Credit Union of Texas, based near Dallas, is believed to be one of the first in the industry to debut this perk.

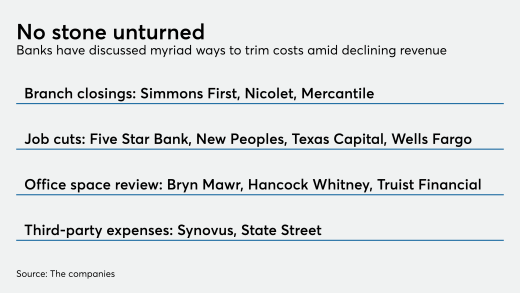

With the coronavirus pandemic intensifying and hopes for a quick economic recovery fading, banks large and small are reducing headcounts, shuttering branches, shedding office space and generally trying to trim expenses wherever they can.

Three months ago, Stephen Squeri, the chairman and CEO of American Express, declared a global "economic free fall" due to the coronavirus. Its second-quarter earnings show how far a fall it has been.

Lenders need to use alternative data as an overlay to traditional underwriting methods to help creditworthy customers in hardship because of the coronavirus crisis.

Home-renovation loans to add features such as offices and pools could be one source of lending as credit unions struggle with overall sluggish loan demand.

In this uncertain environment, companies that are nimble and adaptive are rising to the challenge, finding new ways to navigate the crisis and embracing innovative electronic solutions, says Bank of America's Daniel Stanton.

Financial institutions want to protect customers and employees from the coronavirus but are caught in the middle of a politically charged public health debate. The stance taken by the industry’s largest trade group gives them cover.

The CEOs of the credit card lenders Discover and Synchrony are urging Congress to come through with another round of government stimulus so that struggling households can continue paying their bills.

-

Credit Union of Texas, based near Dallas, is believed to be one of the first in the industry to debut this perk.

July 24 -

With the coronavirus pandemic intensifying and hopes for a quick economic recovery fading, banks large and small are reducing headcounts, shuttering branches, shedding office space and generally trying to trim expenses wherever they can.

July 24 -

Three months ago, Stephen Squeri, the chairman and CEO of American Express, declared a global "economic free fall" due to the coronavirus. Its second-quarter earnings show how far a fall it has been.

July 24 -

Lenders need to use alternative data as an overlay to traditional underwriting methods to help creditworthy customers in hardship because of the coronavirus crisis.

July 24 MeasureOne

MeasureOne -

Home-renovation loans to add features such as offices and pools could be one source of lending as credit unions struggle with overall sluggish loan demand.

July 24 -

In this uncertain environment, companies that are nimble and adaptive are rising to the challenge, finding new ways to navigate the crisis and embracing innovative electronic solutions, says Bank of America's Daniel Stanton.

July 24 Bank of America

Bank of America -

Financial institutions want to protect customers and employees from the coronavirus but are caught in the middle of a politically charged public health debate. The stance taken by the industry’s largest trade group gives them cover.

July 23