The

Many credit unions offer prize-linked savings as a way to improve consumers’ financial behaviors through gamification. These initiatives require members to make at least one deposit per month into a savings account and those deposits then qualify account holders for the chance to win periodic rewards. Not all credit unions offer these programs, and the additional funds are not generally considered to be so substantial that they have a

Because money and prizes are involved, states must pass laws that permit these programs, and they are not offered in every state. Some industry groups run their own programs or license them out to other states. Others, in states where prize-linked savings are permitted but an independent program is not offered, take part in the national Save to Win program.

The Wisconsin Credit Union League’s Wincentive has seen a 76% increase in deposits this year, compared to a 41% increase in 2019, though Tara Krejcarek, SVP of strategic partnerships at the league, noted, “it’s not all attributed to COVID — we’ve added another credit union who participated, we had [some] promotions [and] we had our annual prize drawing.”

Still, she said, “we definitely have seen a larger increase than normal.”

Similarly, Minnesota’s Wincentive program has seen a 45% increase in balances since the start of 2020, according to Julia Miller, communications director for the Minnesota Credit Union Network.

The biggest of these programs, Save to Win, run by the credit union service organization CU Solutions Group, includes 150 credit unions across 27 states, and growth during the pandemic has been substantial.

“In the beginning when COVID started to hit we expected there would be a ton of people [who] would close their accounts or withdraw their funds because of everything going on,” said Kristen Moore, program manager. “We just expected there would be a huge deluge of people taking money out and closing their accounts."

That didn't happen and Save to Win lost only 72 accounts in April and May, Moore added.

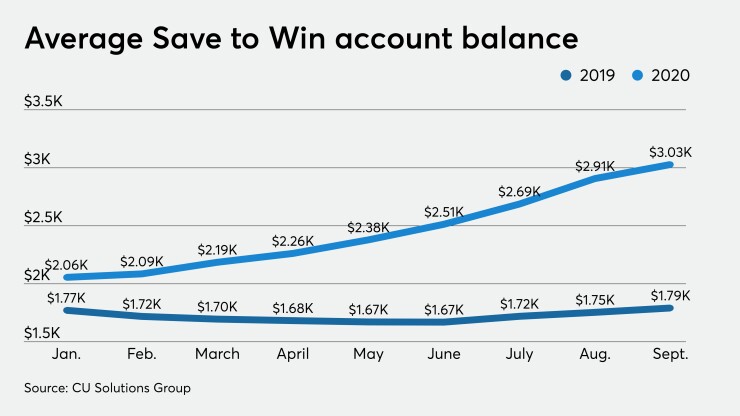

Overall more than 1,200 new Save to Win accounts were added between March and September. At the end of the third quarter, the average Save to Win account had more than $3,000 in it, a 69% increase over one year prior. The number of Save to Win accounts, however, is growing more slowly this year. Participation in the program increased by 7% from January to September, compared with a 16% uptick for the same period last year.

Organizers say it’s difficult to determine where exactly the new funds are coming from. Since the start of the pandemic, many consumers who lost their jobs during statewide lockdowns saw a period in which they were receiving an additional $600 in weekly unemployment benefits from the federal government, along with, in some cases, additional benefits from states. Most Americans also received $1,200 checks from the government to help spur the economy during the spring, and reduced consumer spending in general left many people with additional funds to put aside.

The problem for prize-linked savings programs is that since it’s unclear where the influx of funds is coming from, there’s little way to predict how long it might last.

“We can certainly conclude that it may be because of the stimulus payments and the increased unemployment, however, it may just be that people were kind of scared by COVID and now they’re looking to prepare better for the future,” said Moore. “We don’t have any empirical data to say it was stimulus or unemployment because credit unions don’t track it at that level.”

Krejcarek said Wincentive organizers expect balances to continue to grow.

“I don’t think we’ll see them increase like they have in the last seven months, but I think we’ll continue to see those balances go up,” she said.

Steve Reider, CEO of the consulting firm Bancography, suggested the real wild card for credit unions is whether or not lawmakers end up moving ahead with additional COVID relief legislation.

“If we don’t see additional stimulus and the extension of unemployment benefits …we’ll start to see that savings rate decline again, so to me that’s a variable that is uncertain as to how much of this we’re going to see.”

One other factor helping kick up savings rates, he added, is “people have nowhere to go. People aren’t taking vacations, so there’s a reduction of spending from that perspective, too.”

Deposits have been up drastically for the entire industry this year. Savings balances increased by 17% in August from a year earlier, according to the October trends report from CUNA Mutual Group.

Despite an increase in deposits across the industry, organizers said they have not seen any indications that credit unions are looking to step back from these programs. Many said that’s largely because prize-linked savings doesn’t generally operate on a large enough level to have a substantial impact on the balance sheet.

Reider noted that many credit unions’ balance sheets are made up of small portions of many different items, rather than, for example, putting 60% of the loan base in commercial lines.

“Three percent here and 4% there, and you add up enough of those little segment targets and suddenly you get to 10% of your balance space,” he said.

Reider added, “Success in the credit union world is a lot more about consistently hitting singles than home runs.”