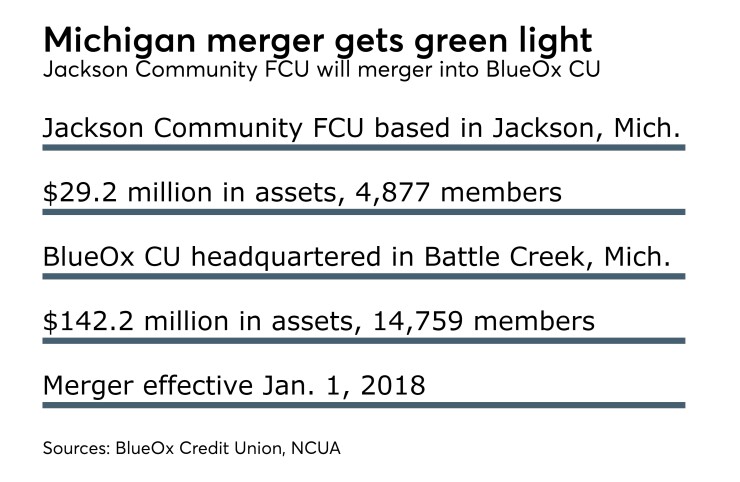

Members of $29.2 million Jackson Community Federal Credit Union, Jackson, Mich., have voted to approve a merger into $142.2 million BlueOx Credit Union, headquartered in Battle Creek, Mich.

The member vote took place Dec. 19, with the two CUs announcing the results Dec. 20. The merger will take effect Jan. 1, 2018. The following months are described as “serving as a transition period,” as member accounts from Jackson Community FCU are to be converted to the BlueOx system by April 14, 2018.

Jackson Community FCU has 4,877 members. BlueOx CU has 14,759 members.

Membership in BlueOx CU is open to individuals who live in 17 counties in lower Michigan.

“Jackson Community chose BlueOx as a merger partner after much research and consideration,” Jim Francis, Jackson Community FCU’s president and CEO, said in a statement. “BlueOx Credit Union mirrors our member and community-based philosophies, and staffing strength of both institutions will be maintained. No staff positions will be lost in the process.”

“Smaller credit unions are increasingly challenged by regulation and other operational factors,” said Fran Godfrey, BlueOx Credit Union’s president and CEO. “This merger recognizes we are better together. When we align two strong, local organizations it provides tremendous value and strength to everyone.”

In 2016, Jackson Community FCU had $149,709 in net income, according to its call report. Its net worth ratio as of Dec. 31, 2016 was 12.81 percent (“well capitalized”).

In its most recent call report, Jackson Community FCU listed $81,360 in net income through the first nine months of this year. Its net worth ratio as of Sept. 30, 2017 was 12.37 percent (“well capitalized”).

BlueOx CU reported $598,122 in net income for 2016. Its net worth ratio as of Dec. 31, 2016 was 9.60 percent (“well capitalized”).

Through the first nine months of 2017, BlueOx CU had $249,920 in net income. Its net worth ratio as of Sept. 30, 2017 was 9.81 percent (“well capitalized”).