CUNA GAC is underway

The Governmental Affairs Conference – which is the largest to date with over 5,300 attendees – got underway on Sunday with a session devoted to strategic planning for small credit unions. Main takeaways included increasing deposits, marketing to new members, retaining talented staff and cultivating new services.

For $86 million-asset Hallco Community Credit Union, the management team’s strategy is to stick to a specific service and focus on cultivating it. That means forgoing high-tech bells and whistles and ensuring members have access to their money, said an executive from the Gainesville, Ga.-based institution.

The Hallco executive advised the few hundred small credit unions in attendance to remove barriers for members to improve fund access in addition to advising CEOs to do their research rather than leaving anything up to their board.

Succession planning and tackling CECL were the main priorities voiced by Teri Robinson, CEO and president of the $33 million-asset Ironworkers USA Federal Credit Union. Robinson also serves as the chair for CUNA’s small credit union committee.

CUNA’s President and CEO Jim Nussle argued that the credit union “model is under attack” and that “there’s nothing that the bankers would love more than to try and make us look like banks.”

To fight this, Nussle urged the attending credit unions to educate legislators this week about the credit union difference.

“It’s not the big credit unions that have the relationships with these folks,” Nussle said. “They would much rather talk with you.”

Kerry: "The swamp has gotten bigger."

As he delivered his remarks, he applauded credit unions for providing access to a banking system for the most vulnerable in American society while also making it easier for small businesses to prosper and for families to buy homes with mortgages that they can afford.

“The philosophy of the credit union movement is as fundamental today as it was 110 years ago,” Kerry said. “It’s based on the bedrock belief that everyone ought to be able to achieve a better standard of living by pooling their saving and making loans to co-workers, to neighbors, to people who don’t have access to credit.”

Kerry, who said he has been a credit union member for at least 40 years, also made clear his appreciation for the credit union difference of accessibility and diversity.

“You walk in and you see the whole neighborhood around,” he noted. “Teachers, police men, city workers, every walk of life [is] working together to help invest in the community and to improve the quality of life for every single person’s family.”

Kerry then mentioned his support of the Credit Union Membership Access Act in 1998, which allowed for multiple group chartering for federal credit unions.

The former senator denounced one-size-fits-all regulation, urging credit union members to share their stories and discuss their needs during their time talking with lawmakers later this week.

Kerry’s address also included remarks on the current state of government affairs.

“The biggest threat to America is not coming from Russia or China. We can handle those folks,” he declared. “I’m worried about our own willingness to make our democracy work right here at home.”

He also alluded to the current administration, noting that that “the swamp has not drained, it has gotten bigger.” He then challenged adult Americans “to take responsibility for defining the facts.”

“If we can't agree what the facts are, how do we make a democracy work?” Kerry asked the audience.

Nussle: "We set the table."

Nussle noted that

The trade group CEO also remarked that the biggest win of 2018 was the Economic Growth, Regulatory Relief, and Consumer Protection Act.

“We fought for a moratorium for no new rules from the [Consumer Financial Protection Bureau],” Nussle said.

He then circled back to comments he previously initiated during Sunday’s small credit union roundtable, reiterating that the credit union industry is under attack.

“We don’t just have a seat at the table, we set the table,” he declared.

Donovan talks data breaches

During a general session, Donovan chided one-size-fits-all regulation, noting that this would run $6.1 billion and cost the average credit union member-household $115 per year. The cost for credit union compliance is running three times faster than that of inflation, Donovan said.

To ease credit union concerns, Donovan suggested the National Credit Union Administration take back over supervision of the largest credit unions from the CFPB.

Moving from a director to a commission overseeing the CFPB would allows credit unions to better serve consumers, he argued.

“When you have move people at the table, they bring diverse perspectives," he said. "It will lead to greater stability and that regulatory pendulum won’t swing so severely. It’s more consistent of the democratic principles that are the underpinning of our country.”

Donovan also mentioned the proliferation of data breaches affecting financial institutions. Since 2005, there have been 10,000 data breaches exposing 11.6 billion records, Donovan cited. His urged

Riccobono: “Equal access to information is not a new idea."

