Lenders are struggling to deploy deposits into interest-earning assets, and changes to post-secondary education may further limit these options.

Refinancing has been one of the bright spots in a difficult year for lending, and the industry has concerns that a fee to be imposed by Fannie Mae and Freddie Mac could slow down the business.

New analysis from S&P found that only two of the of the top 20 credit unions that participated in the Paycheck Protection Program loans had assets of less than $1 billion.

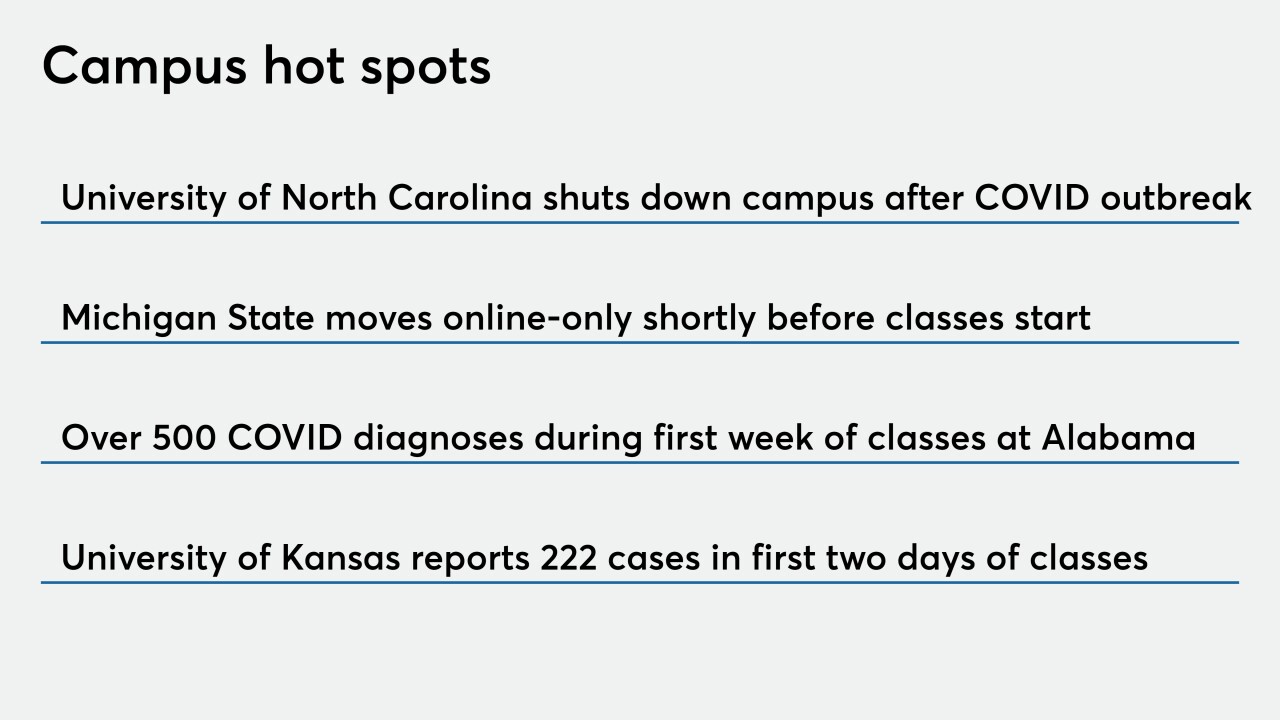

Institutions serving colleges and universities traditionally see membership surge in the fall, but are now planning for a decline as classes move online.

New data from the state regulator showed that assets at credit unions in the Badger State grew by 28% during the first half of this year, versus growth of 14% in the first six months of 2019.

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

The agency solicited input on the effects of the CARD Act regulations as part of a statutory requirement that the bureau review policies 10 years after they are implemented.

