For most companies, $174 billion would blow past any previously set revenue benchmarks and place them well on their way to becoming one of America’s most successful firms.

But for Wall Street banks, that is the total amount they shelled out in fines and settlement fees to help make amends for their role in the financial crisis. To put that number into greater perspective, it is nearly twice the asset size of America’s largest credit union. Yet bank lobbyists have been taking to the pulpit this Congress to raise concern over credit unions’ growth. Not fines. Not egregious offenses of trust. But growth.

As nonprofit, member-owned financial institutions, credit unions successfully serve 114 million consumers across the country. Shortly after the financial crash, credit unions gained attention for being the better financial alternative to the big banks, and rightfully so. Their growth, to put it simply, is the result of better service, better rates and adhering to a better mission. But the banks have grown too, despite claims of suffering from over-regulation. Their growth has been so tremendous, it is hard to understand why some credit unions are being scrutinized for also growing their customer base and asset size, sparking debate over what makes a credit union a credit union.

From nonprofit status and member eligibility requirements to simply growing the customer base, the credit union industry has been relentlessly attacked by bank lobbyists. Considering Americans still have not fully recovered from an economic crash big banks created — why are the bank trade groups making noise now? Who gains from their argument?

Simple. They do. By creating less competition with credit unions and other small financial institutions.

When the Federal Credit Union Act, which established credit unions’ federal charter, was passed in 1934, modern technologies such as cellphones, mobile and online banking, and driverless vehicles were considered pipe dreams. Today, Washington policymakers are actively seeking to reform policies governing these innovations to adjust to 21st-century American consumers — as they should.

Recently, the National Credit Union Administration has pushed reforms that would modernize credit unions’ federal charter and field-of-membership laws — the rules governing who may join a credit union. Much like any other line of business, credit unions’ federal charter must keep pace with changes in state laws, technology and the financial services industry. With reform, the NCUA is taking an important step to permit credit unions to compete in today’s economy and beyond.

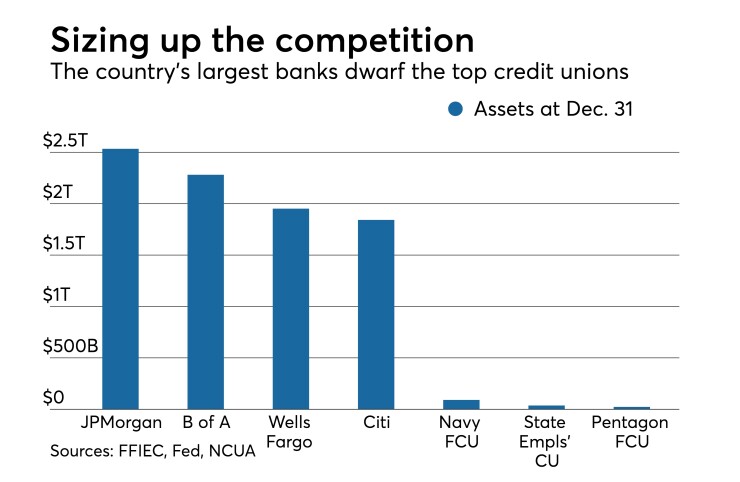

While these changes will allow credit unions to grow, there is nothing inherently wrong with growth, nor are they the only financial institutions that have grown over the years. Their counterparts in the banking industry have grown larger and more profitable than ever before. The fact remains, a “large” credit union still pales in comparison to the asset size of large banks.

The asset sizes of JPMorgan, Wells Fargo, Bank of America and Citigroup are not only well over 20 times that of our nation’s largest credit union, but each one of these individual banks holds more assets than the entire credit union industry combined.

More so, a single credit union does not tell the tale of an entire industry. Before passage of the Dodd-Frank Act, there were more than 10,000 credit unions in operation. As a result of the regulatory burdens and costs associated with the law, consolidation ensued throughout the financial services sector. While some credit unions may have grown, a mere 5% hold more than $1 billion in assets, with the vast majority holding less than $500 million in total assets. This is far from the excessive largess some would like to propagate.

While detractors will continue to beat the drum, credit unions have held true to their core mission as nonprofit financial institutions seeking to deliver safe, affordable products and services to their membership base. Credit unions do not waver in their passion and desire to provide their members with an environment that puts people over profit.

Unlike banks — which are beholden to shareholders’ bottom line — credit unions are committed to serving their membership and local communities. As long as credit unions maintain their nonprofit, member-owned structure, they will remain distinct from banks, regardless of their asset size. To suggest anything otherwise would be a gross misunderstanding of credit unions’ core values, its cooperative structure and those whom credit unions are designed to serve.

If the economy plunges into another 2008-like crisis, I can guarantee it will not be the doing of the credit union industry. What are bank lobbyists doing to ensure their industry does not repeat past mistakes? Right now, it looks like they’re focused on making credit unions the scapegoat — a strategy as transparent as it is hollow.