A number of credit unions have been sued in recent years with

“Equal access to information is not a new idea,” Riccobono said. "Next year is the 30th anniversary of the Americans with Disability Act. The National Federation of the Blind is firm in our conviction that the Americans with Disability Act and other laws and policies make it clear that access in the digital world is as important as the physical world.”

“But sometimes this gets talked about like it was just invented in 2019,” he added.

The organization uses litigation to protect the rights of blind Americans, Riccobono said, while also acknowledging that there’s a “frivolous amount” of lawsuits against financial services companies.

“The number of lawsuits is tiny compared to the number of inaccessible websites and uncompensated barriers that blind people face in trying to get access to their own money,” Riccobono said.

His final piece of advice to credit unions was for them to refrain from signing confidentiality agreements after reaching a settlement because by doing so, “it doesn’t disclose to anybody that you care about accessibility.”

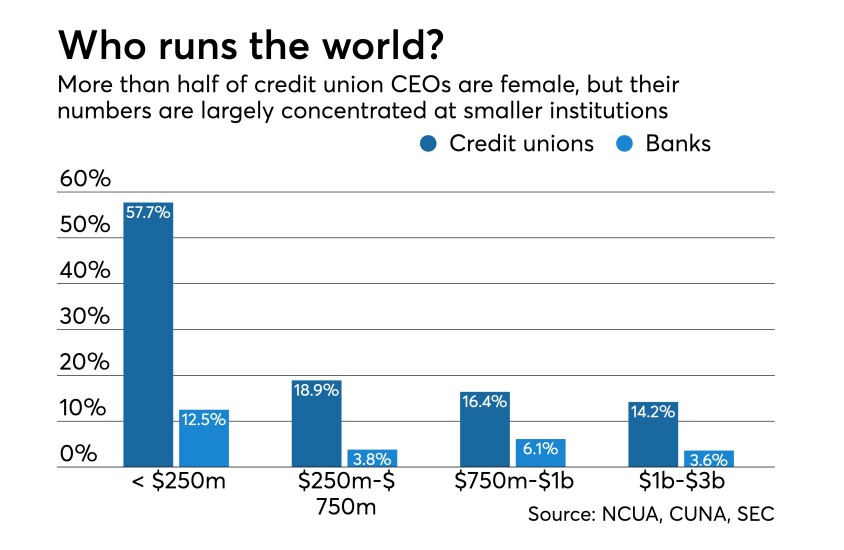

Gauging effectiveness of diversity efforts

The hour-long discussion, billed as “The State of the Movement: Addressing Diversity, Equity, and Inclusion within the Credit Union Movement,” featured a series of what one attendee described as “eye-popping” statistics gauging the industry’s progress employing and serving women and minority groups.

When it comes to women, the news was generally good. According to one of the panelists, CUNA Senior Policy Analyst Samira Salem, nearly

The C-Suite diversity

Salem noted that nearly 90 percent of CEOs are white, with the majority being older than 56 years of age. Just 8 percent of board members are African-American, she added.

Another panelist, Adrian Johnson, chairman of the African-American Credit Union Coalition, said his group counts a total of 164 African-American CEOs industrywide, with more than half, 87, leading institutions with less than $6 million of assets.

Johnson said his group, which was founded in 1999, is developing a networking initiative to showcase young African-American credit union professionals who he hopes will be hired by larger credit unions.

“Our members are hungry to get involved and make a difference. The only thing they need is an opportunity,” said Johnson, who also serves as chief financial officer of the $1.2 billion-asset Municipal Employees Credit Union in Baltimore.

Juan Fernandez, the CEO of Leverage Point, an Albuquerque, N.M.-based firm that provides strategic planning and other consulting services to credit unions, said the search firms that guide credit union in hiring executives and selecting board members need to make diversity a higher priority.

“In my experience I haven’t seen many that emphasize that as something they’re looking for,” said Fernandez, who attended Monday’s session. “We have to make them realize this something that is really important. The C-Suite should look like the rest of the country.”