The TILA-RESPA Integrated Disclosure rule is having an adverse effect on credit union lending, according to the Credit Union National Association.

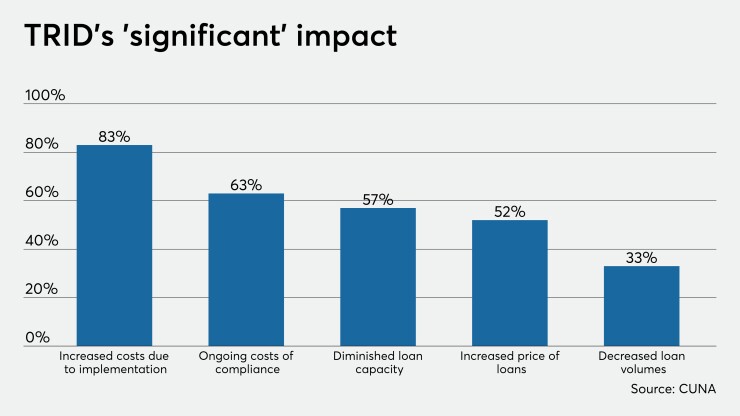

A recent survey from the CUNA Lending Council revealed 33% of respondents saw “significant” or “somewhat” decreased loan volumes following TRID implementation, while 52% reported the rule has “somewhat” or “significant[ly]” increased the price of loans for members.

The trade group highlighted those statistics in a recent letter to the Consumer Financial Protection Bureau as it assesses TRID and its impact.

“Because credit unions, as community-based lenders, are typically smaller in asset size and loan volume, complex regulatory requirements like the TRID Rule have a disproportionate effect,” CUNA wrote, adding that as a result credit unions rely on vendors and credit union service organizations to aid with compliance efforts.

“The reality is that when credit unions are burdened by the cost of regulation, consumers receive fewer options for financial products and services. Ultimately, when consumers are unable to access desired credit and services from their local credit union, they are often required to turn to higher-cost lenders that may not have their best interests and financial wellness in mind,” added CUNA.

An overwhelming majority of respondents to CUNA’s survey (83%) also reported “significant” or “very significant” initial costs related to TRID implementation, while 63% had the same response related to ongoing costs associated with compliance. Fifty-seven percent said ongoing compliance costs had diminished lending capacity at their credit unions due to it taking longer to offer and complete loans.

The group called on the CFPB to make a variety of modifications to TRID, including dealing with closing delays and consumer waivers of mandatory waiting periods, which CUNA says create unnecessary friction in the lending process; easing the process of fixing clerical errors in a loan after closing; expanding official guidance clarifying treatment of second lien loans; and more.

“The TRID rule is by no means perfect and there are areas that should be addressed. But as the rule assessment progresses, CUNA respectfully requests the Bureau refrain from adopting broad, wholesale changes to the TRID Rule’s structure,” the letter reads. “Dramatic changes to the TRID Rule would only serve to create additional compliance costs and require credit unions to expend finite resources that could otherwise be applied toward serving their members. Rather, the CFPB should focus its efforts on providing clarity using targeted interpretive rules or official guidance that resolves ongoing compliance concerns.”