CUSO Financial Services L.P. (CFS) added seven credit union partners across the United States to its investment program portfolio.

The new partners and collaborations include:

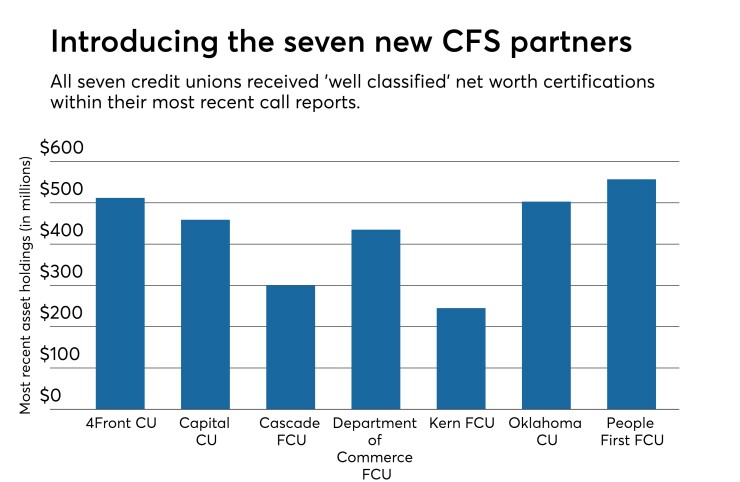

- 4Front Credit Union, of Michigan, for a startup managed program. The CU holds $512 million in assets and serves 70,000 members across 14 branches.

- Capital Credit Union, of North Dakota, for a managed hybrid startup. The 30,000 member credit union is spread across ten branches and sits on $459 million in assets.

- Cascade Federal Credit Union, of Washington, for a startup managed program. $300 million worth of assets are stashed away across four branches for its 10,000 members.

- Department of Commerce Federal Credit Union, of Washington D.C., for a startup managed program. This credit union has pooled $435 million worth of assets among its three branches and 19,000 members.

- Kern Federal Credit Union, of California, for a dual program. With $245 million in assets, this credit union holds 20,000 members shared between its two branches.

- Oklahoma Credit Union, of Oklahoma, for a startup managed program. This credit union has $503 million in assets and over 40,000 members.

- Allentown, Pa.-based People First Federal Credit Union ($557 million in assets), is joining CFS to develop a managed investment program for its membership.

“We considered two other firms, but were drawn to CFS because of its comprehensive and fully integrated dataVISION® platform as well as their ability to work jointly with us to develop new service outreach initiatives,” Jeffrey Albert, president and CEO of PFFCU, said in a statement. “So far, since starting our investment program with them in May, we have already gained tremendous interest from our members with nearly $1 million in the pipeline.”

As Credit Union Journal reported, People First FCU made news earlier this month when

CFS’s pipeline includes its tradition of “white glove” customer service, multi-channel delivery systems and upgraded technologies. One technology the organization speaks to is its fully-integrated home banking for investments, which CFS says is a favorite among banks and credit unions.

“We are pleased to welcome all of our new programs to CFS,”

Established in 1997, San Diego, Calif.-based CFS specializes in placing investment programs in credit unions and banks. The firm also provides customized help with investment and insurance solutions to over 200 U.S. financial institutions. CFS and its parent company, Atria Wealth Solutions, recently received large capital investments in its dataVISION® financial advisor platform and its MyPortfolioView™ client portal.