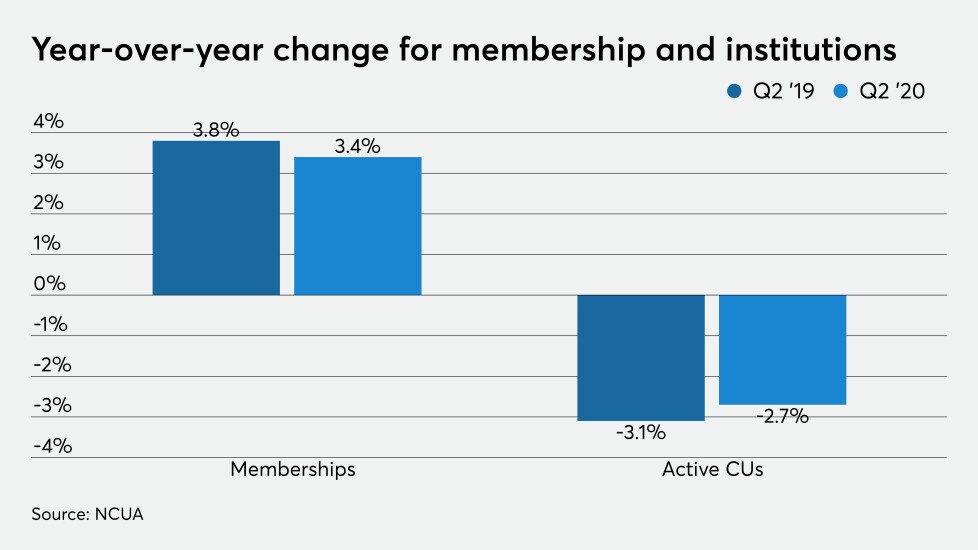

New data from the National Credit Union Administration offers a clearer picture of how the industry has been impacted by the coronavirus pandemic.

The agency's Quarterly Credit Union Data Summary for the second quarter, released last week, offers wider insights into how credit unions have performed since the COVID-19 outbreak overtook the nation. Because this report came out at the start of the final month of the third quarter, the data largely confirms what many in the industry already knew: lending is down, deposits and loss reserves are up, and margins are being squeezed in a way they haven't been since the Great Recession.

But this data is notable because it provides a fuller picture of the toll the pandemic and economic downturn have taken on credit unions of all sizes, but particularly at the lower end of the asset spectrum. Because the outbreak began in mid-March, much of the industry's first-quarter results were shielded by two relatively normal months. The second-quarter data covers a period when much of the country was in lockdown, many nonessential businesses were shuttered and consumer spending had dropped substantially.

Read on for highlights from the report. A look at first-quarter data