When Cadence Bancorp. agreed to buy State Bank Financial in June, it got more than just a beachhead in a new market.

Acquiring the $4.9 billion-asset Atlanta company would add heft that Cadence needs to help defray a sharp increase in regulatory expenses.

Cadence, which is based in Houston, is one of 12 banking companies included in this annual ranking for the first time because they grew above the $10 billion asset mark in 2017, a threshold where much more aggressive regulatory requirements kick in.

"It's really imperative for these banks that they're able to grow and grow fast to offset the new compliance costs," said Kevin Halsey, a consultant at Capital Performance Group.

The $10 billion mark has strategic implications. Crossing the line triggers costly stress tests and caps on interchange fees, and that requires giving careful consideration to the best way to build scale rapidly — either through organic growth or acquisitions.

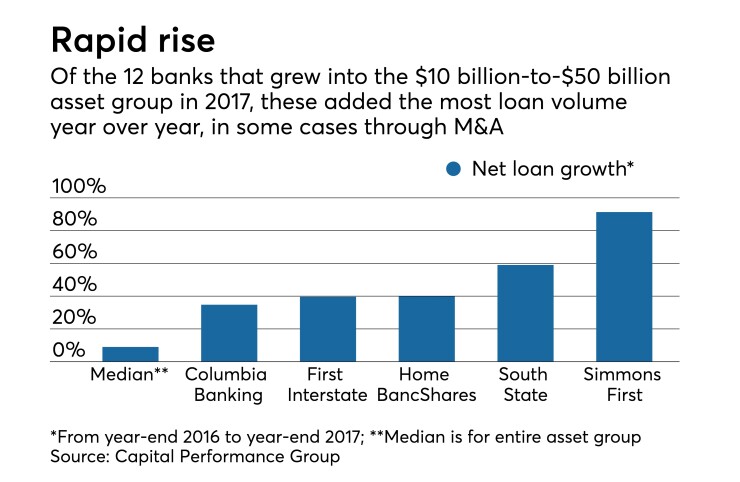

Banks in the $10 billion to $50 billion asset class have pursued both tactics. The $15 billion-asset Simmons First National Corp. in Pine Bluff, Ark., and the $14 billion-asset Home BancShares in Conway, Ark., are serial acquirers that crossed the $10 billion threshold as of Dec. 31. Since 2016, Simmons has closed five deals and Home three.

Some larger banks in the group are doing well growing organically, Halsey said. The $25 billion-asset Texas Capital Bancshares in Dallas posted net loan growth of 17.5% in 2017, without an acquisition. That growth, which exceeds the overall peer group's median of 8.99%, came largely from commercial-and-industrial and commercial real estate lending.

See our other rankings:

Cautiously optimistic: The top 200 publicly traded community banks The branch-closing conundrum: Our 2018 ranking of midtier banks

Overall performance for banks in this asset class — ranked here by returns on average equity across three years — was mixed. Median net loan growth rose from the previous year's 7.8%, but core deposit growth slipped to 8.35% from 8.9%. The banks as a group posted higher revenue growth (a median of 9.61% for 2017, up from 7.35% the year before), but also higher noninterest expense growth (7.34%, up from 6.41%).

They excelled at improving efficiency, though. The median efficiency ratio dropped 274 basis points from the previous year, to 57.97%, according to CPG. And some of the newcomers set the pace; Home BancShares' efficiency ratio was 37.61%, and Cadence's was 52.69%.

Cadence hit $10 billion of assets during the third quarter of 2017, not long after its initial public offering in April. It makes sense that Cadence made a big acquisition so soon after reaching the milestone, said Halsey (who also wrote

Click on "view table" below to see the latest ranking.

Special offer for American Banker subscribers only: If you have a paid subscription to American Banker, you can request an Excel chart of data on these regional banks for a limited time. Capital Performance Group compiled the Excel chart, which shows additional metrics and analysis beyond the data points displayed below. To receive a reply, the request for this subscriber bonus must be received by