Net interest margins have been expanding at a nice clip over the past year, giving a boost to bank profits. But with the Federal Reserve likely to either hold the line on, or further cut, interest rates, margin expansion may grind to a halt.

Regional banks are especially vulnerable to this trend because they rely heavily on lending for profits and, unlike big banks, typically don't have large fee-generating operations to offset downturns in loan demand.

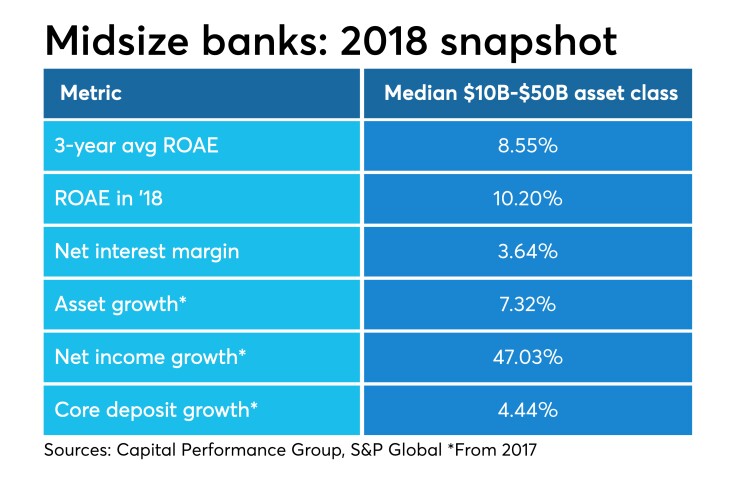

To be sure, regionals' median net interest margin climbed 16 basis points to 3.64% over the 12-month period that ended Dec. 31, 2018, as shown in our annual ranking of banks with $10 billion to $50 billion of assets.

But banks in this size range are very dependent on net interest income.

The median for net loans as a percentage of assets for this group of banks was 70.68% at Dec. 31, 2018, compared with 64.4% at banks with more than $50 billion of assets, according to Capital Performance Group, which compiles the ranking for American Banker. (Click on the "view table" button at the end of this article to see the full ranking or on the links below to see the rankings for past years.)

See previous annual rankings for regional banks:

'Grow and grow fast:' The newbie rule for regional banks (2018)The one bank metric that matters most now (2017)

Even if interest rates stay put or decline, regional banks will be under pressure to raise deposit prices to remain competitive, said Kevin Halsey, a senior consultant at CPG. Online-only banks that are paying market-leading rates are a big part of the competition.

Deposit costs are already on the rise for regionals, as their median cost of funds at Dec. 31 was 0.73%, a 23-basis-point increase from a year earlier.

To make up for some of the margin compression, regionals will need to accelerate fee income, Halsey said. Total noninterest income for the group slowed from a 26.9% growth rate in 2017 to 3.6% last year.

The problem is regionals tend to lack the side businesses — capital markets and asset management for institutional investors, for example — that the big banks possess to offset downturns in loan demand.

"They need to boost revenue streams that aren't dependent on interest rates," Halsey said. "But that's a significant challenge as well."

The following chart provides a detailed overview of the performance of banks with assets of $10 billion to $50 billion; they are ranked by three-year returns on average equity.

Click on "view table" below to see the latest ranking.