Credit unions talk a big game about teaching members good financial behaviors, but fintech is eating the movement’s lunch when it comes to helping consumers save money.

One of the leaders in that effort is Acorns, an app that connects to a user’s credit or debit cards and rounds up purchases to the next dollar, holding the accumulated difference in escrow and investing it with a risk portfolio determined by the user. The service costs just $1 per month for balances of less than $5,000 and users can withdraw their funds at any time.

Acorns currently has 1.8 million user accounts in the United States, and the company said it targets its services at consumers who earn less than $100,000 per year – middle-class demographics not unlike what credit unions serve. According to Karim Habib, director of lending solutions at CUNA Mutual Group, Habib's own research in 2015 found that Acorns users had a combined savings of approximately 25 million, though the app's user base has nearly tripled since then. Acorns representatives did not provide a current total dollar amount that users have saved by using the service.

Round-up savings isn’t a new idea – Bank of America has offered its Keep the Change feature for more than a decade, rounding up every debit card purchase to the next dollar and depositing the difference into a savings account cost-free – yet the vast majority of credit unions haven’t embraced the concept

“What it comes down to is technical capability,” noted Habib. “It comes down to cost and prioritization. Do credit unions see this as a threat today? Probably not – it’s probably lower on their to-do list. They have other technology they want to focus on and this might be lower down the chain, and that’s why they’re not willing to invest the money it would take to create [this sort of account feature].”

The bigger issue, said Habib, is that CUs are once again being cut out of the relationship with their members’ money. Saving a nickel here and a dime there may not seem like a significant threat, but if Acorns or similar fintechs eventually enter the lending space then credit unions could really begin to feel the pinch.

“We’re talking about change right now, but what they’ll start losing eventually are the relationships,” he said. “It’s not just the deposit relationship, but it could be the lending relationship as well.”

Let others try it first

Anne Legg, CEO of Thrive Strategic Services, a credit union consulting firm, observed that one reason CUs may not have adopted similar account functionalities is because while credit unions do many things well, they tend not to be leaders in technological innovation.

“There are some that are, but on the whole…they love to see somebody go to market first,” she said. “Holding that secondary position was great during the financial crisis, because it kept them from making decisions that wouldn’t be prudent. On the downside, there’s been enough history in the overall financial marketplace that has proven that these ideas are effective and [CUs] can do this and maybe make it better.”

So then why don’t they? Legg suggested two theories: for starters, technology costs have only recently begun to drop “in a way that could make it very easy and accessible to take on these challenges,” but there may also be a generational factor at play.

CUs, she said, “are innovation laggards, but there’s also leadership change happening in the credit union space.” As one generation of credit union executives retires, the younger generation of management may place more of an emphasis on adopting these sorts of solutions.

