stability Oversight Council will hold an executive session next week to consider whether Zions Bancorp. should still be considered a systemically important financial institution.

April 5 -

The Treasury Department's inspector general is seeking the identity of an Office of Financial Research employee who produced several YouTube videos that raised concerns about discrimination and diversity problems.

April 4 -

His suggestion to force major agency rules to be preapproved by Congress is a threat to consumers and lenders alike.

April 3IntraFi Network -

The latest salvo by the acting director of the Consumer Financial Protection Bureau — proposing in the agency's semiannual report that all CFPB rules be subject to congressional approval — left many observers stumped if not outraged.

April 2 -

As part of a larger regulatory relief effort, regulators have raised the dollar-amount threshold for commercial real estate transactions that require a formal appraisal.

April 2 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney proposed dramatic curbs to his agency's power in a report Monday, including a recommendation that all CFPB rules must be approved by Congress.

April 2 -

Burdensome regulation has made it hard for community institutions to operate alongside bigger rivals, leaving consumers with less choice and more expensive banking options.

March 29 Sageworks

Sageworks