How can credit unions, especially small institutions, compete with Quicken Loans’ Rocket Mortgage “Push button, get mortgage” campaign?

They can’t – and, sources said, they shouldn’t try.

“Getting the right home loan is not as easy as pushing a button,” declared Tim Mislansky, president of My CU Mortgage, a credit union service organization wholly owned by $4.4 billion-asset Wright-Patt Credit Union, Beavercreek, Ohio. “It is a complex process with lots of people involved. While technology can ease the process, credit unions can win in the market by helping members through it. A mortgage is often a member’s most significant financial decision and members only get one every few years at most. They need trusted guidance.”

And that, sources said, is where CUs can compete with – and even beat – the fintechs of the world: by focusing on their status as a trusted neighbor and community partner that can provide quality service. But with fintech competition heating up as analyst predict an oncoming economic slowdown and credit union growth slowing in some areas, some in the industry are examining how CUs can close the technology gap in order to keep pace with the competition.

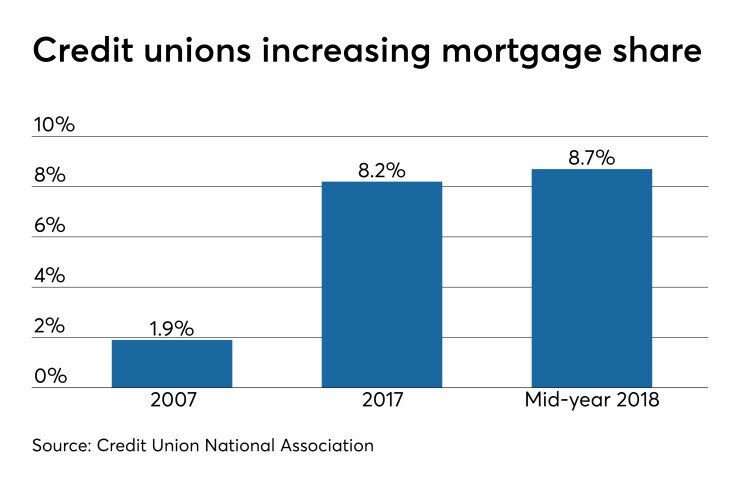

According to

Mislansky acknowledged credit unions do not have the budgets or the venture capital to develop technology as larger institutions or fintechs do, but he insisted they can keep up.

“Credit unions have a number of options, large and small, to compete with Rocket Mortgage and other fintech competitors,” he said. “I think the biggest is to emphasize the fact the credit union is local and in the community. It is real people helping real people.”

The fintechs of the world do have slick technology, Mislansky continued, but he questioned if they have the people to support the promises made in their commercials.

“Credit unions have loyalty from their members that the fintechs would love to have,” he said.

But it’s not just fintechs. In some instances, said one observer, CUs may be held back by the technology in their own shops.

Amy Moser, VP of mortgage services for $8.2 billion-asset Mountain America Credit Union in Sandy, Utah, noted most CUs have loan origination systems that allow them to do more than their home-grown or paper-intensive “relics of the past.”

“However, there is still a gap in the technology credit unions are currently using and the technology that is required to move to a fully digital mortgage,” she said. “The LOS is a great start, but we can’t forget the technology that is needed to ingest, fulfill, close and deliver a digital mortgage.”

Fighting the status quo

Bem Rempe, chief operating officer at LenderClose, said while most credit unions have access to the technology they need to compete, they may not be taking the steps necessary to integrate that technology into their process.

LenderClose is a Des Moines, Iowa-based fintech that digitizes the lending process for community financial institutions.

Rempe said too many CUs have a desire to, or cultural preference for, maintaining the status quo.

“After all, if it the process isn’t broken, why fix it?” he said ironically, adding LenderClose often hears financial institutions say “This is how we’ve always done it” or “There’s nothing wrong with the process.”

Those types of objections to evolution can “stifle” credit unions from achieving the level of growth and borrower experience potential they are otherwise fully capable of, Rempe asserted. He said this change-resistant attitude fundamentally denies today’s shift in borrower expectations and the “competitive complexity” of today’s real estate lending marketplace.

“While consumers may prefer, for the time being, to get a mortgage or HELOC from their primary financial institution, that preference is eroding,” Rempe warned. “Just as consumers are now comfortable letting PayPal move money in and out of their accounts, they are just becoming increasingly comfortable allowing Rocket Mortgage, Zillow, LendingTree and other digital natives access to their most valuable personal and financial data to secure a loan faster or in a more seamless way.”

Mind the (technology) gap

Moser said MACU is not focused on competing with Rocket Mortgage or the other fintech competitors in the mortgage ecosystem. Instead, it is concentrating on ways it can make it easier for members to do business with the credit union and establish long-term banking relationships.

“Our members want to apply for a mortgage online, sign and send documents digitally, and have a painless mortgage experience,” she assessed. “When we combine a digital mortgage experience and our unique mix of mortgage products and then couple it with the other financial services that we offer, we do not have to focus on the competition – we can focus on refining our processes and products.”

Part of how MACU has refined its mortgage product over time, she said, has been to take the process piece by piece.

“The best way to close the gap is to assess where your technology currently is and then map out a plan,” counseled Moser.

Mountain America started at the end of the mortgage process, with e-closings. Moser said once the credit union mastered that, it moved on to on another area. “While there are many excellent vendors and options available to move into the digital space, the key is aligning with a vendor that can help you reach your digital mortgage goals while simultaneously improving upon the member experience, and creating efficiencies and velocity with the mortgage process.”

Rempe and Mislansky both emphasized the importance of finding the right vendor or CUSO partner.

Credit unions, in particular, said Rempe, will want to look for innovators that share their people-centric philosophies and who view collaboration as more than a way to scale for financial gain.

“CUSO innovators, for instance, understand that scaling is not about the oppression of competitors, it’s about bringing the most good to the most people most quickly,” he said. “That is a key differentiator for the fintech startups born within the credit union movement, and also of the digitally transforming legacy CUSOs that are doing a great job evolving their own technology for today’s environment.”

Mislansky cautioned that while vendors and other partners can help small and mid-size institutions get access to technologies they might not otherwise be able to afford, that in and of itself is not a complete solution.

“Credit unions that invest in technology or partner to obtain it need to realize having the coolest web or mobile application only goes so far,” he said. “If the front-end member experience is great, but the back office processes behind the scenes are clunky, the member will feel it. So credit unions should think through the life of the loan origination, considering not only the application, but how documents are delivered, whether electronic signatures are accepted and that back office processes are automated.”

While the technology CUs need is already out there, Rempe cautioned that CUs must “look at innovation from the member lens, not from a technology lens.

“The biggest mistake credit unions make today is trying to follow the hot new trend or tech without understanding if it is going to solve a real member problem,” he said.