When a member calls TruChoice Federal Credit Union, employees answer the phone by saying, “Hello, how can I make your life easier today?”

“Members typically pause the first time they hear it and you can hear the smile in their voice from that moment on,” Ken Acker, TruChoice FCU CEO, said in a written statement. “It shifts the interaction from a transactional request to a conversation about their hopes, dreams and financial goals, and how TruChoice can help them on that journey.”

It’s a phrase that’s part of the credit union’s SMILE program, an acronym that summarizes the member service standards of the organization and helps it live up to its brand promise to bank simply. The acronym stands for:

· Show Enthusiasm: Believe in the value TruChoice offers.

· Make Life Easier: We’re here to help people untangle their finances.

· Invite Them to Share: Find out what matters to them—what are their goals?

· Let Them Know You Care: Show them we are a partner, not just their banker.

· Exceed Expectations: Win their hearts and minds. Follow up and follow through.

“We’ve lived and breathed this culture, but none of it was written down,” said Jessica Holland, TruChoice FCU vice president of retail.

The acronym sets the stage for how TruChoice FCU employees design and develop products, evaluate processes and interact between departments. “Since we are all on the same page with what we want our member experience needs to be, we can avoid unnecessary tension between departments,” Acker said. “We have a tight-knit team as a result.”

The initiative came from a staff meeting where employees generated ideas about what the letters would mean and voted on which phrases to use. “We wanted something reflecting what we do every day and wanted our members to feel the feeling you get when someone gives you a genuine smile,” Holland said.

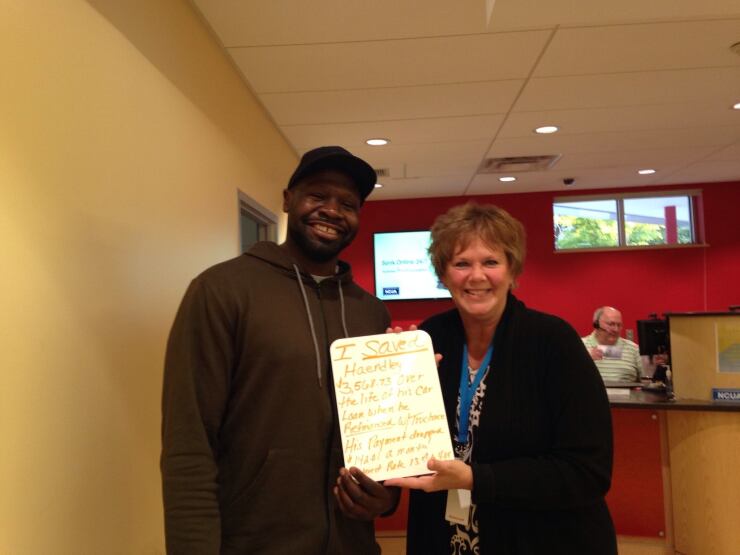

Success stories are shared throughout the branches and on social media, such as how much money members saved on debt consolidation, lowered interest rates, shortened loan terms and more.

Since TruChoice FCU implemented SMILE, the CU has helped members save over $690,000. The credit union has earned a 4.7 rating on Facebook and improved its average total relationships-per-member from $14,301 to $14,651, while also maintaining an average of three products per member.