Members of McGraw Hill Federal Credit Union approved a proposal on Monday to merge the institution into Pentagon Federal Credit Union.

In a letter to members, Michael Sullivan, president and CEO of MHFCU, said the merger is expected to close on May 1.

Based in East Windsor, N.J., McGraw-Hill FCU has about $426 million in assets. The $24.5 billion-asset PenFed is based in McLean, Va.

Sullivan noted that PenFed will continue to operate MHFCU’s two existing branches – one in East Windsor, N.J., and the other in New York City – and plans to add another Manhattan branch this summer.

This is the latest growth move for PenFed following several months of high-profile activity.

In early January, PenFed announced an

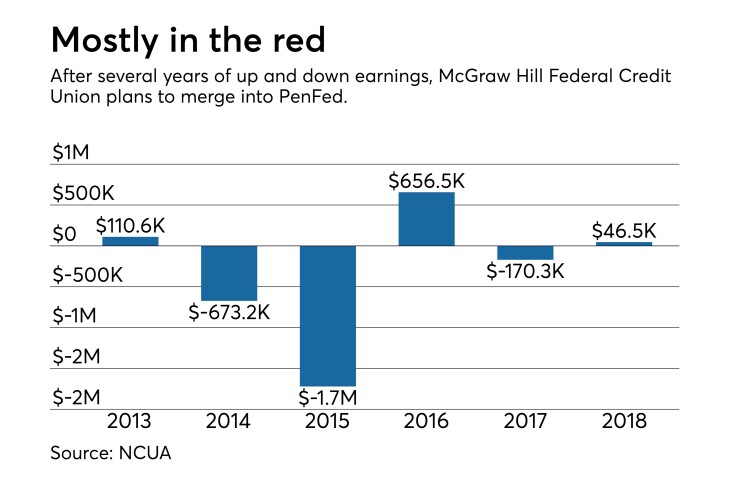

Based in East Windsor, N.J., the $426 million-asset MHFCU posted net income of about $46,400 in 2018, after recording a net loss of about $170,300 in the prior year.

Meanwhile, PenFed posted net income of about $156 million in 2018, a 12.6 percent decline from the prior year.