Credit unions can finally see the full picture of how the industry performed in 2020, and while it’s not pretty, it could have been worse.

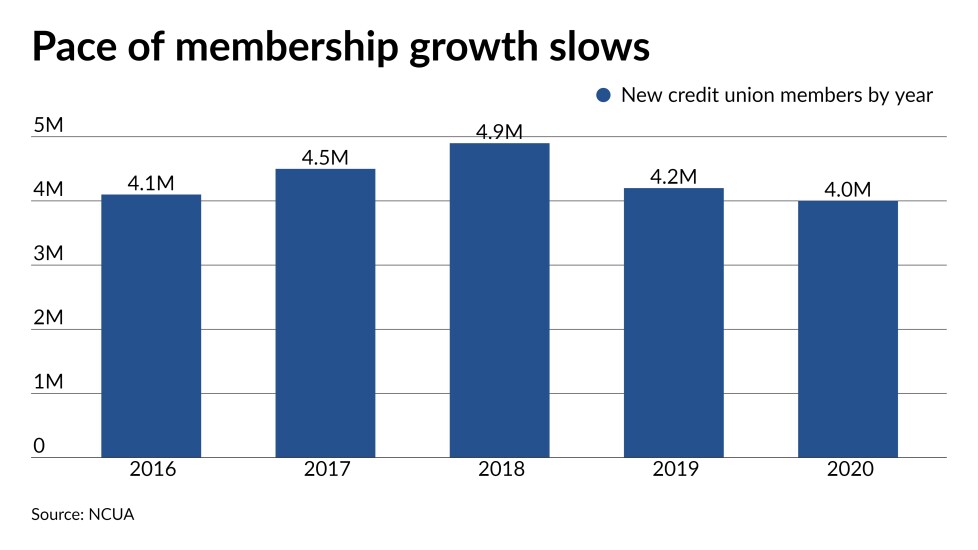

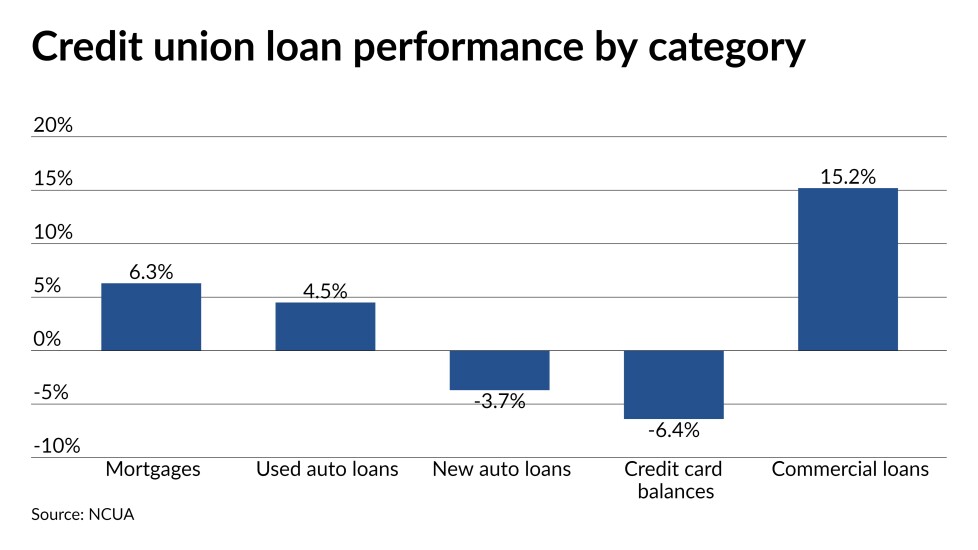

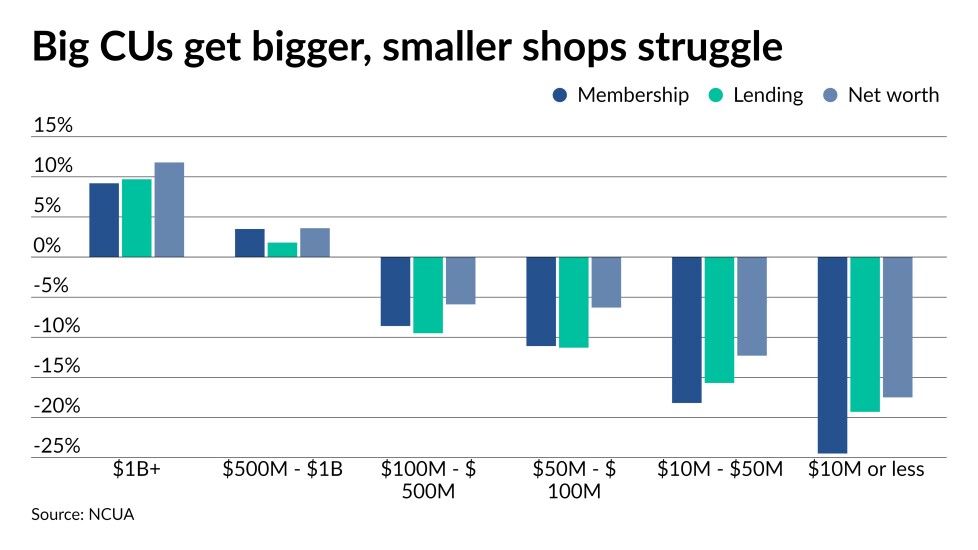

Membership continued to grow, lending never dried up – thanks in large part to the mortgage-refinancing boom – and there was no liquidity crisis. However, as the National Credit Union Administration’s latest Quarterly Credit Union Data Summary shows, there were plenty of stiff headwinds at the close of last year that will continue to dog the industry well into 2021.

