Legislation the president signed this week will extend the deadline for the Paycheck Protection Program to May 31 from March 31, giving businesses two additional months to apply for loans.

By purchasing additional assets and securities, the Federal Reserve provided the financial markets with enough liquidity to weather the pandemic recession. But with the economy starting to recover, it needs to reduce such funding before it creates dangerous bubbles over the long term, say two former bankers.

Lawmakers approved a bill that will allow the Paycheck Protection Program to remain open until May 31. It was originally set to expire on March 31.

Banks ditched radio ads, direct mail and sports sponsorships and instead produced spots for social media, video games and streaming services, all while adjusting their messages to feel more relevant to the times. Now, with coronavirus cases declining, will they return to the old normal?

The 14 lenders that dominate U.S. credit cards slashed $99 billion from their customers’ spending limits in 2020, mostly affecting financially troubled households.

Twelve months after the public health emergency began, executives say it forced them to reexamine where employees work, retail strategies, office layouts and more.

To drive the recovery we need to move beyond traditional data and models to incorporate new transaction and payment information that is more timely, more insightful, and more inclusive, FinRegLab's Melissa Koide and FICO's Larry Rosenberger write.

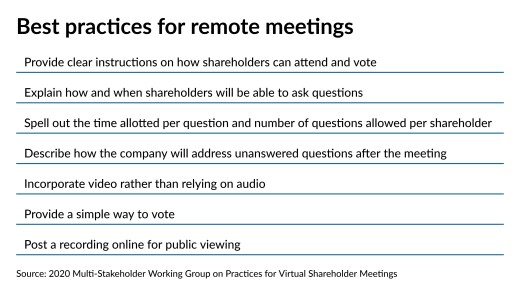

Online and hybrid gatherings last year left shareholders demanding that companies make it easier to join the meetings, ask questions and vote this time around.

-

Legislation the president signed this week will extend the deadline for the Paycheck Protection Program to May 31 from March 31, giving businesses two additional months to apply for loans.

March 31 -

By purchasing additional assets and securities, the Federal Reserve provided the financial markets with enough liquidity to weather the pandemic recession. But with the economy starting to recover, it needs to reduce such funding before it creates dangerous bubbles over the long term, say two former bankers.

March 26 Washington Mutual Bank

Washington Mutual Bank -

Lawmakers approved a bill that will allow the Paycheck Protection Program to remain open until May 31. It was originally set to expire on March 31.

March 25 -

Banks ditched radio ads, direct mail and sports sponsorships and instead produced spots for social media, video games and streaming services, all while adjusting their messages to feel more relevant to the times. Now, with coronavirus cases declining, will they return to the old normal?

March 24 -

The 14 lenders that dominate U.S. credit cards slashed $99 billion from their customers’ spending limits in 2020, mostly affecting financially troubled households.

March 22 -

Twelve months after the public health emergency began, executives say it forced them to reexamine where employees work, retail strategies, office layouts and more.

March 22 -

To drive the recovery we need to move beyond traditional data and models to incorporate new transaction and payment information that is more timely, more insightful, and more inclusive, FinRegLab's Melissa Koide and FICO's Larry Rosenberger write.

March 22 FinRegLab

FinRegLab