Northern Hills Federal Credit Union is using artificial intelligence to help it approve more loans.

The

“Members don't want to take the time to come into the credit union, or even fill out an application online and wait a day or two ... to find out whether or not they've been approved because other larger institutions and fintechs are giving them instant gratification,” said Floyd Rummel III, CEO of Northern Hills.

The lender, which is still testing its AI tool, is among a growing number of credit unions that are working with fintech developers to enter new markets or improve their core capabilities. Whether to help

Using Northern Hills’ historical loan data, and incorporating other customer data through LexisNexis such as bill-payment records, the AI algorithm can provide quicker decisions on certain loan applications.

“Because members can go online or through some other fintech, answer a few questions and get approved for a loan or credit card almost immediately, the time to utilize AI is now,” Rummel said.

The applications for AI and machine learning aren’t limited to lending. Interactive conversation bots and automated call center directors can help members address simple needs from checking balances to resetting login credentials, freeing up representatives to invest their time in more complex matters.

The

AI can improve customer engagement, provide analytics and handle back-office tasks, but the technology has its own drawbacks that financial institutions should consider, according to Craig Focardi, an analyst for the Boston-based research and advisory firm Celent.

“The storage of any information for AI faces the same kinds of security challenges as the storage of customer information, so credit unions need to provide the same level of protection that they do for their traditional on-premise data management as they might do for AI,” Focardi said.

Earlier this year, the National Credit Union Administration

In the request, the five agencies sought comment from financial institutions, trade groups and other industry stakeholders on the potential applications for AI and machine learning to help draft legislation that will mitigate the potential risks posed to banks and credit unions.

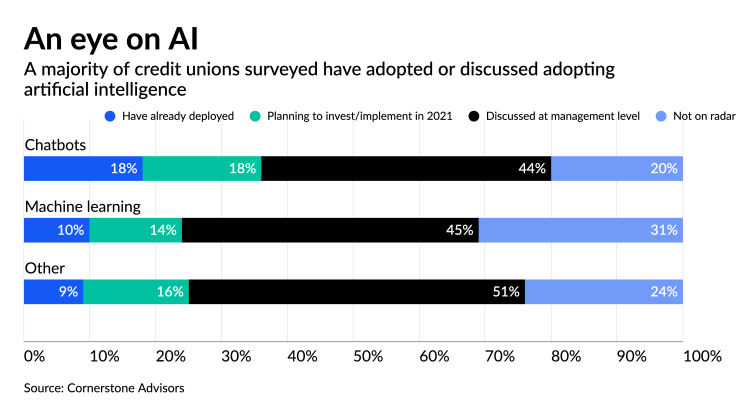

A study by

Fintechs that offer AI products already address security. Posh Technologies, a Boston-based provider of AI chatbots, built a system to securely handle account balances, login credentials and financial advice.

“If we're serving information like transaction history, balances or payments back to the user, we need to first verify that they are who they say they are and that requires an exchange of sensitive information,” said Karan Kashyap, co-founder and CEO of Posh. “During a session, if we have to touch information, we will make sure it's encrypted the whole time … and once concluded we will redact all of the sensitive details.”

Zest AI, a Los Angeles-based fintech, offers credit unions a tool for the loan underwriting process that uses machine learning to help quickly assess risk and increase approval percentages. Its models can be adjusted to compensate for unseen patterns of bias.

“Throughout the cycle of building the model, we work with the credit union to perform fair lending analyses of protected groups within demographics like Hispanics, Blacks and others,” said Zest AI’s chief legal officer, Theodore “Teddy” Flo.

Within these reviews, Zest and the institution look at loan approval rates between different demographics to see if there is an unjust disparity and adjust the model before it is fully initialized.

“Using the technology at our disposal, we can help the credit union to improve the acceptance rates for groups like women and people of color, without sacrificing accuracy … so when clients come to us asking ‘Could we change our model to treat other demographics more fairly?’ we can help them do that,” Flo said.