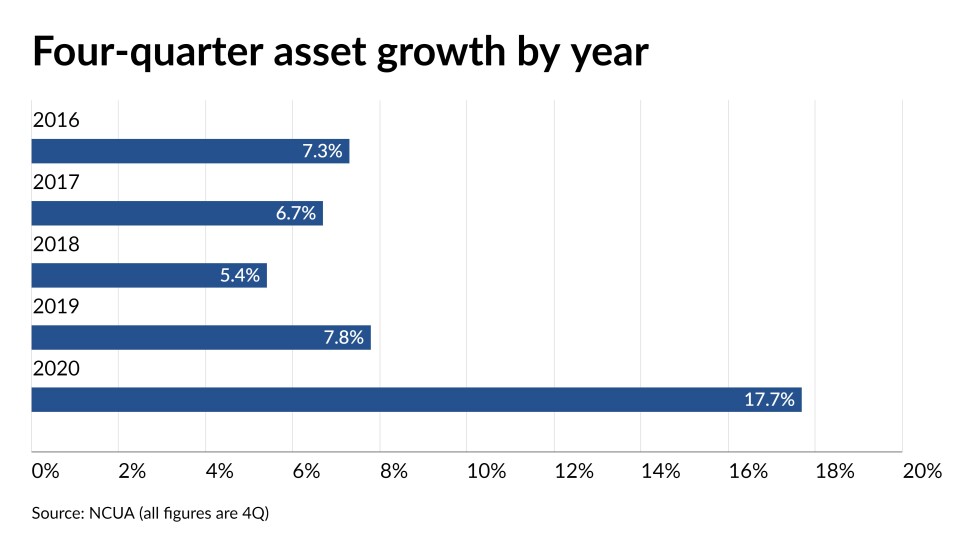

Deposit growth remains extremely high, with the industry closing out 2020 with insured shares and deposits up nearly 20% from one year before. On top of that, lending continued to slow, ending the year with growth of just 4.9%, and the loan-to-share ratio fell by more than 10 points compared to where it stood at the end of 2019.

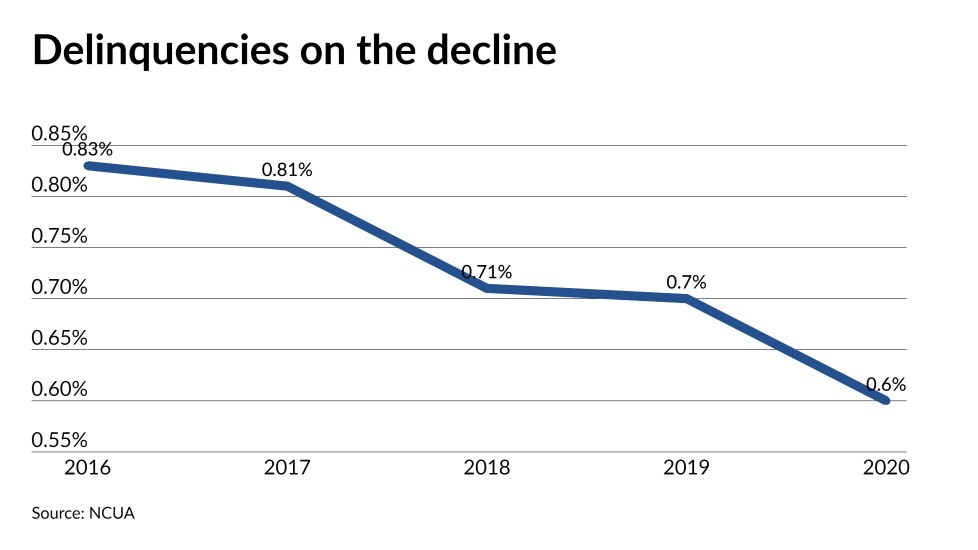

If there’s good news to be found, it’s that the pace of consolidation in the industry wasn’t largely impacted by the pandemic and recession, and delinquency rates remain low.

Read on for more highlights from the report. For a look at third-quarter data,