The need to reach younger consumers is pushing credit unions to dip a toe into new social media platforms.

While legacy services such as Facebook, Twitter and Instagram continue to dominate the social media landscape, new players are emerging all the time. And some credit unions believe the that video-sharing platform TikTok may be the most likely to help them reach a younger audience.

“From an organic standpoint, it’s what Instagram was four or five years ago, where you could get on there and reach hundreds of thousands of people without having to pay for that space,” said Meredith Olmstead, founder and CEO of FI Grow Solutions.

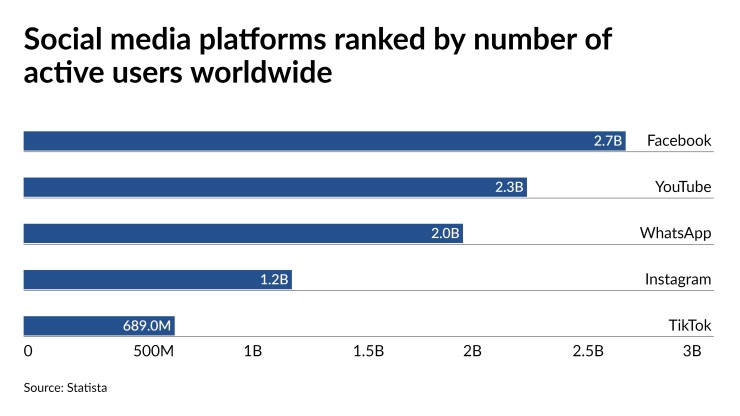

Those traditional platforms like Facebook and Twitter are bigger — Facebook has 2.7 billion users worldwide and Twitter has

But the more established platforms tend to skew older. More than half of all Facebook users are over age 35, according to NapoleonCat, a site specializing in social media statistics, and nearly 40% are 45 or older. Twitter's largest user demographic is between 30 to 49 years old. By comparison, TikTok's audience is engaged — the average user spends 45 minutes a day on the app, according to social media firm Social Sprout. And, more importantly, TikTok's users are overwhelmingly young, with the biggest chunk of users between the ages of 18 and 24, and more than half are under 35. That's the audience credit untions are most eager to reach.

Reaching younger potential members is important because the age of the average credit union member has been stuck at about 47 for decades. And as those consumers age out of their prime borrowing years, the industry will need to bring in younger members to keep business flowing. Worse, there are indications that membership

Carolina Trust Federal Credit Union in Myrtle Beach, S.C., has begun experimenting with TikTok in conjunction with its use of a Gen Z brand ambassador. The credit union’s average member age is between 50 and 55, said Jessica Wilson, chief development officer at the $305 million-asset credit union, and that age range “hasn’t moved in years.”

The brand ambassador “does videos similar to any other influencer, really — little fun videos of cooking or even the transition videos you see people on TikTok doing,” said Wilson. “We’ve created almost a subbrand with her because she’s young and relatable.”

In general, the credit union is targeting consumers ranging from their late teens to early 40s, with a focus on the student population at Coastal Carolina University. The turn to TikTok is part of a broader social media outreach effort that also includes Instagram and Facebook.

“TikTok was just something that, because of the age our brand ambassador is in, she’s familiar with it, so we started to go down that path,” said Wilson.

As with other platforms, credit unions have to tailor their approach to TikTok, said Lauren Robirds, digital marketing strategist at Your Marketing Co., a South Carolina-based firm that works with credit unions across the country.

“Not a lot of people want to follow their credit union on TikTok if it’s just basic information about an auto loan,” she said. “It has to be engaging and catch that younger crowd — you have to do something crazy and unique.”

One strategy some institutions have used, she said, is to focus on financial education, including the basics of credit scores and money-management. “Definitely things that people in the younger generation don’t have a solid education on,” she said.

Excel Federal Credit Union near Atlanta began building TikTok into its social media strategy for 2021 and has been “testing what resonates with a small group of people so we can invest dollars behind what’s most successful,” explained Britney Bailey, marketing director at the $140 million-asset credit union.

So far its content has primarily been 60-second clips about subjects such as home improvement projects, credit cards, the fundamentals of credit and more.

“It’s intended to be easy to consume and based around financial literacy,” she said. “Nothing is strictly driving a product. Obviously we’re timing our content to go along with our promotions for the quarter so that holistically our advertising is spreading the same message, but none of it is a direct ‘click her to apply now’ type of ad.”

As the credit union has branched out into TikTok, however, it has also scaled back a bit from some other platforms, including Instagram, which was often used for showcasing content “behind the scenes” at Excel that members might not ordinarily see.

“Because of COVID and being offsite, I haven’t been there with the phone to snap pictures of the big moments,” said Bailey.

Security hasn’t been a major concern with social media platforms up to this point, but that’s not the case with TikTok. The app, which originated in China, came under scrutiny last summer over concerns that it posed a national security threat or could, at the minimum, be an espionage tool. While the Trump administration

“Everything TikTok-related is on outside devices, so nothing is behind the firewall or on the VPN,” explained Excel’s Bailey. “We also aren’t necessarily encouraging our members and consumers in our market to adopt the app. We’re letting them know, 'We’re here if you are," but we’re not pushing them to download it.”

Similarly, Wilson said all of Carolina Trust’s activity with the service stays off of the credit union’s infrastructure, and none of it is conducted on credit union-owned devices, at the direction of the credit union’s senior vice president of IT.

Olmstead, however, suggested some security concerns for credit unions may be overblown.

“I’m not convinced the security concerns with TikTok are any more substantial than any other social platform,” she said. “You simply have to create a posting policy and strategy for monitoring the platform and a plan for dealing with any violations or problems that could arise. These aren’t platforms where you’ll be discussing account information so the risk is fairly minimal. And specific account-related questions would need to be taken offline no matter what platform you’re using, unless it’s a secure chat specifically designed for financial institutions to use.”

Security concerns aside, one of the biggest questions for the industry is simply whether the app has any staying power. After all, Snapchat seemed like a major player a few years ago, but it never widely caught on with the industry. But Olmstead said that's part of the strategy — seeing what works and what doesn't, and adapting.

“Gone are the days where we all do the same things for 30 years,” said Olmstead. “Understanding and normalizing the idea that things will change and there’s constant evolution, particularly in the digital space, will help people feel more comfortable with the idea of trying new things. It’s not the end of the world to pull down your page if you decide it wasn’t worth your time.”