The National Credit Union Administration's latest quarterly report on the industry's financial performance contained some positive news for credit unions.

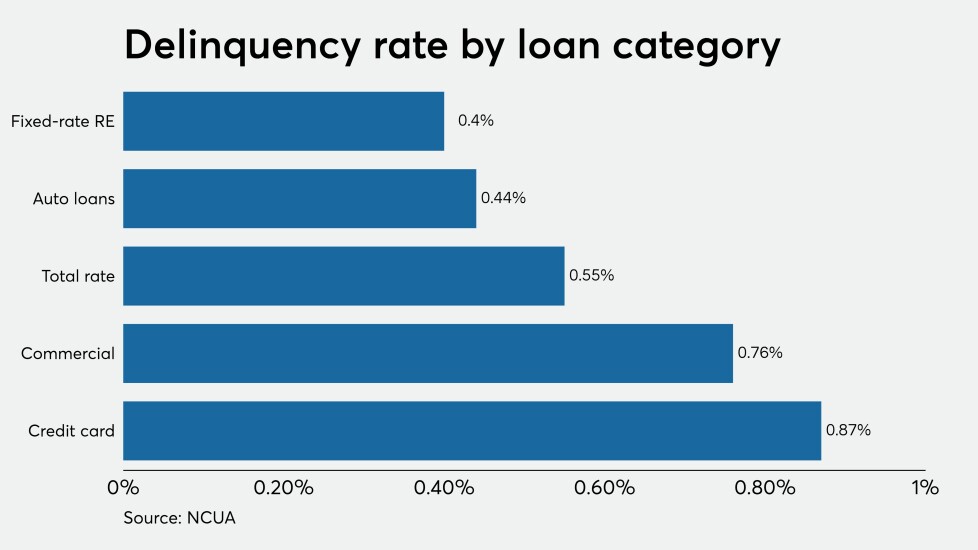

Credit quality remains strong despite an elevated unemployment rate tied to the coronavirus, according to NCUA's data. Earnings also improved from the second quarter.

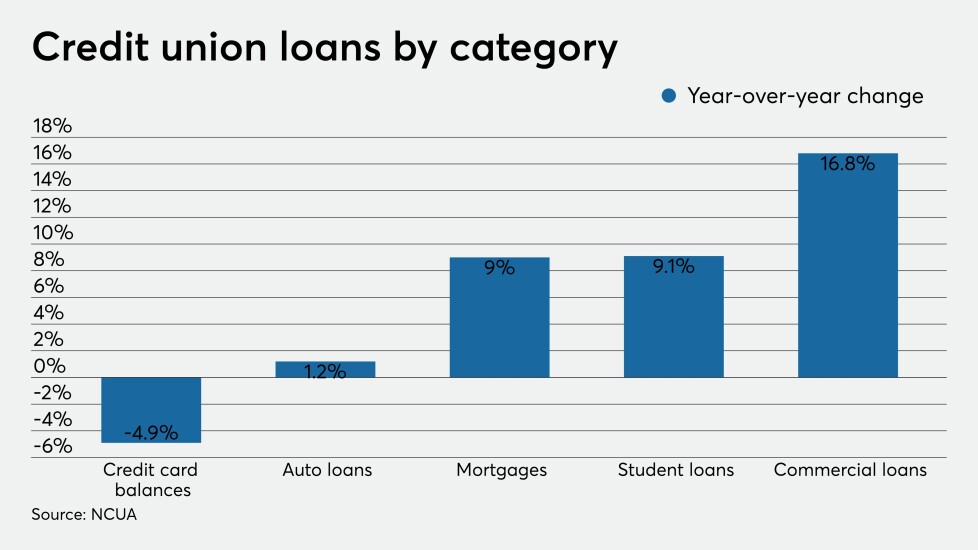

However, there were also signs that at least some credit unions could face challenges ahead. For instance, only the largest group of credit unions by asset size reported adding to their loan balances while every other asset category posted a decline, a continuation of a trend seen in the second quarter.

