Kyle Hauptman could shake up the National Credit Union Administration’s dynamic if the Senate confirms his nomination to the board.

President Donald Trump

Hauptman is a staunch opponent of the Dodd-Frank Act. That puts him at odds with current NCUA board member Todd Harper, who helped craft that legislation. That could mean more clashes over regulatory policy if Hauptman is confirmed.

Still, given his background, credit unions are hopeful that Hauptman will advocate for loosening of regulations.

“I would like to get his regulatory philosophy and how he would approach his goals and regulation,” said Todd Mason, president and CEO of the Maine Credit Union League, the state that Hauptman is from. “Going back to Chairman [Rodney] Hood, I would like to hear something like ‘effective, but not excessive regulation’ during the Senate confirmation hearings.”

NCUA declined to comment for this story. Hauptman did not return a request for comment.

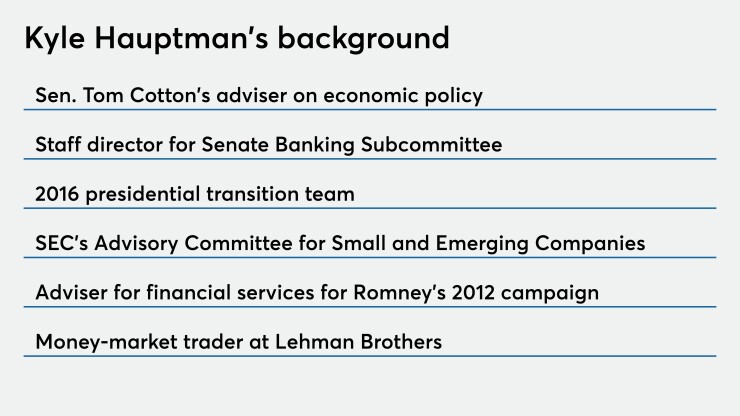

Hauptman has worked more broadly within financial services, though not directly with credit unions. He spent five years at the now defunct Lehman Brothers and served on the Securities and Exchange Commission’s Advisory Committee for Small and Emerging Companies.

He is currently the economic policy adviser for Cotton and the staff director of the Senate Banking Committee's Subcommittee on Economic Policy. That experience could help him through the Senate confirmation process.

“I don’t think that not having direct credit union experience would hamper him from being a strong credit union advocate,” said Larry Sewell, vice president of corporate partnerships and advocacy at Together Credit Union in St. Louis, Mo. Sewell is also the vice chairman of the executive board of directors for the African-American Credit Union Coalition.

From opinion pieces published in various outlets over the last few years, it’s clear that Hauptman is in favor of lifting some regulations. The Wall Street Journal previously referred to him as a

Hauptman has written about what he called the “collateral damage” of the Dodd-Frank Act.

"Unfortunately, Dodd-Frank has disproportionately hit community banks," he

That’s a view likely to be shared by many in the credit union industry. The number of small institutions has continued to shrink while the ranks of big credit unions have grown. Industry observers have long argued that keeping up with regulatory demands is one driver behind consolidation.

However, Hauptman’s argument could also cause an internal rift on the board since Harper helped draft the Dodd-Frank legislation. Harper, the board’s lone Democrat, “led efforts to rein in ‘too-big to-fail’ financial institutions,” according to his LinkedIn page.

During his time on the board, Harper, who was also nominated by Trump, has called for more oversight of

In contrast, Hauptman worked at investment banking giant Lehman Brothers at the time of its collapse in 2008.

“I think if he was confirmed to the NCUA board, it would mean that Chairman Hood will have a firm partner on the NCUA board to affect an agenda that seems to be inclined toward regulatory relief,” said Ryan Donovan, chief advocacy officer at the Credit Union National Association.

Hauptman has also argued that cryptocurrency and blockchain can increase national competitiveness. This view would complement the other board members, noted Lucy Ito, president and CEO of the National Association of State Credit Union Supervisors.

“I hope he’d bring an interest in fostering competition and increasing options for consumers given the digital interest,” she added.

During Hauptman’s confirmation hearing, Ohio Sen. Sherrod Brown, ranking member of the Senate Banking Committee, along with other Democrats may bring up his opposition to Dodd-Frank. But Democrats currently lack a majority on the committee so they would not be able to block his nomination without being joined by some Republicans.

There’s a possibility that his work with Cotton could be used as a cudgel against Hauptman as well. Cotton, a Trump ally, has been at times a lightning rod. He recently argued in

Despite these potential issues, many believe that Hauptman will be confirmed, especially with the presidential election looming in November. If Democratic nominee Joe Biden wins the election, he would probably pick a Democrat to fill the spot. That would mean the board’s balance would shift from the current two Republicans and one Democrat to two Democrats and one Republican.

By law, there must be at least one member on the board from the president’s opposing party. Hauptman’s term would end in August 2025.

The Senate could move quickly to confirm as many Trump nominees — even for lower profile positions such as the NCUA board — as possible before the election.

“The calendar is always a factor when it comes to nominations,” said John McKechnie, a credit union consultant and a former staffer at CUNA and the NCUA. “This close to an election, probably even more so. On the other hand, Congress has operated in two time frames: now and not now. So when Congress wants to get something done, they can.”