The National Credit Union Administration has approved a massive expansion of a Texas credit union's field of membership, believed to be one of the first such approvals under a new rule that was the subject of a

The big question is how quickly other credit unions will follow suit.

Gulf Coast Federal Credit Union was previously a community-chartered credit union serving consumers in Corpus Christi, Texas, and surrounding areas. But as a federal credit union with multiple common bonds, it was eligible under the NCUA's revised rule to add other well-defined local communities and underserved areas. Its field of membership now covers 455 census tracts, totaling 24 counties and a population of more than 2.3 million.

The Texas institution says the expansion will help fend off competition from credit unions with even larger footprints.

“The Corpus Christi market was very nice and fine a few years ago … but at the end of the day, multibillion-dollar credit unions were coming in [including Pentagon Federal Credit Union, Randolph Brooks FCU and Security Service FCU], and without us being able to expand into other markets like they did, we were going to get pushed down,” said Jeremy Garza, president and CEO of the $256 million-asset institution.

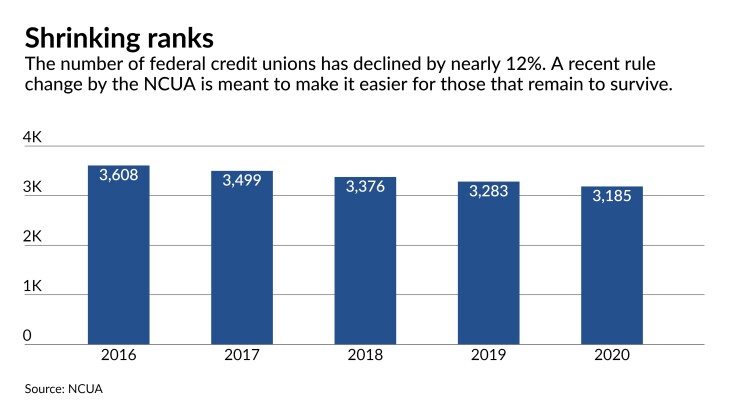

Recent data from the NCUA showed that credit unions with under $1 billion of assets are losing members and net worth, and their loan growth is slowing. As a result, many of those institutions — which constitute more than 80% of the industry as a whole — are likely to look for growth opportunities anywhere they can find them.

Gulf Coast began the process of seeking the NCUA's approval even before the Supreme Court declined last summer to hear a challenge by the banking industry to the field-of-membership rule. The entire process still took the better part of a year.

Expanding field of membership under the new rules is "more work [than converting to a community charter] and for smaller credit unions it’s probably not going to be the right strategy,” said Sam Brownell, CEO of the consultancy CU Collaborate, which assisted Gulf Coast with the expansion effort. “The credit unions this is a benefit for are the ones that feel they have penetrated their market as much as they can. … If you’re a small credit union and it’s too much money to hire a consultant to do this and go through this complicated process, a community charter may give you enough room to grow without this.”

The move will give Gulf Coast access to more rural areas in South Texas.

Keith Leggett, a retired American Bankers Association economist who frequently comments on credit union issues, suggested similar expansions could aid smaller institutions that are in a saturated market and want to move into areas with less competition.

However, Leggett said the complex application process — including analysis of census tracts, underserved areas, combined statistical areas and more — could hinder adoption.

“You have to do your research if you’re going to apply for it and therefore the process is going to probably take more time, because you’re going to have a lot more back and forth with the NCUA with regard to illustrating that this is a well-defined local community,” he said. “It may cause some to consider not to pursue this — that’s always going to be one of the issues.”

The end result, he added, could be a wider embrace of community charters.

The new NCUA rule enables federal credit unions to expand their fields of membership to include underserved areas that can often provide more potential members than would be included as part of a community charter, which are generally defined by county lines.

Brownell suggested that despite the additional homework involved, the NCUA's new FOM rule provides a wider path to growth for multiple-common-bond credit unions than a community charter.

Still, many noted that there are also geographic reasons why some credit unions might not take advantage of the new rule.

Some markets won’t have the same volume of underserved areas as others, due to factors such as population density, median household income and more. On top of that, some states have substantially more permissive credit union charters than others, and about half of all states have

“I think you have a race to the bottom taking place, because what’s occurring is NCUA is reacting to what has happened in the states where NCUA was losing larger credit unions to [state charters],” said Leggett. “You start looking at Florida, which has a much more expansive field-of-membership rule, or Michigan, where the whole state can be part of your field of membership. This is part of NCUA trying to compete with the states, which have basically put in place more liberal field-of-membership rules.”

Carrie Hunt, executive vice president and general counsel at the National Association of Federally-Insured Credit Unions, said the new rule provides “a bit more parity” for federal charters.

“In certain states, this makes the federal charter more competitive,” she said.

Between an ongoing pandemic, economic downturn, a pinch on credit union earnings and the work required to put the new expansion measures into place, it may take a few years to determine how widely the FOM rule is being used, said Vincent Hui, managing director at Cornerstone Advisors.

“Two things are going to be impactful to help streamline the process: One is that folks will learn from other credit unions on how to do it [and] how to do it faster,” said Hui. “The second is that NCUA and regulators will also get more experienced in terms of reviewing and approving these things, and that will help the process as well. Is it going to go down from nine months to nine days? Probably not, but probably somewhere in between there.”