A future driven by autonomous vehicles is closer than many credit unions may think.

The rise of self-driving vehicles is reason enough for credit unions to get involved before the lending window closes, according to Brian Hamilton, VP of innovation and insights at CU Direct.

“Personal vehicle ownership as we know it today will be impacted,” Hamilton predicted.

The National Highway Traffic Safety Administration lists six phases of autonomous vehicles, ranging from 0, with no automation whatsoever, to 5, including full automation and even the option of no steering wheel. Still, manufacturers such as Tesla are working their way toward full automation; most Teslas are only at a “Level 2” right now (“Partial automation”), but those are nevertheless more advanced than most vehicles on the road today.

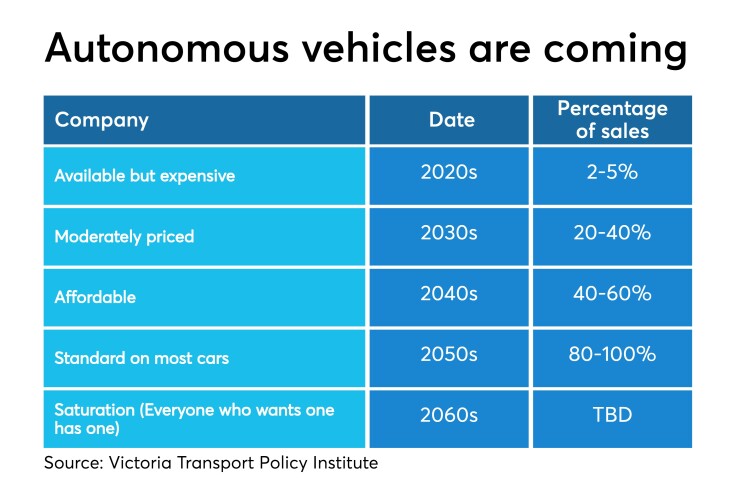

Experts predict small-scale deployments within the next five years, though full integration of autonomous vehicles on the road isn’t expected for 30 to 50 years. Level 4, which does not require a driver to operate the vehicle, is likely to surface within the next decade, though those cars will only drive within a geo-fenced area. Level 5, which won’t include steering wheels or pedals, is not expected for quite some time.

Despite that long lead time, some credit unions are already entering the market. Alliant Credit Union in Chicago separates Tesla loans from the rest of its auto portfolio, including a separate landing page and application with e-loan and e-sign capabilities. The credit union first partnered with Tesla in 2004 after noticing many potential borrowers were directed to Alliant straight from Tesla’s website.

The popular brand is a good loan product for Alliant, at least from a price perspective: Today’s Tesla Model 3, the company’s most affordable vehicle, starts at $35,000, while the Model S sedan starts at $75,000 and a Model X SUV carries an MSRP of $85,000.

“We originated loans and [Tesla customers] spoke very highly of us,” said Jeremy Pinard, Alliant Credit Union’s vice president of consumer lending. “Their customers drove other Tesla customers to us because we had a digital experience before most.”

As reported, Alliant made the decision several years ago to

“We were more comfortable with a digital experience [than other institutions],” he said. “These consumers were getting referred from Tesla’s website; we had a separate landing page for them where we had a separate application, and we closed everything electronically. Even years ago when the volume got big in 2015-2016, we were closing everything electronically through DocuSign.”

But wider changes are expected to take place in the market in the coming decades. The rise of self-driving cars will also impact the auto lending landscape. For one thing, Hamilton said, the number of cars per household is likely to decline en masse, along with additional increases in the number of city dwellers living without a car.

But Hamilton insisted those changes won’t spell the death of auto lending. Instead of fewer cars on the road as usage of autonomous vehicles rises, he said, it’s likely there will actually be more cars but less traffic congestion thanks to an expected decline in accidents. Data from the U.S. Department of Transportation and NHTSA shows roughly 94% of all U.S. auto accidents are the result of driver error.

And those who continue to drive, he added, will be less likely to own their vehicle individually, but rather share ownership with others. Small groups, business loans, micro fleet loans, and shared vehicle loans are the entities expected to be on the rise with autonomous vehicles.

“There’ll be more loan opportunities for [loans], they just won’t look like what they look like today,” Hamilton said.

No clear answers yet

Aside from the impact these vehicles could have on credit union portfolios, self-driving cars also face a skeptical public, as outlined in a 2014 study from the University of California, Berkeley. Liability was a chief concern for higher-income consumers, especially with determining who shoulders legal responsibility in an accident. All groups surveyed expressed concerns regarding costs.

The concept of a self-driving vehicle has become more normalized since that study’s release five years ago, but some major barriers remain, including how these cars will be regulated at the federal, state and local level. Liability for motor vehicle-related fatalities is determined at the state and local level.

“The question will be, when will the regulators feel comfortable that this new paradigm won’t be disrupted,” said Kirk Drake, the CEO and president of Ongoing Operations LLC.

“As credit unions enter newer markets, you get these early adopters that get in before the regulators know how to say no, and then there's a time that they'll [the regulators] block everyone else out and those early adopters end up creating unique market advantages,” Drake continued.

The good news for credit unions, however, is they as lenders will almost certainly be shielded from many of the ethical dilemmas that arise if self-driving cars injure or kill someone.

As the “provider of consumer enablement,” said CU Direct’s Hamilton, credit unions and other financial institutions lending to consumers who buy self-driving cars will likely be off the hook for accident liability just the way they are in today’s car market.

While Tesla dominates the autonomous vehicle domain, that could all change in the future, which is why experts point to the importance of aligning with early adopters.

“If you're not plugged into these platforms with these large direct consumer providers, then it’s going to be difficult to interject in the value chain for the consumer,” Pinard said. “Consumers don't want to have to jump out of Tesla’s platform, go find their financing somewhere else, and then bring that back to Tesla. If you're not plugged into that platform, then that’s where it’s going to become increasingly difficult to compete for those loans.”