Auto lenders are bracing for one of their largest hits ever because of the coronavirus.

Car loans are a significant source of revenue for credit unions, making up about a third of the industry’s $1.1 trillion in loans in the fourth quarter, according to the National Credit Union Administration’s 2019 annual report.

Because of that, the anticipated slowdown related to the current pandemic is likely to inflict a certain amount of pain on a large number of credit unions.

"You're going to see auto lending die,” said Bill Handel, vice president of research at Raddon, a research firm that’s part of Fiserv. “We believe [that] because people just aren't making those purchases.”

Growth was already slowing for auto loans prior to the coronavirus becoming widespread. These credits increased by 2.5% in January from a year earlier, according to CUNA Mutual Group’s March trends report. That’s the lowest monthly uptick the industry has posted going back to at least January 2018.

Auto loans at credit unions totaled $375.1 billion in the fourth quarter, according to NCUA quarterly data.

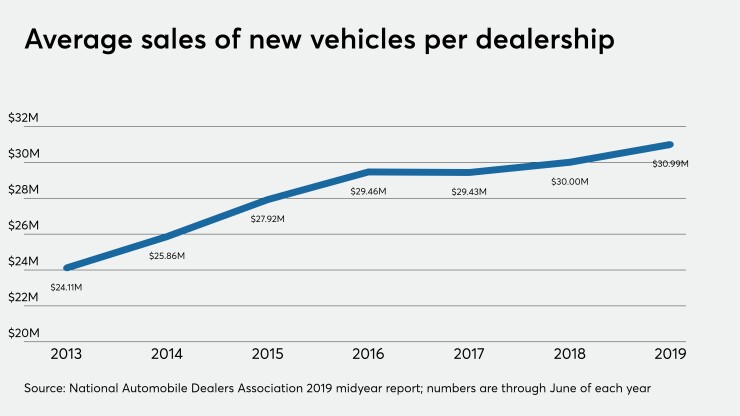

The average sales of new vehicles per dealership totaled $30.99 million in 2019, up about 5% from 2016, according to data from the National Automobile Dealers Association.

“In the last four years, we’ve been fairly stagnant and we’ve been broadcasting that there’d be continued weakness and even further softening, even prior to this coronavirus because consumers have purchased a lot of cars,” Handel said. “It’s just that simple.”

Now credit unions are expecting demand to plummet.

Chartway Federal Credit Union in Virginia Beach, Va., has already seen a 35% decline in indirect auto originations from a year earlier and expects to see volumes fall by 50% for 2020, said George Pita, the institution’s chief lending officer. Auto lending is the largest segment of the $2.2 billion-asset credit union’s loan portfolio.

“I believe this trend is going to continue until we see demand back up in auto, which will really depend on the timing of when this virus situation subsides,” Pita said. “Eventually we’ll be busy again and there’ll be some pent-up demand, rates are low and at that point in time we’ll expect to see lending tick up quite a bit across the board.”

The decline will partly come from consumers staying home to practice social distancing. As consumers drive less, the need to buy a new car is no longer top of mind.

Hundreds of millions of people in dozens of states are being urged or ordered to stay at home. CU Direct has noticed a dip in loan demand where those requests are being made. There’s also been confusion about whether car dealerships are considered essential businesses and can stay open.

Demand is also likely to drop because of the financial fallout from the measures taken to halt the spread of the coronavirus. Roughly 10 million Americans have recently filed for unemployment benefits as non-essential businesses have closed and laid off workers.

CUNA Mutual Group predicted

If consumers are worried about job security, they could be less likely to take out a loan to buy a vehicle. There are also concerns that borrowers won’t be able to repay existing debt. Chartway has already experienced members needing to skip payments, primarily with auto loans and credit cards.

To counteract this, some lenders are introducing credit with terms favorable to borrowers. For instance, Ford is offering a six-month payment relief program. Eligible new car buyers can defer payments for up to three months while Ford will cover another three months of payments.

Toronto-Dominion Bank plans to give most employees the option to return to the office this month and is aiming for workers to officially transition to their new working models by June.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

Employees will still have some flexibility to work from home, but are strongly encouraged to collaborate with colleagues in person, according to people familiar with the matter.

But determining the level of potential defaults is hard to predict right now since the pandemic is unprecedented with no end in sight, Pita said. The auto loan delinquency rate was 0.65% in the fourth quarter, almost flat from the same period a year earlier but up 7 basis points from the third quarter, according to NCUA data.

“As we do skipped payments and extensions for members, that’s going to have an impact on the timing for default and potential for default,” Pita said. “There’s also a lot of states that have had to stop repossessing vehicles, so that’s obviously going to impact on whether those members end up paying or not. We do not know, so we’re having to take that into account.”

Still, the additional mortgage activity may not be enough to have a significant impact for some credit unions.

“We’ll obviously have some refinancing with mortgages which should be helpful in freeing up some cash flow on the margin for some households, but generally speaking they’re not going to take the cash they save, run out and spend it on cars,” said Mike Schenk, chief economist at the Credit Union National Association.

“It’s a pretty big deal,” he said.