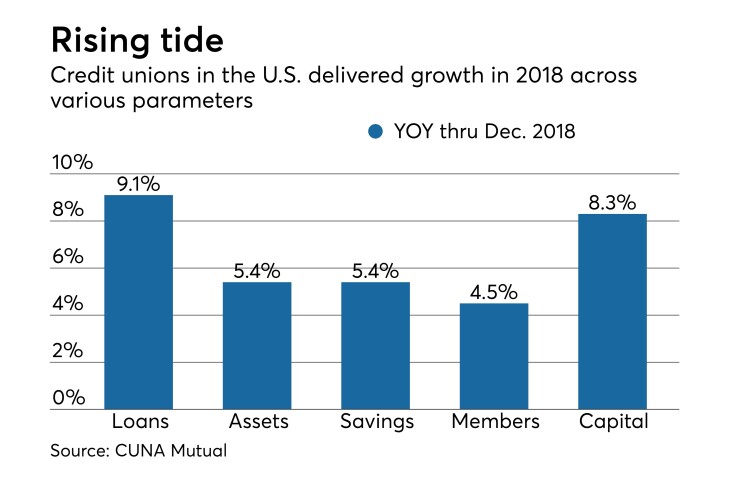

Credit unions closed out 2018 with gains across a series of key metrics.

That’s according to the latest Credit Union Trends Report from CUNA Mutual Group, which revealed loan balances at CUs up 9.1 percent for the 12-month period ending in December 2018. During December loan balances rose by 0.6 percent, 20 basis points below the pace of December 2017.

The total 2018 loan growth figure shows continued gains for the industry, but it is more than a full percentage point below where things stood one year prior. Loan growth for 2017 was at 10.6 percent, according to CUNA Mutual, which said all loan categories saw a slowdown in 2018 except adjustable-rate first mortgages.

CUNA Mutual predicted loan growth will further slow to 8 percent this year and just 6 percent in 2020.

Membership rose by 5.1 million, the largest year-over-year increase in the movement’s history. Total credit union membership at year-end stood at 118.8 million, a 4.5 percent increase over 2017. For the month of December, membership was up by 0.36 percent (428,000 new members), slightly higher than the 0.34 percent growth recorded in December 2017.

Those new members, however, have fewer institutions to serve them. At year-end there were 175 fewer credit unions in existence than at the start of 2018 (12 of those shutting their doors in December alone) though that is an improvement from 2017, when 222 CUs closed up shop.

Other highlights from the report include:

- Auto loan balances for the year were up by 11.9 percent, rising 1.2 percent in December, down slightly from the 1.3 percent seen in December 2017

- Total assets for the year were up 5.4 percent, though December saw growth slip to 0.3 percent for the month, down from 0.4 percent one year prior

- Loan delinquency rates in December fell to 0.67 percent, down from 0.88 percent the year before. CUNA Mutual attributed that to fast loan growth

- Real estate loan balances at CUs increased by 8.1 percent in 2018, the slowest pace recorded since 2014.

- Second mortgage loan balances grew by 10.7 percent during 2018, CUNA Mutual said, “after eight years of falling or low balance growth due to members rolling second mortgages into refinanced first mortgages.”