With big banks largely shunning the program, small banks see an opening to grab more market share in commercial lending.

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

Dennis Devine will have to navigate a number of issues, including economic strife and a pandemic, as he takes the helm at the $13 billion-asset institution.

Observers say the rare denial is rooted in skepticism that a new bank can succeed under current economic conditions and a signal to other proposed banks to hit the pause button.

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

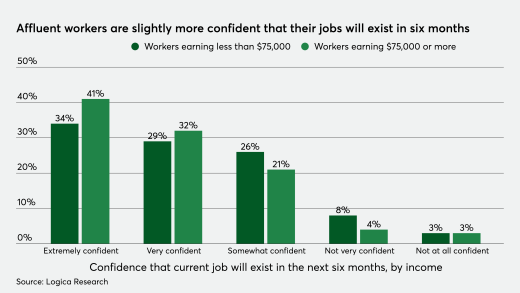

While anyone can lose employment during a pandemic or recession, below a certain threshold it becomes more likely that workers could lose their income — and thus default on credit card payments.

Dana Wade, a former OMB official, says a strong capital footing will help the Federal Housing Administration weather an uptick in delinquencies and ensure the mortgage market is viable once the economy recovers.

A rise in chargebacks has renewed a push for an independent standards body by the SPP, formed in 2018 to represent merchant groups .

-

With big banks largely shunning the program, small banks see an opening to grab more market share in commercial lending.

August 19 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 19 -

Dennis Devine will have to navigate a number of issues, including economic strife and a pandemic, as he takes the helm at the $13 billion-asset institution.

August 19 -

Observers say the rare denial is rooted in skepticism that a new bank can succeed under current economic conditions and a signal to other proposed banks to hit the pause button.

August 18 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 18 -

While anyone can lose employment during a pandemic or recession, below a certain threshold it becomes more likely that workers could lose their income — and thus default on credit card payments.

August 18 -

Dana Wade, a former OMB official, says a strong capital footing will help the Federal Housing Administration weather an uptick in delinquencies and ensure the mortgage market is viable once the economy recovers.

August 18

![“We will step up and do whatever we can to make sure that we ensure market stability,” said FHA Commissioner Dana Wade. “But we know [the pandemic will] ... pass and we're going to have a strong, vibrant economy when it does."](https://arizent.brightspotcdn.com/dims4/default/3f72ae1/2147483647/strip/true/crop/3462x1951+0+221/resize/520x293!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F86%2Fa5%2F2a944fc3439c83e983c974aa82ca%2Fwade-dana-bl-081720.jpg)

![“We will step up and do whatever we can to make sure that we ensure market stability,” said FHA Commissioner Dana Wade. “But we know [the pandemic will] ... pass and we're going to have a strong, vibrant economy when it does."](https://arizent.brightspotcdn.com/dims4/default/7956e80/2147483647/strip/true/crop/3462x1947+0+223/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F86%2Fa5%2F2a944fc3439c83e983c974aa82ca%2Fwade-dana-bl-081720.jpg)