Credit union CEOs face a difficult balancing act right now as the country reels from economic strife and a public health crisis.

Many senior leaders at credit unions have led teams through prior crises, including the 2008 recession. Some of the lessons CEOs learned from these prior events can be helpful now as they guide their employees and members through the coronavirus pandemic, experts said.

But the current environment presents unique challenges that most executives have never dealt with before. That includes widespread financial anxiety for members and the mental toll the prolonged quarantine has taken on workers.

Dealing with these challenges has required credit union CEOs to step up their leadership and communication skills.

“When people are feeling uncertain and even frightened, governance and leadership don’t just matter. They matter exponentially more,” said Michael Daigneault, co-founder and CEO of consulting firm Quantum Governance. “In times of crisis, there is a premium on leadership and governance.”

Officials rushed to slow the spread of the coronavirus by closing or limiting business operations. The economy severely contracted as a result of those moves and consumers limiting their outings due to social-distancing efforts and stay-at-home orders.

Millions of Americans have filed for unemployment benefits since the middle of March while the unemployment rate has shot up to 14.7% in April from just 3.5% at the end of 2019, according to the Bureau of Labor Statistics. There have been predictions that

In contrast, the unemployment rate peaked at 10% in October 2009 during the prior crisis, according to the Bureau of Labor Statistics.

Credit unions have jumped in to help members alleviate some of the economic pain by providing relief measures, such as allowing borrowers to skip some loan payments and

With many consumers and business owners struggling, executives need to ensure they are being proactive in handling member relations right now, said Jim Kasch, CEO of Canidae Consulting.

That includes frequent communication, Kasch said, since research has shown those experiencing financial anxiety may have trouble processing information regarding their money, so “they tend to close off their minds to anything that makes them think about it.” Members may need to see the same information several times before they fully process it, even if that information would help them.

These messages should come from the CEO and go beyond simply telling members about logistical changes, such as whether a branch lobby is closed. Instead, the credit union needs to emphasize it is there to help members during these difficult times, Kasch said.

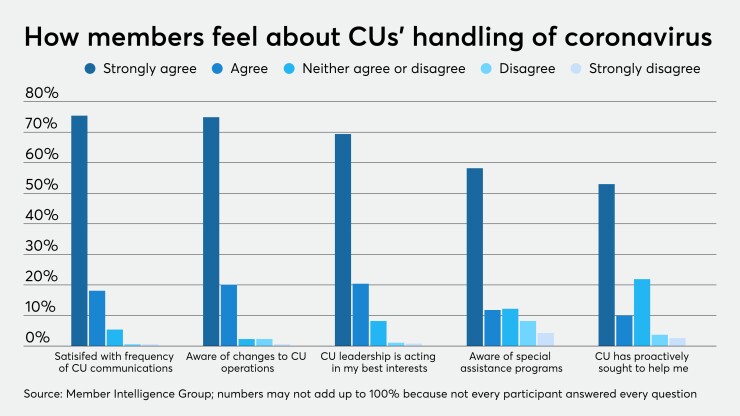

Overall, members seem satisfied with how credit unions have handled the coronavirus, according to data from Member Intelligence Group, a research firm subsidiary of Canidae Consulting. In a recent survey from Member Intelligence Group, about three-quarters of respondents said they “strongly agree” that they were aware of changes to credit union operations. But that number fell to just 58% when respondents were asked whether they were aware of special programs to help them.

“The lesson we learned with this is you can’t overcommunicate during periods like these,” Kasch said. “The recommendation to credit unions is to get on a regular routine of communicating with members.”

Orange County’s Credit Union in Santa Ana, Calif., has called more than 20,000 members to let them know about emergency relief options, hours of operations and other changes. This is the preferred method of communication, if the credit union can spare the resources, Kasch said.

The $1.8 billion-asset shop initially reached out to members without an email address on file and to those who could not leave their homes for fear of exposure to the virus, said CEO Shruti Miyashiro.

“While it’s not unusual for us to place personal phone calls to our members, the magnitude of the calls made significantly increased during these times with the high level of uncertainty and unease to our community due to COVID-19,” added Miyashiro, who was in Europe in March when the outbreak began and had to self-quarantine for 14 days when she returned.

However, Miyashiro noted another challenge CEOs have faced: helping employees navigate the health crisis. There are more than 1.8 million coronavirus cases in the U.S. and more than 107,000 deaths as of Thursday, according to the U.S. Centers for Disease Control and Prevention.

“Leading through a crisis also requires empathy for the various emotions people are feeling and the ability to provide a sense of calm and confidence for those who are nervous, anxious or frightened,” Miyashiro added. “But on top of that, executives have also had to deal with employees who are perhaps afraid of contracting the virus themselves on the job or passing it along to a loved one.”

That’s not something most credit union CEOs have dealt with before, experts said. Daigneault has heard from executives who were grappling with the gravity of the decision making required right now.

Toronto-Dominion Bank plans to give most employees the option to return to the office this month and is aiming for workers to officially transition to their new working models by June.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

Employees will still have some flexibility to work from home, but are strongly encouraged to collaborate with colleagues in person, according to people familiar with the matter.

“I’ve heard CEOs say, ‘No one told me that life-or-death decisions would be part of my job description as a credit union CEO,’” Daigneault added. “That’s a tough realization.”

Every decision at Securityplus Federal Credit Union in Baltimore has been centered on public health with the consideration that “if our staff and members come into contact with the virus, people could die,” said CEO Brett Noll.

Additionally, employees could be mentally exhausted from spending weeks at home, perhaps homeschooling children while juggling full-time jobs.

There has also been a paralyzing element to the crisis since there is no clear timeline of when society will return to normal. Even as stay-at-home orders are lifted, executives should plan for potentially second waves of the outbreak and for officials to reinstitute public health measures, said Lisa Hannum, president and CEO of the consulting firm Beehive Strategic Communication.

“We’ve been in this for eight to 10 weeks and people are tired,” Hannum said.

“You may feel like, ‘Aren’t we done communicating about this crisis?’ But really we are just getting started," she added.

All of this is compounded by the fact that members and employees today have higher expectations for the brands they use or companies they work for, Hannum said. There has been a

For instance, Bank of America announced after the Parkland, Fla., school shooting in 2018 that it would no longer lend to gun manufacturers while Jamie Dimon, CEO of JPMorgan Chase, has publicly rebuked President Trump for withdrawing from the Paris Agreement on climate change and for his failing to criticize racists after the Charlottesville, Va., rally in 2017.

And as the nation undergoes a difficult period regarding race relations in the wake of George Floyd’s death in police custody, many credit union groups and

That means there is more pressure for CEOs to strike the right tone in emphasizing community with communication to employees and members.

“We want to associate ourselves with brands or credit unions that believe what we believe,” Hannum said. “Those expectations have been rising for the last two decades.”

Noll of Securityplus has tried to keep up employee morale by injecting levity into the workday where he can. For instance, the $398 million-asset institution created a

“There is an element of fear that we haven’t experienced before,” Noll said. “We’ve faced tough economic situations and terrorism. But the ongoing fear is always there and people are on guard. It’s hard to keep people uplifted.”