This story is part of Credit Union Journal's

Amid the coronavirus pandemic, credit unions are grappling with business continuity planning as they turn to remote work.

Many CUs are taking steps to protect staff and members by instructing some employees to work from their homes in order to prevent further spread of COVID-19. But remote staffing presents unique challenges for financial institutions, given the need for in-person interactions that take place inside brick-and-mortar facilities.

Up to 150 million Americans are expected to contract the coronavirus according to Brian Monahan, the attending physician for Congress and the U.S. Supreme Court. Other experts such as Harvard epidemiologist Marc Lipsitch have predicted as much as 40% to 70% of adults worldwide could contract the virus. Data from Johns Hopkins University shows that as of the morning of March 18, nearly 6,500 Americans have been diagnosed with COVID-19, resulting in 114 deaths.

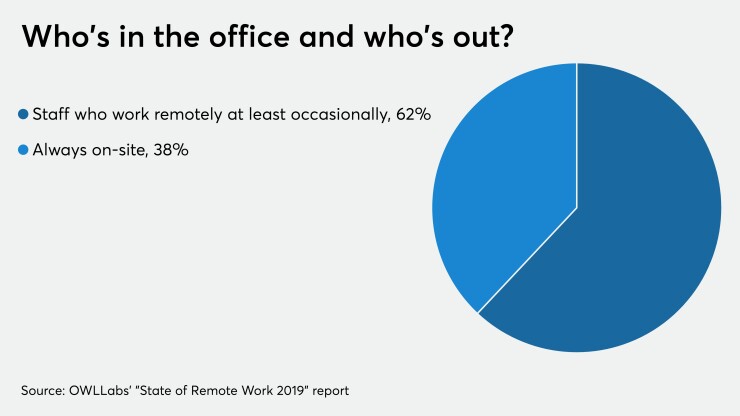

That grim outlook is leading some institutions to question just how many onsite staff are essential and who can work from home – particularly as a

“If we had to, we could open a branch with limited staff and even reduce hours if need be,” said Marty Wye, president and CEO of InFirst Federal Credit Union.

More than half of employees at the Alexandria, Va.-based institution have the ability to work remotely. Of the CU's 42 employees, roughly 15 have laptops they can take home while a handful of others are already set up for remote access. The credit union is considering reallocating laptops in order to maximize effectiveness for those working from home.

As more CUs shift to remote staffing, many are stress-testing their networks to determine bandwidth capabilities and ensure

“Training is really important on how individuals are using that technology once they’re at home because again, a lot of these individuals aren’t used to working in that environment – they come to the office every day,” Carroll said. “The human-error aspect is really what opens up security issues and viruses.”

Read more:

Indeed, financial institutions will need to start thinking about technology and what equipment they need to enable remote work. Credit union trade groups have penned letters to Congress asking for additional support for the industry, including a request for

For now, however, those still coming into the office should get comfortable with taking their laptops home each day with the understanding that they may not be returning the next, said Michael Fried, a partner at Mazars USA.

“It’s an evolving situation so some organizations are still all on-site, others are starting to send certain people home and others might be trending to send everyone home,” he continued. “I think it’s about understanding how it’s impacting your business and how you’re working around those things creatively.”

Many CUs say that they’re prepared since they test their networks regularly.

Tonée Picard, chief development officer at $1.1 billion-asset Bay FCU, said the credit union’s computer systems are tested frequently to ensure that employees can work remotely. Members of the CU’s management team all have the ability to work from home and about 40% of employees are cross-trained.

“You need licenses, enhanced security, Wi-Fi, hotspots – it’s more than just having a laptop,” she said. “You’d have to increase licenses for security and other software that is used for banking, and have secure VPNs set up. Anyone who’s buying a lot of computers [should know] it’s not just buying a computer, there’s more to it than that.”

The joining of Align Credit Union and Alltrust Credit Union is among the first of several deals in the pipeline where both institutions have more than $250 million of assets, as the ongoing pressures of the COVID-19 pandemic prompt more firms to pair up, experts say. Carmen Sylvester, Alltrust's CEO, will lead the combined organization.

The last three months of 2021 were strong for most lenders, which will report results soon. But the outlook for the coming months has been clouded by the spread of the newest coronavirus variant, which has many banks grappling with staffing shortages and branch restrictions.

Average per-loan charges last year were little changed despite the addition of a new temporary fee for refinancing. Those for loan-to-value ratios above 80%, home-purchase financing and adjustable-rate mortgages only rose slightly.

However, working from home isn’t an option for all employees. That’s particularly true for staff in member-facing roles, including tellers, who may not be able to work if credit unions close branches as a result of the pandemic. As of March 17 many credit unions across the country had begun in-branch access to appointment only, but few – if any – had closed branches outright.

“When it comes to servicing members and cashing checks or accepting deposits, you can’t work from home to meet member’s needs,” admitted Wye.

The Alexandria, Va.-based InFirst has facilities in five different areas and sees a total of between 17,000 to 18,000 in-house transactions per month, but tellers are separated from the public behind bullet-resistant glass. Employees are also “constantly washing hands and using hand sanitizer,” Wye added.

For employees who can’t work remotely, many credit unions are transferring those staffers to other departments or finding other ways for them to complete their work.

But employees unable to work from home need not worry, so long that they can be transferred to other departments within their credit union or find another way to do their job.

Coastal Credit Union in Raleigh, N.C. relies heavily on

“I think we’d find other spots at other branches and we’d move them to another branch,” said Arlene Babwah, Coastal’s VP of risk management. “If we closed that branch, e’d want to direct traffic to alternate locations.”

This story was updated at 9:36 A.M. on March 18, 2020 to better reflect current data about the pandemic's spread across the United States.