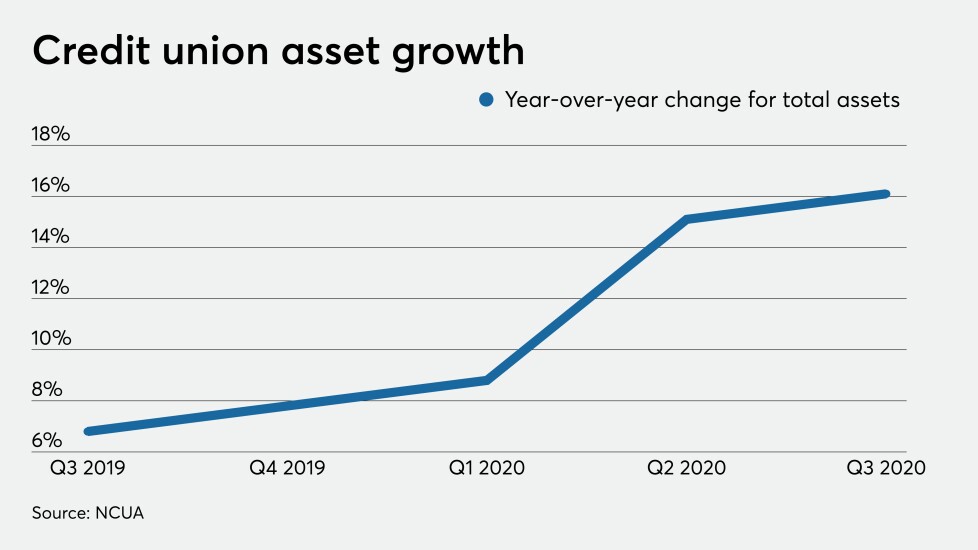

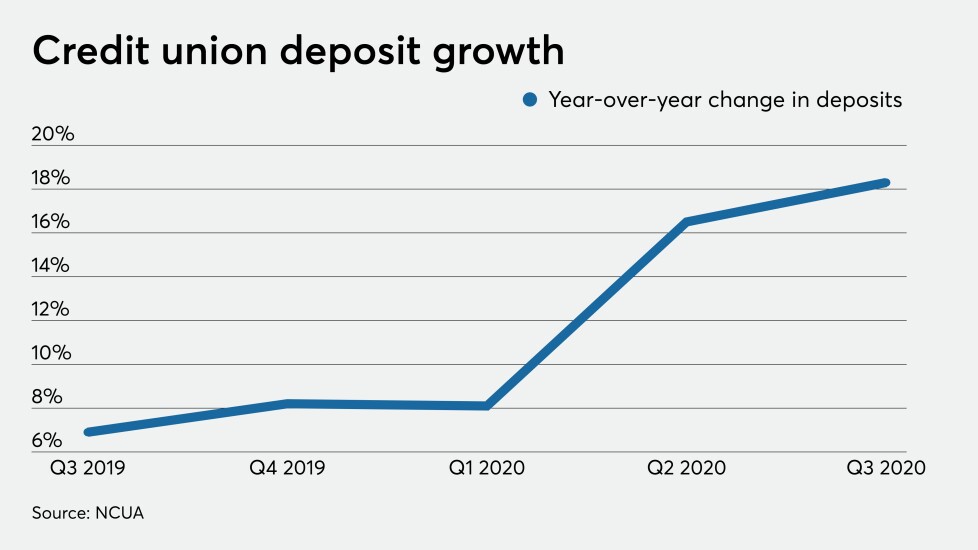

Much of the reported asset growth came from credit unions adding to their investment portfolios rather than making more loans. And the industry could be dealing with excess liquidity for the foreseeable future as deposits continue to pour in.

Read on for more highlights from NCUA third-quarter data. A look at second-quarter data