Future Change

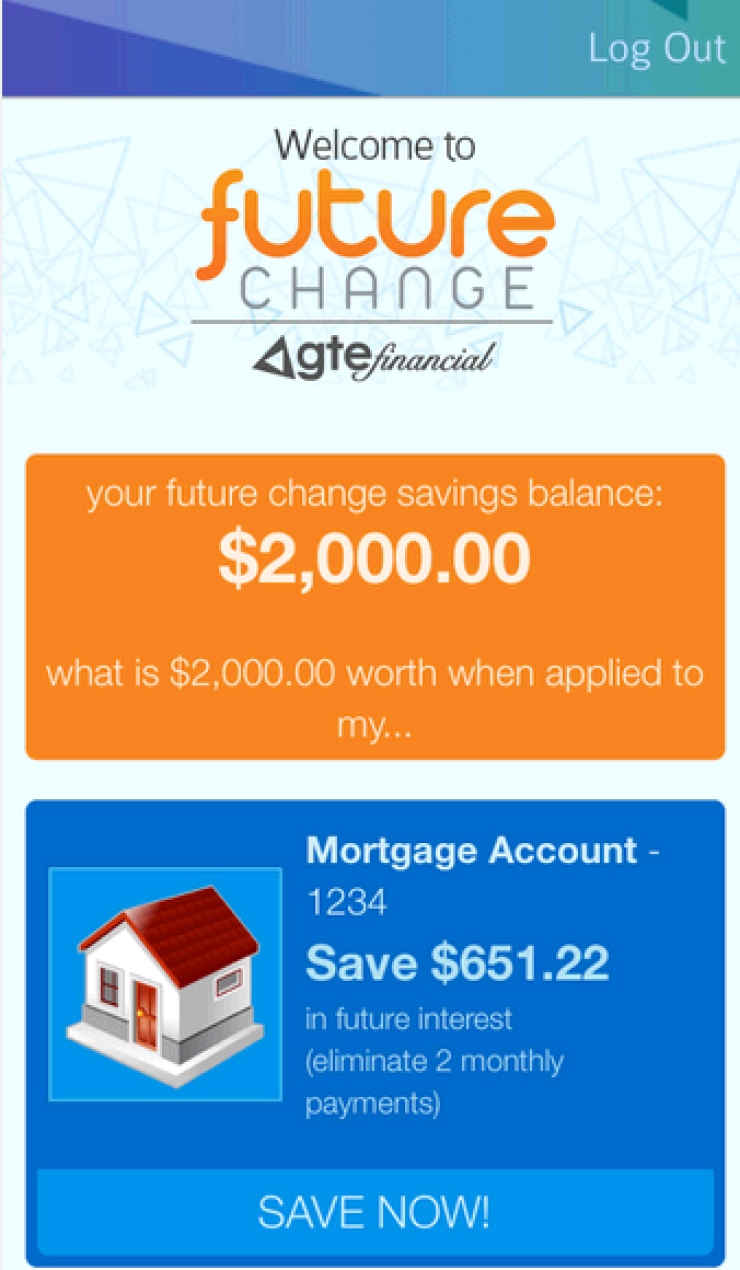

While most CUs don’t have a round-up offering, one credit union that has embraced the idea is Tampa’s GTE Financial, which in 2015 launched Future Change, an app that allows members to round up purchases and set aside money to pay off their loans at the credit union more quickly.

“We wanted to build [round-up capabilities] in an app because we’re trying to come up with different ways to teach our members to save, and millennials are all about apps,” said Chad Burney, COO and CIO at GTE. Along with round ups, the app also includes personalized financial literacy and gamification. The app is free to download and members can log in with their existing online banking credentials to connect it to the checking accounts and debit cards they want to round up with.

In the two years since GTE began offering Future Change, $1.3 million per year has been moved to roundup savings accounts, with members making more than 3,500 principal payments on their loans. The app has been downloaded more than 15,000 times and Burney said members log in about 14,000 times per month.

Fifteen thousand downloads may sound like an impressive number, but the $1.9 billion credit union has more than 250,000 members, and Burney said that while participation with the app has exceeded expectations, the biggest challenge right now is “trying to get the product out there and getting members to use it.”

Burney conceded that for many credit unions round up savings “just don’t bubble up to the top” of the priority list, but he also suggested that core system limitations may be a major constraint.

“I’ve been an LIS/Fiserv/DNA client since 1996; you have to have a core that allows you to do this type of development, and outside of Fiserv’s DNA core, I don’t know a lot that do that,” he said, adding that many core systems are either antiquated or not as open as other systems that allow round ups.

And, added Burney, for CUs that want to put their cards top of wallet with members, a feature that helps them easily save money could help push the CU’s plastic to the top.

‘The opportunity is now’

At least one person disputes the notion that saving with the likes of Acorns and other apps is as easy as it sounds.

“I think it’s a great concept that’s not as low-effort as it may seem,” observed Ben Morales, CTO at Washington State Employees CU. “I’ve got to download another app, connect it to my bank account and make that work. Does that lead to a typical sophisticated user or somebody that really needs to save? I wonder. Someone might try it for novelty, but I’m trying to understand the target market.”

Morales noted that some CUs did attempt to offer similar products around the time that B of A’s Keep the Change was released, but “they didn’t understand truly the fact that as a society, Americans do not save – and that includes our members,” he said. But, he added, that was more than a decade ago, and attitudes and behaviors have changed somewhat in the wake of the Great Recession.

“The opportunity is now,” he emphasized, adding that WSECU is pursuing a round-up solution through its QCash subsidiary (of which Morales is also CEO). “This small concept could go a long way to really supporting members in where they want to go in their financial lives.”

Guy Russo, chief information officer at Lenexa, Kan.-based CommunityAmerica CU and chair of the CUNA Technology Council, concurred with Morales, and he noted that these offerings are tied to helping establish behaviors that are part-and-parcel of the credit union ethos.

“These fit well within the credit union movement, because credit unions tend to be more member-focused, and we try to find ‘easy buttons’ for our members to help them manage their assets better, whereas in a [for-profit] banking environment it’s about the fees,” observed Russo. “As the millennial generation starts to say ‘These apps are important to me,’ credit unions will either integrate with one of these vendors or build something comparable.”

Russo discounted the idea that cost is what’s holding back institutions from offering these features – “My gut tells me it’s a question of focus,” he said, adding that more emphasis is being put on money makers like mortgages right now – and he echoed Legg’s belief that a new generation of CU managers will increase the focus on these sorts of offerings.

“As millennials get into management, the awareness of this stuff goes up.”