A recent merger in California has highlighted a difficult choice many single-sponsor credit unions face today: Diversify your field of membership or risk closing your doors as the result of a merger.

Members of Cal Poly Federal Credit Union, which serves California Polytechnic State University in Pomona, Calif., voted last month to approve

Representatives from Cal Poly FCU did not respond to requests for comment, but losing the on-campus space for its operations basically meant the end of its time as a stand-alone entity.

"This is why credit unions need multiple employer groups, associational groups [or] community charters — to provide diversification so that they can survive whether they get sponsor support or not," said Dennis Dollar, a credit union consultant and former chairman of the National Credit Union Administration. "You are seeing the reason for the essentiality of increased FOM options for credit unions that are so often fought by the banks. Diversification is the key to long term viability."

Credit unions across the country have been chartered to serve universities, but many of them have diversified over the years, including Alabama Credit Union.

ACU was originally chartered to serve the University of Alabama, and today it maintains on-campus branches in both Tuscaloosa and Huntsville. The Tuscaloosa branch is located in the student center, while the credit union owns a building on leased land at UAH. Both have leases that extend forward several years, said Steve Swofford, president and CEO of the $1.2 billion-asset institution.

"It would certainly impact our ability to serve the two campus populations were we to lose those offices, but we operate in 20 counties across Alabama, and thus would not threaten our viability," Swofford said. "But it’s a good argument for diversification."

Alabama CU broadened its field of membership years ago in order to attain the growth necessary to be competitive going forward.

But Swofford said universities are often primary targets for banks, which have more money to spend to earn exclusivity on the campuses. Campus credit unions that have not diversified risk losing out to banks or much larger credit unions willing to spend "big bucks" for on-campus branches, naming rights, ATMs and access to students, faculty and alumni, he said.

"At Alabama Credit Union, we have an excellent relationship with the universities we serve, but we share the campuses with other institutions. Our diversified field of membership certainly insulates us to some degree from a decision down the road to grant exclusivity to another institution," he said.

‘Diversification is essential’

All new credit unions need a sponsoring company, institution or organization to get off the ground, but the credit union then stands on its own once it is operational. Some sponsoring groups provide more support to the credit union than others, but no support beyond the initial sponsorship is required.

Support is critical for credit unions with a single sponsor, and in the 1980s the NCUA began allowing institutions to have multiple companies — known in the industry as select employer groups — as members. It is also why many SEG-based credit unions have turned to the community charter.

"Growth is important for credit unions, but diversification is essential," Dollar said.

Having the support of multiple employer groups takes the pressure off of the potential problems that could arise if a sole employer group closes, gets bought out, downsizes or decides it can no longer support the credit union as much as before, he said.

For example, at one time there were more than two dozen credit unions chartered to serve local Sears employees, but many of those institutions remained focused just on Sears workers and did not diversify their membership, and in 2018 the last remaining Sears credit union

For much of the history of the industry, it wasn’t uncommon for credit unions to be located in the same building as their sponsor group, with members frequently working on-site. Companies like Sherwin Williams, International Harvester and Acme Steel provided space for credit union offices often at no charge. Having rent-free space was an economic plus for a credit union, especially during their early years, explained Michael Fryzel, an attorney and former NCUA chairman.

Occasionally, some type of disagreement or event would result in credit unions being forced to leave those locations.

"When the Sherwin Williams Company closed its entire production facility on the south side of Chicago, the credit union lost its home. Rather than close, it moved to a free-standing facility, retained its name and became a community-chartered credit union," Fryzel said.

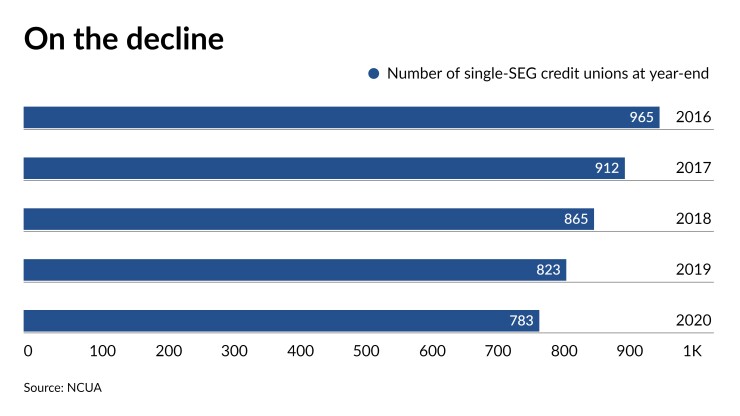

And as the community charter grows in popularity, the number of single-sponsor credit unions is likely to continue to fall.

There were 965 single common-bond credit unions operating in 2016, but by the end of last year that figure had fallen to 783, or about 15% of the industry as a whole. Many of those single-SEG shops that disappeared did so by merging into larger institutions.

The Gerber Products Company sponsored Gerber Federal Credit Union in Fremont, Mich., back in 1950. When the company was sold to a Swiss company in the mid-1990s, the credit union started to add SEGs, eventually adding 125 before converting to a

"We have been in our own building on our own land since 1989," said John Buckley Jr., president and CEO of the $195 million-asset credit union. "We were essentially on our own since 1999, when the payroll and benefits package was separated from Gerber Products HR and we processed our own."

Still, the credit union was largely dependent upon Gerber employees well into the late 1990s, when as much as 25% of the member base was employed by the company. Once it expanded its SEG base, however, said Buckley, it served a broad enough range of consumers by the 2010s that it was a de facto community charter before officially becoming one.

Dollar said a credit union that loses its primary sponsor support has options including adding other employers as SEGs, converting to a community charter, securing associational groups or merging with another credit union that already has that diversification of membership.

"The direction that a credit union will take is largely dependent upon how crucial the sponsor group’s support is to its survival —such as if they have to give up facilities, technology, employee marketing access or staff that was provided previously by the sponsor. That might impact the credit union’s options," he said.