Third-quarter earnings for community banks could determine how quickly the pace of credit unions acquiring banks returns to pre-pandemic levels.

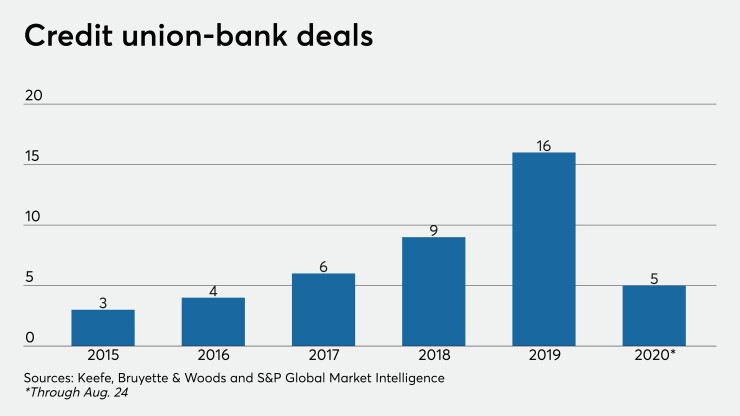

The coronavirus and its devastating impact on the economy has had a chilling effect the number of credit unions buying banks in 2020, with just five such deals announced so far. Those transactions spiked last year with a record 16 credit unions trumpeting deals, shattering the previous high of nine in 2018.

But a combination of factors has conspired to dampen interest in deals this year. Community banks' recent deposit growth coupled with

The added unknown impact of economic issues on asset quality and what will ultimately happen to Paycheck Protection Program loan balances have some potential buyers and sellers sitting on the sidelines.

“Some of the answers will come to the surface in the third quarter, but it may take to the end of the fourth quarter to get a clear enough picture for buyers to come back to the market,” Holthaus said. “But I don’t think we’ll see too many new deal announcements until the end of the first quarter of 2021 and into the second quarter.”

Rodney Showmar, CEO of the $1.5 billion-asset Arkansas Federal Credit Union in Jacksonville, has made no secret of his desire to acquire a bank. But he said that might not happen anytime soon because his institution is now dealing with some of that capital pressure.

Arkansas Federal has grown total assets by $181 million through July, led by $156 million in new loans. But that growth has also reduced the credit union’s net worth ratio and subsequently its ability to buy a larger bank.

Showmar said the company looked at one potential transaction recently, but it wasn’t the right fit.

“I’m not sure if the current environment is a challenge or an opportunity as I have seen almost an equal amount of bank deals canceled as I have seen new ones announced,” he said. “The review of loans will be even more important in this challenging environment, and we anticipate the value of deposits is lower due to the overall rate environment.”

Holthaus said credit unions experienced an unusual level of organic deposit growth in the second quarter, and the impact has been a decline in capital ratios,

“The big question is how sticky are the deposits, where are capital ratios going as a result and when will margins stabilize,” Holthaus said. “The lack of answers to these and other questions is making buyers somewhat more cautious.”

Toronto-Dominion Bank plans to give most employees the option to return to the office this month and is aiming for workers to officially transition to their new working models by June.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

Employees will still have some flexibility to work from home, but are strongly encouraged to collaborate with colleagues in person, according to people familiar with the matter.

But don’t tell that to Crane Credit Union in Odon, Ind.

The $700 million-asset Crane said last week that it

Crane in June also

Michael Bell, a lawyer at Honigman in Michigan, who has advised many credit unions on bank acquisitions, said a handful of deals in the works “are going to happen” sooner or later. He echoed Holthaus in saying many CEOs are waiting for the next earnings results before pulling the trigger.

“Everybody is interested to see the Q3 numbers come out. Then the question will be is that enough? I think it will be for some, and then we’re going to need Q4 numbers for others,” he said.

Bell said there will be at least two more whole-bank deals announced before the end of the year with a larger number of branch transactions.

Other factors might also be at play holding up deals, including a regulator's decision to block a sale in Colorado. The Colorado Banking Board in January rejected

But Bell said some sellers specifically want to work with credit unions in order to get the cash payout, and even the situation in Colorado has not deterred them too much.

And it is not only deals involving credit union buyers that are stagnating. According to S&P Global Market Intelligence, banks had announced just 58 deals as of the end of July. If that pace continues, bank acquisitions should fall far short of the 270 deals announced in 2019.

Jacob Thompson, a managing director at SAMCO Capital in Dallas, said conditions are not favorable for an upswing in M&A anytime soon. He added, however, that the groundwork was laid for some deals before the pandemic hit, and those could make it to the finish line this year.

For example, Thompson said SAMCO is working on a merger of equals that started last year. Both sides remain committed and have significantly progressed toward an announcement, he said.

“But most buyers are so focused on getting their own house in order that it’s just too risky to step out there to try to acquire another franchise," Thompson said.