A new report from Access Softek showed at least one in five members are likely to reduce their branch visits once the pandemic ends, though the risk of consumers leaving their credit union entirely may have declined.

Consumers are reluctant to take on additional debt in the wake of the coronavirus, cutting into credit unions' revenue streams. That could spur more institutions to roll out rewards programs to promote debit card usage.

Over 90% of loans from CUs in the Empire State are eligible for forgiveness using the $150,000 threshold.

The Senate Banking Committee will vote this week on Kyle Hauptman's nomination to the NCUA board while the full chamber continues to debate additional coronavirus relief measures.

Some professionals have admitted to sleeping or drinking while working from home. Technology could help financial services firms ensure employee productivity doesn't slip.

The measure would release $2 million in funding for the U.S. Postal Service to launch pilot programs to provide basic services such as checking accounts and bill payment.

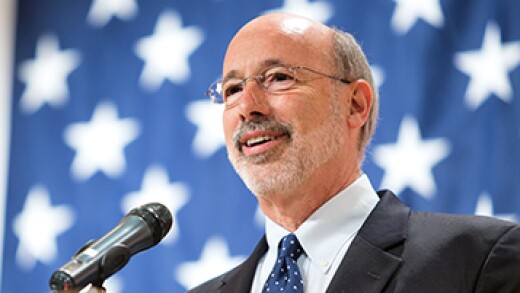

The financial services industry urged Gov. Tom Wolf to reconsider guidelines that excluded their employees from receiving this benefit.

Members of the Senate Banking Committee took the agency’s leader to task for eliminating underwriting requirements for small-dollar lenders, which lawmakers said has left consumers more vulnerable during the pandemic.

-

A new report from Access Softek showed at least one in five members are likely to reduce their branch visits once the pandemic ends, though the risk of consumers leaving their credit union entirely may have declined.

August 5 -

Consumers are reluctant to take on additional debt in the wake of the coronavirus, cutting into credit unions' revenue streams. That could spur more institutions to roll out rewards programs to promote debit card usage.

August 5 -

Over 90% of loans from CUs in the Empire State are eligible for forgiveness using the $150,000 threshold.

August 4 -

The Senate Banking Committee will vote this week on Kyle Hauptman's nomination to the NCUA board while the full chamber continues to debate additional coronavirus relief measures.

August 3 -

Some professionals have admitted to sleeping or drinking while working from home. Technology could help financial services firms ensure employee productivity doesn't slip.

August 3 -

The measure would release $2 million in funding for the U.S. Postal Service to launch pilot programs to provide basic services such as checking accounts and bill payment.

July 31 -

The financial services industry urged Gov. Tom Wolf to reconsider guidelines that excluded their employees from receiving this benefit.

July 29