Credit cards

Some investors worry the rebound in consumer lending will inevitably lead to more defaults. Here’s why bank executives disagree.

-

Borrowing on plastic climbed by $52 billion in the fourth quarter, the New York Fed found, as consumers splurged on holiday shopping and inflation drove up the cost of goods and services. It's the biggest jump in the 22 years the data has been tracked.

February 8 -

Six members of the Senate Banking Committee are asking questions about a flurry of lawsuits against credit card customers. The bank denies that it has resumed using robo-signing.

February 7

-

The new product will help Barclays' U.S. bank reach customers who may not want — or qualify for — its cobranded cards. It's part of a strategy to reach more consumers after card balances declined last year.

January 31 -

The expenses jumped 33% last quarter, which was generally in line with trends elsewhere in the credit card industry. The battle for new customers is “intense,” CEO Richard Fairbank told analysts.

January 26 -

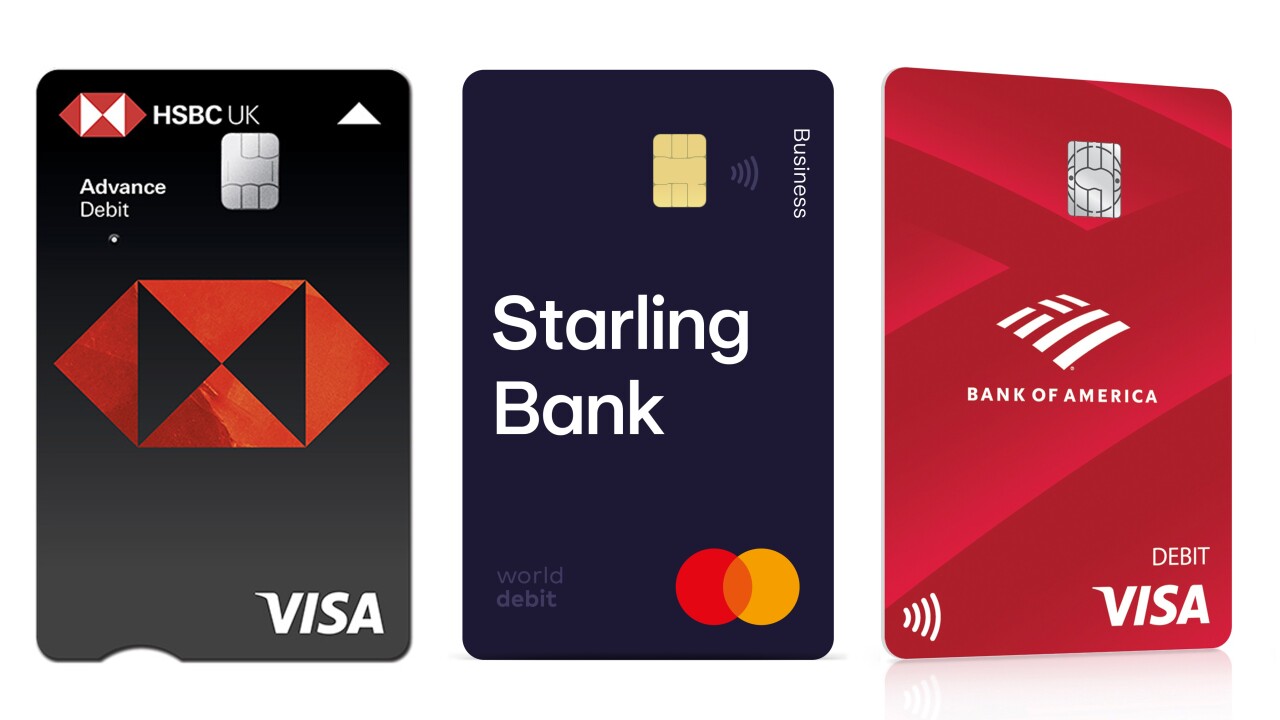

Switching from a horizontal layout — a relic of embossed account numbers — is an attempt by issuers like HSBC, Starling Bank and Bank of America to address accessibility challenges faced by customers with dementia, visual impairments and other conditions.

January 24 -

Goldman's second consumer credit card borrows many features of its three-year-old Apple Card, such as instant issuance through a mobile app and an emphasis on virtual account numbers.

January 10