As demand for secure and seamless digital payments increases, financial institutions must prioritize a digital-first payments strategy that incorporates the latest trends, says CSI's Matt Herren.

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

Mastercard reported a sharp decline in payments in its most recent quarter, but some digital seeds it planted before the coronavirus pandemic are already bearing fruit.

The company's results put firm numbers on one of the most discussed business trends of the pandemic economy — the acceleration of digital payments.

As Senate Republicans consider a new coronavirus relief package, the Federal Reserve chairman said easing the so-called Collins amendment would help financial institutions support the economy.

In what was a challenging quarter for the industry, the company reported strong loan growth and a wider margin. Continued momentum will depend on government stimulus, the reopening of New York City and borrowers' ability to make payments after their deferral periods end.

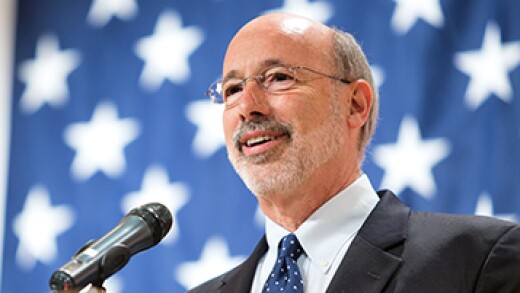

The financial services industry urged Gov. Tom Wolf to reconsider guidelines that excluded their employees from receiving this benefit.

Members of the Senate Banking Committee took the agency’s leader to task for eliminating underwriting requirements for small-dollar lenders, which lawmakers said has left consumers more vulnerable during the pandemic.

-

As demand for secure and seamless digital payments increases, financial institutions must prioritize a digital-first payments strategy that incorporates the latest trends, says CSI's Matt Herren.

July 30 CSI

CSI -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 30 ACES Risk Management Corp.

ACES Risk Management Corp. -

Mastercard reported a sharp decline in payments in its most recent quarter, but some digital seeds it planted before the coronavirus pandemic are already bearing fruit.

July 30 -

The company's results put firm numbers on one of the most discussed business trends of the pandemic economy — the acceleration of digital payments.

July 29 -

As Senate Republicans consider a new coronavirus relief package, the Federal Reserve chairman said easing the so-called Collins amendment would help financial institutions support the economy.

July 29 -

In what was a challenging quarter for the industry, the company reported strong loan growth and a wider margin. Continued momentum will depend on government stimulus, the reopening of New York City and borrowers' ability to make payments after their deferral periods end.

July 29 -

The financial services industry urged Gov. Tom Wolf to reconsider guidelines that excluded their employees from receiving this benefit.

July 29