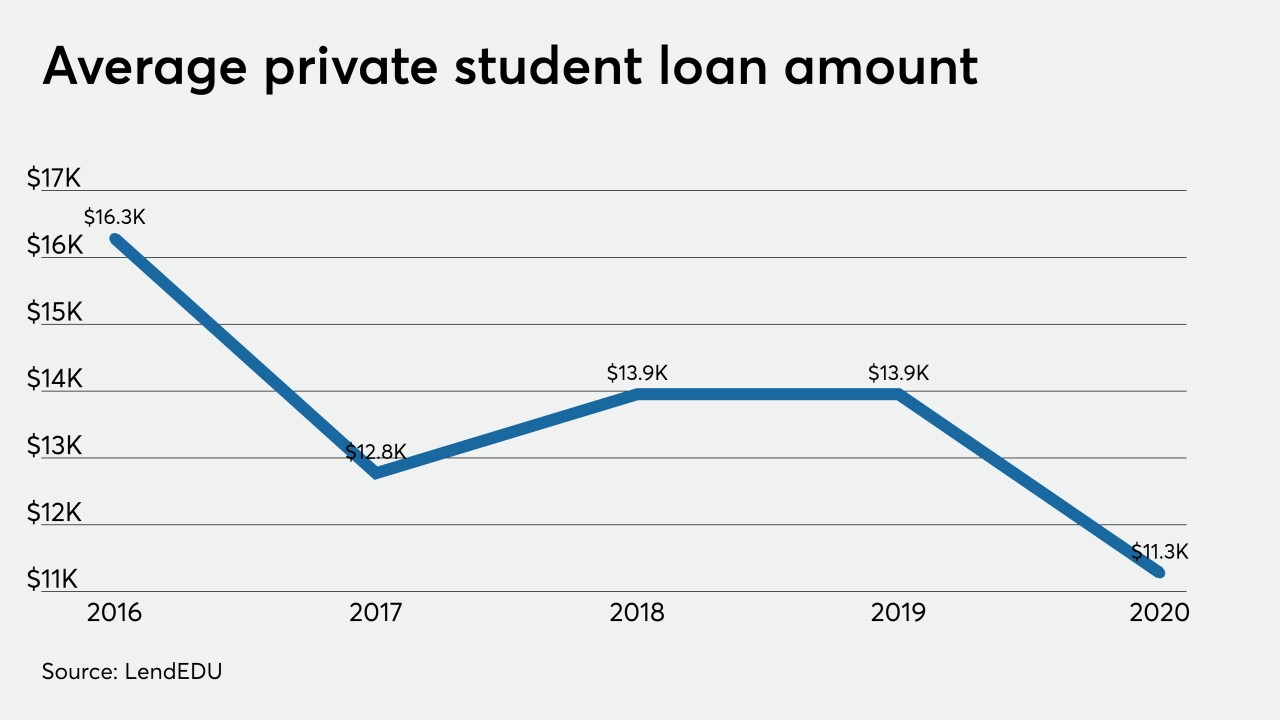

Shifts in consumer behaviors have boosted interest in several loan categories, which could be a boon for credit unions.

-

Lenders are struggling to deploy deposits into interest-earning assets, and changes to post-secondary education may further limit these options.

September 1 -

Refinancing has been one of the bright spots in a difficult year for lending, and the industry has concerns that a fee to be imposed by Fannie Mae and Freddie Mac could slow down the business.

August 28 -

New analysis from S&P found that only two of the of the top 20 credit unions that participated in the Paycheck Protection Program loans had assets of less than $1 billion.

August 27 -

Institutions serving colleges and universities traditionally see membership surge in the fall, but are now planning for a decline as classes move online.

August 27 -

New data from the state regulator showed that assets at credit unions in the Badger State grew by 28% during the first half of this year, versus growth of 14% in the first six months of 2019.

August 26 -

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

August 25 -

The agency solicited input on the effects of the CARD Act regulations as part of a statutory requirement that the bureau review policies 10 years after they are implemented.

August 25